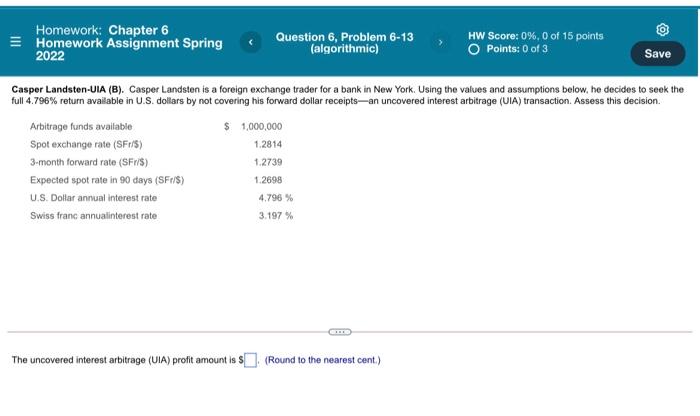

Question: Homework: Chapter 6 Homework Assignment Spring 2022 Question 6, Problem 6-13 (algorithmic) HW Score: 0%, 0 of 15 points Points: 0 of 3 Save Casper

Homework: Chapter 6 Homework Assignment Spring 2022 Question 6, Problem 6-13 (algorithmic) HW Score: 0%, 0 of 15 points Points: 0 of 3 Save Casper Landsten-UIA (B). Casper Landsten is a foreign exchange trader for a bank in New York. Using the values and assumptions below, he decides to seek the full 4.796% return available in U.S. dollars by not covering his forward dollar receipts an uncovered interest arbitrage (UIA) transaction. Assess this decision. Arbitrage funds available $ 1,000,000 Spot exchange rate (SF1/5) 1.2814 3-month forward rate (SF/S) 1.2739 Expected spot rate in 90 days (SFf/S) U.S. Dollar annual interest rate Swiss franc annualinterest rate 1.2698 4.796 % 3.197% The uncovered interest arbitrage (UIA) profit amount is $. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts