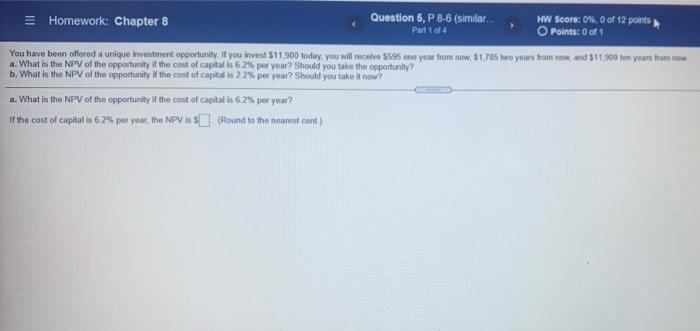

Question: = Homework: Chapter 8 Question 6, P 8-6 (similar HW Score: 0%, 0 of 12 points Part 1 of 4 Points: 0 of 1 You

= Homework: Chapter 8 Question 6, P 8-6 (similar HW Score: 0%, 0 of 12 points Part 1 of 4 Points: 0 of 1 You have been offered a unique investment opportunity If you invest 511.900 today, you will receive 5595 one year from now, 51786 two years from now, and $11.300 ton years from now a. What is the NPV of the opportunity if the cost of capitalis 6.2% per year? Should you take the opportunity? b. What is the NPV of the opportunity it the cost of capital in 22% per year? Should you take it now? a. What in the NPV of the opportunity if the cost of capital is 6.2% per year? if the cont of capital in 5.2% per year, the NPV a 5 (Round to the nearest cont)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts