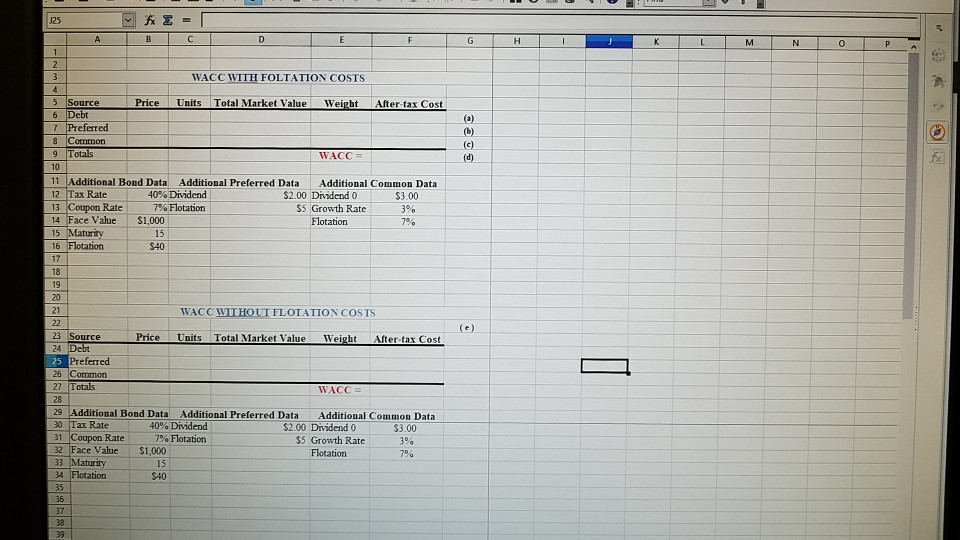

Question: please show how answer would be entered in this excel format, thank you! what would I enter for Units, price, total market value, weight, and

please show how answer would be entered in this excel format, thank you!

what would I enter for Units, price, total market value, weight, and after tax?

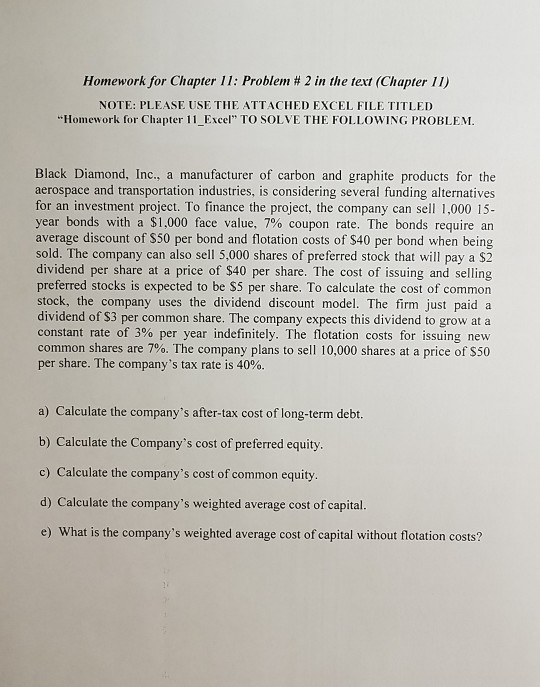

Homework for Chapter 11: Problem #2 in the text (Chapter 11) NOTE: PLEASE USE THE ATTACHED EXCEL FILE TITLED lomework for Chapter 11 Excel" TO SOLVE THE FOLLOWING PROBLEM Black Diamond, Inc., a manufacturer of carbon and graphite products for the aerospace and transportation industries, is considering several funding alternatives for an investment project. To finance the project, the company can sell 1,000 15- year bonds with a $1,000 face value, 7% coupon rate. The bonds require an average discount of $50 per bond and flotation costs of $40 per bond when being sold. The company can also sell 5,000 shares of preferred stock that will pay a $2 dividend per share at a price of $40 per share. The cost of issuing and selling preferred stocks is expected to be $5 per share. To calculate the cost of common stock, the company uses the dividend discount model. The firm just paid a dividend of $3 per common share. The company expects this dividend to grow at a constant rate of 3% per year indefinitely. The flotation costs for issuing new common shares are 7%. The company plans to sell 10,000 shares at a price of $50 per share. The company's tax rate is 40%. a) Calculate the company's after-tax cost of long-term debt. b) Calculate the Company's cost of preferred equity. c) Calculate the company's cost of common equity. d) Calculate the company's weighted average cost of capital e) What is the company's weighted average cost of capital without flotation costs? G H I J K L M N O 15 MIN A B C D E F 11 2 3 WACC WITH FOLTATION COSTS 4 5 Source Price Units Total Market ValueW eight After tax Cost 6 Debt 7 Preferred 8 Common 9 Totals WACC = 10 11 Additional Bond Data Additional Preferred Data Additional Common Data 12 Tax Rate 40% Dividend $2.00 Dividend 0 $3.00 13 Coupon Rate 7% Flotation $5 Growth Rate 3% 14 Face Value $1,000 Flotation 15 Maturity 16 Flotation $40 aos 21 19 20 WACC WITHOUT FLOTATION COSTS 22 23 Source Price Units Total Market Value Weight After-tax Cost 24 Debt 25 Preferred 26 Common 27 Totals WAICC 28 29 Additional Bond Data Additional Preferred Data Additional Common Data 30 Tax Rate 40% Dividend $2.00 Dividend 0 $3.00 31 Coupon Rate 7% Flotation $5 Growth Rate 3% 32 Face Value $1,000 Flotation 7% 33 Maturity 15 34 Flotation 35 $40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts