Question: Homework for Chapter 13: Problem #1 in the text (Chapter 13) NOTE: PLEASE USE THE ATTACHED EXCEL FILE TITLED Homework for Chapter 13_Excel TO SOLVE

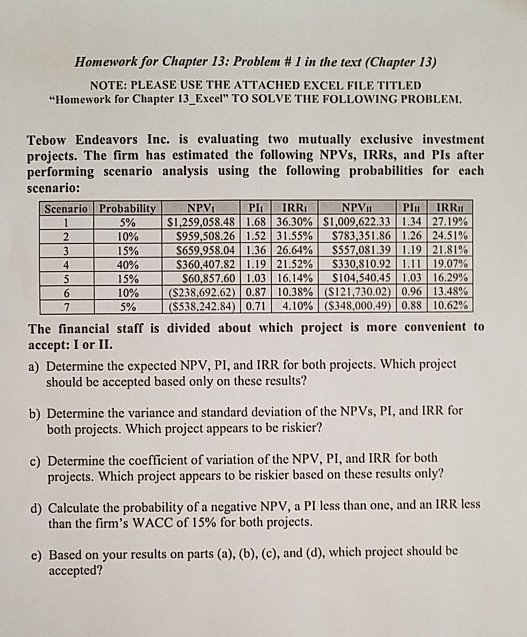

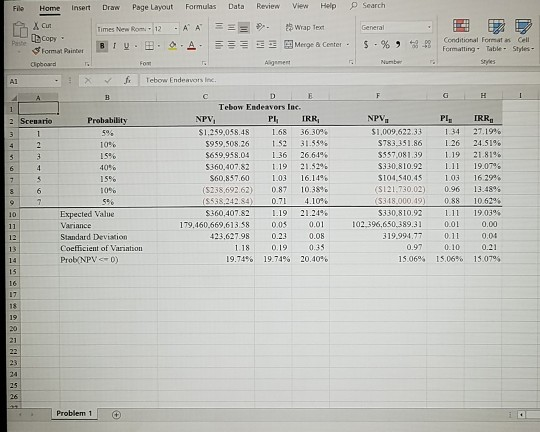

Homework for Chapter 13: Problem #1 in the text (Chapter 13) NOTE: PLEASE USE THE ATTACHED EXCEL FILE TITLED "Homework for Chapter 13_Excel" TO SOLVE THE FOLLOWING PROBLEM. Tebow Endeavors Inc. is evaluating two mutually exclusive investment projects. The firm has estimated the following NPVs, IRRs, and Pls after performing scenario analysis using the following probabilities for each scenario: Scenario Probability NPV PIIRRINPVIIPAL IRRI 1 5 % $1,259,058.48 1.68 36.30% $1,009.622.331 .34 27.19% 2 10% $959,508.26 1.52 31.55% $783,351.86 1.26 24.51% 15% $659,958.041.36 26.64% $557,081.39 1.19 21.81% 40% $360,407.82 1.1921.52% 330,810.921.11 19.07% 5 15% $60,857.60 1.03 16.14% $104,540.45 1.03 16.29% 6 10% ($238,692.62) 0.87 10.38% ($121.730.02) 0.96 13.48% 5% ($538,242.84) 0.71 4.10% ($348,000.49) 0.88 10,62% The financial staff is divided about which project is more convenient to accept: I or II. a) Determine the expected NPV, PI, and IRR for both projects. Which project should be accepted based only on these results? b) Determine the variance and standard deviation of the NPVs, PI, and IRR for both projects. Which project appears to be riskier? c) Determine the coefficient of variation of the NPV, PI, and IRR for both projects. Which project appears to be riskier based on these results only? d) Calculate the probability of a negative NPV, a PI less than one, and an IRR less than the firm's WACC of 15% for both projects. e) Based on your results on parts (a), (b), (c), and (d), which project should be accepted? File Search Home insert X Cur Draw Page Layout Times New Rom 12 - A V Formulas Data A === A. Review > View Help wrap Text Mergea Center. LL Copy 229 3 Formal Painter B 5 - % Number Conditional Formats Cell Formatting Table Styles - styles Algement - > f Tebow Endeavors Inc. Probability 596 10% 1596 40% 159 Tebow Endeavors Inc. NPV, PIIRR, $1.259,058.48 1.68 36.30% $959.508.26 1.52 31.55% $659.958.04 1.36 26.64% $360.407.82 1.19 21.52% S60,857.60 1.03 16.14% (S238,692.62) 0.87 10.3 (S538.242.84) 0.71 4.10 $360,407.82 1.19 21.24% 179.460.669,613.58 0.05 0.01 423,627.98 0.23 0.08 1.18 0.19 0.35 19.74% 19.74% 20.40% 10 NPV. $1.009.62233 S783.351.86 S557.081.39 S330.810.92 $104 540.45 (S121.730.02) $348.000 49) $330.810.92 102.396,650.389.31 319.994.77 0.97 15.06% PL. 134 26 1.19 .11 1.03 0.96 0.88 1 .11 0.01 0.11 0.10 15.06% IRR, 27.19% 24 519 21.819 19.0796 16.29% 13.489 10.679 19.03% 0.00 0.04 0.21 15.07% Expected Value Varia Standard Deviation Coefficient of Variation Prob(NPVD) Problem 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts