Question: *Homework Help - Q&A from Onl x @ CONNECT Homework 2 - FINC 3: X 5 Question 1 - CONNECT Homewo X + X >

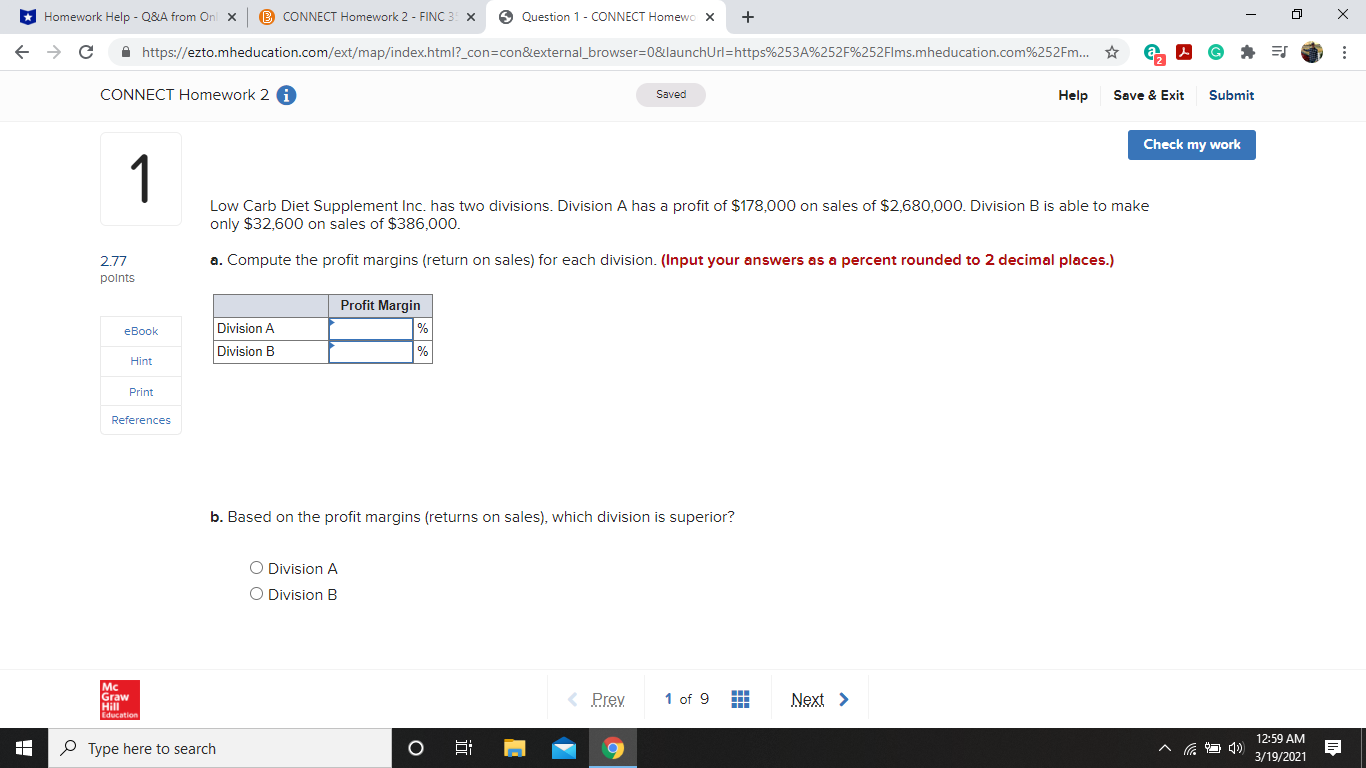

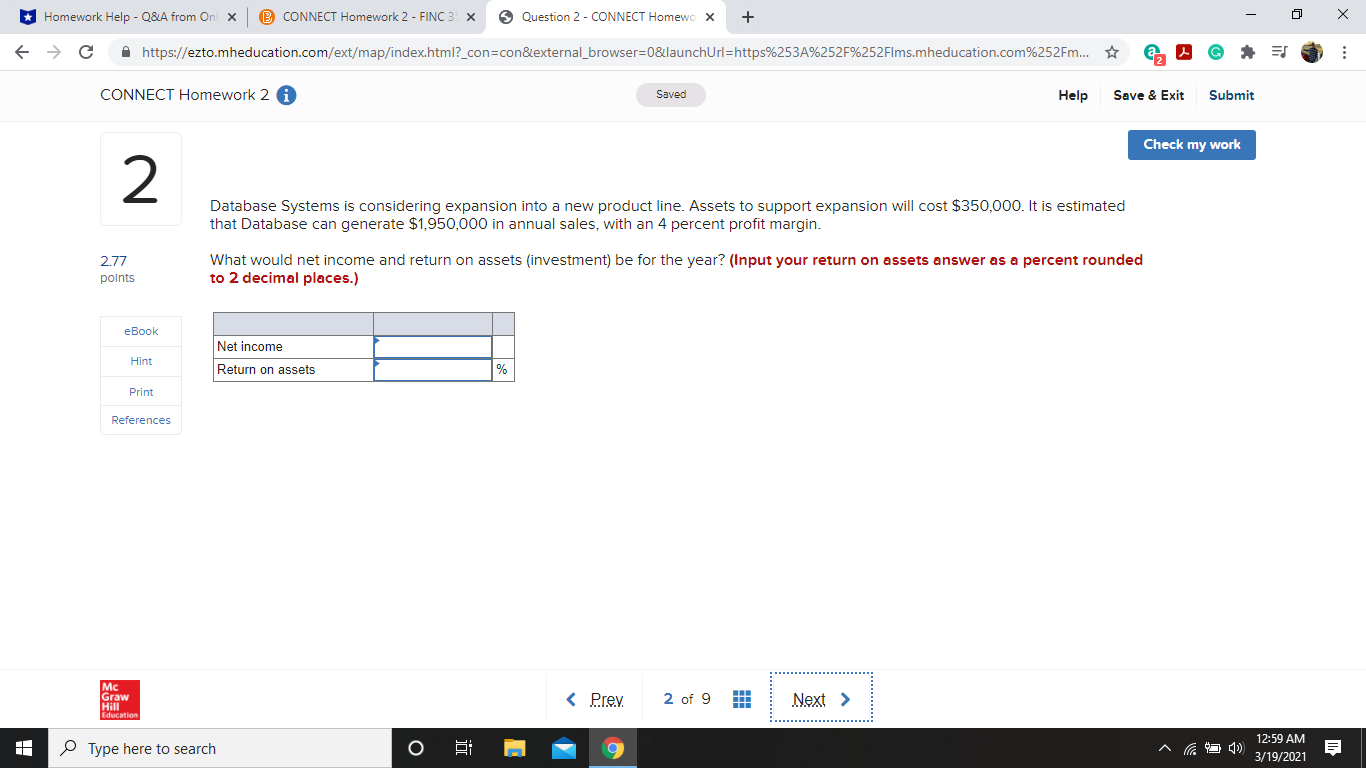

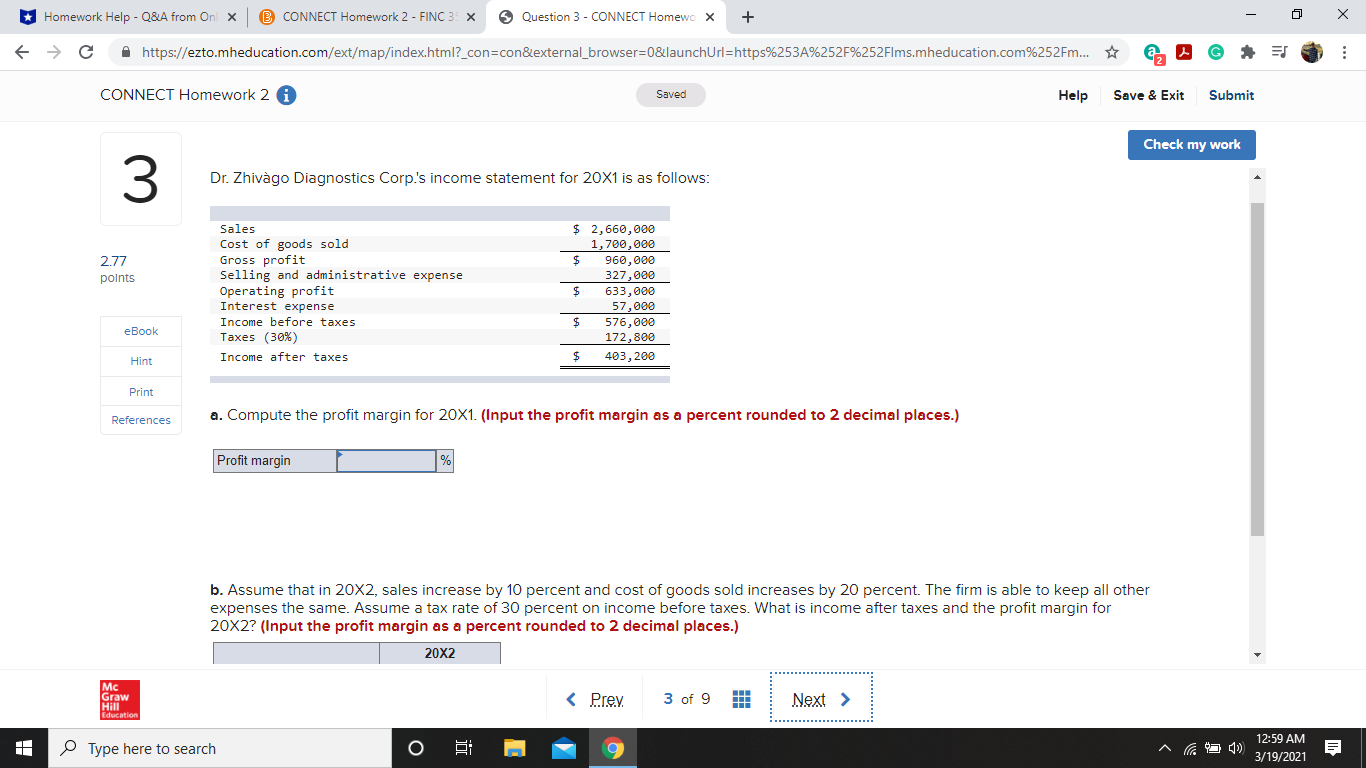

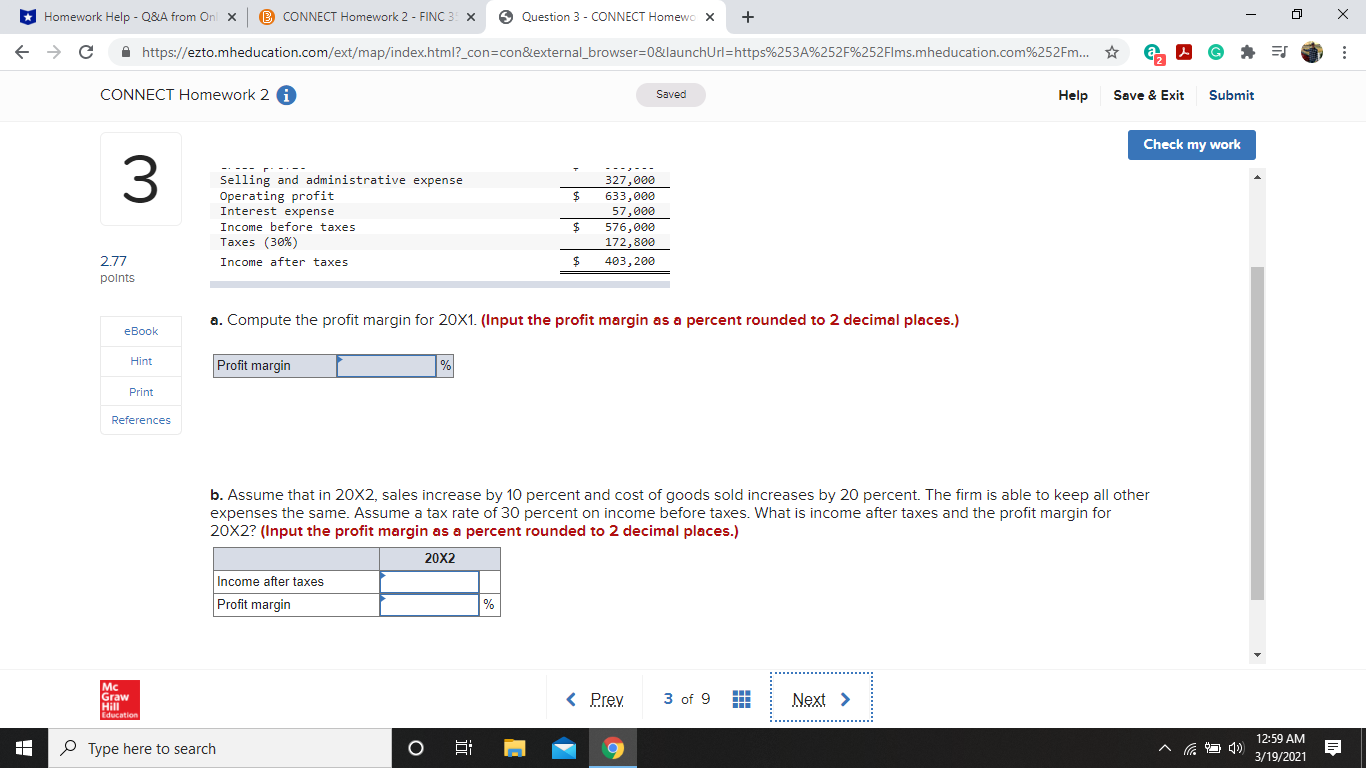

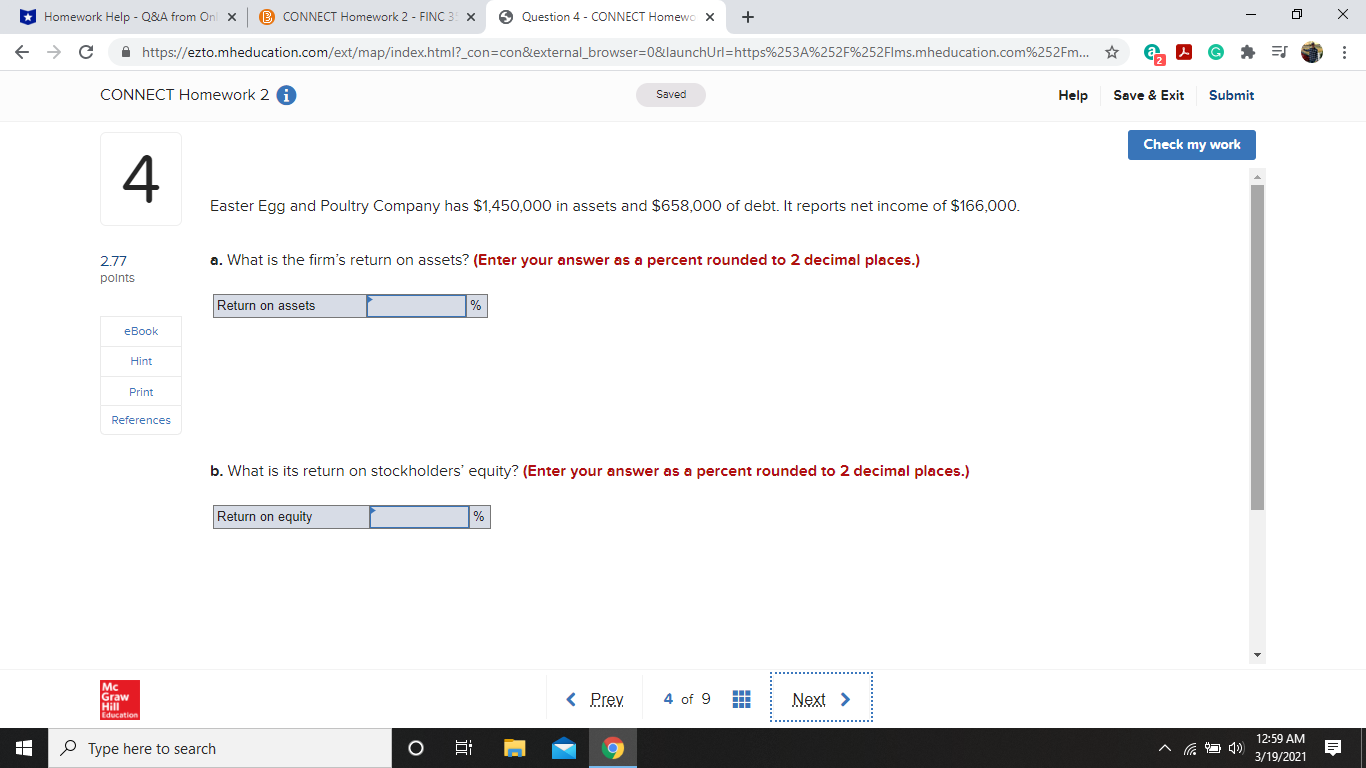

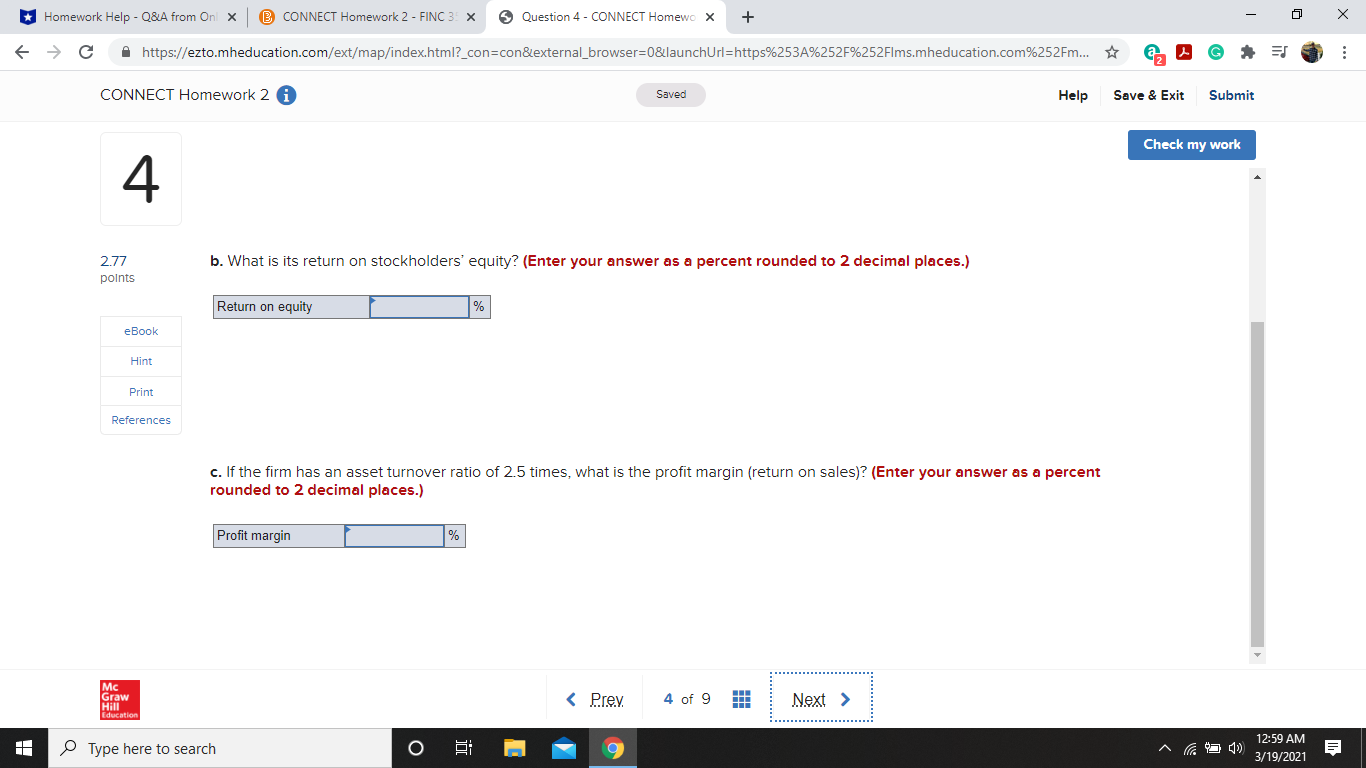

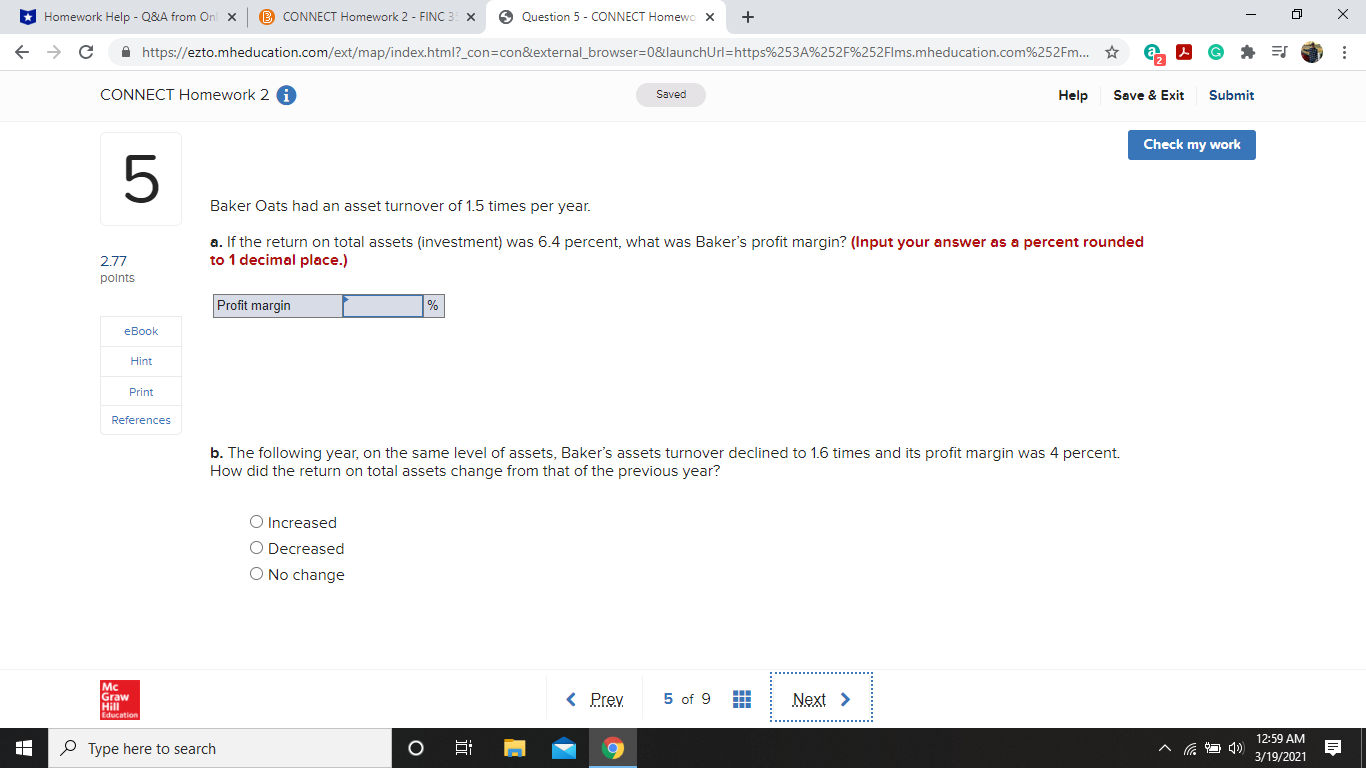

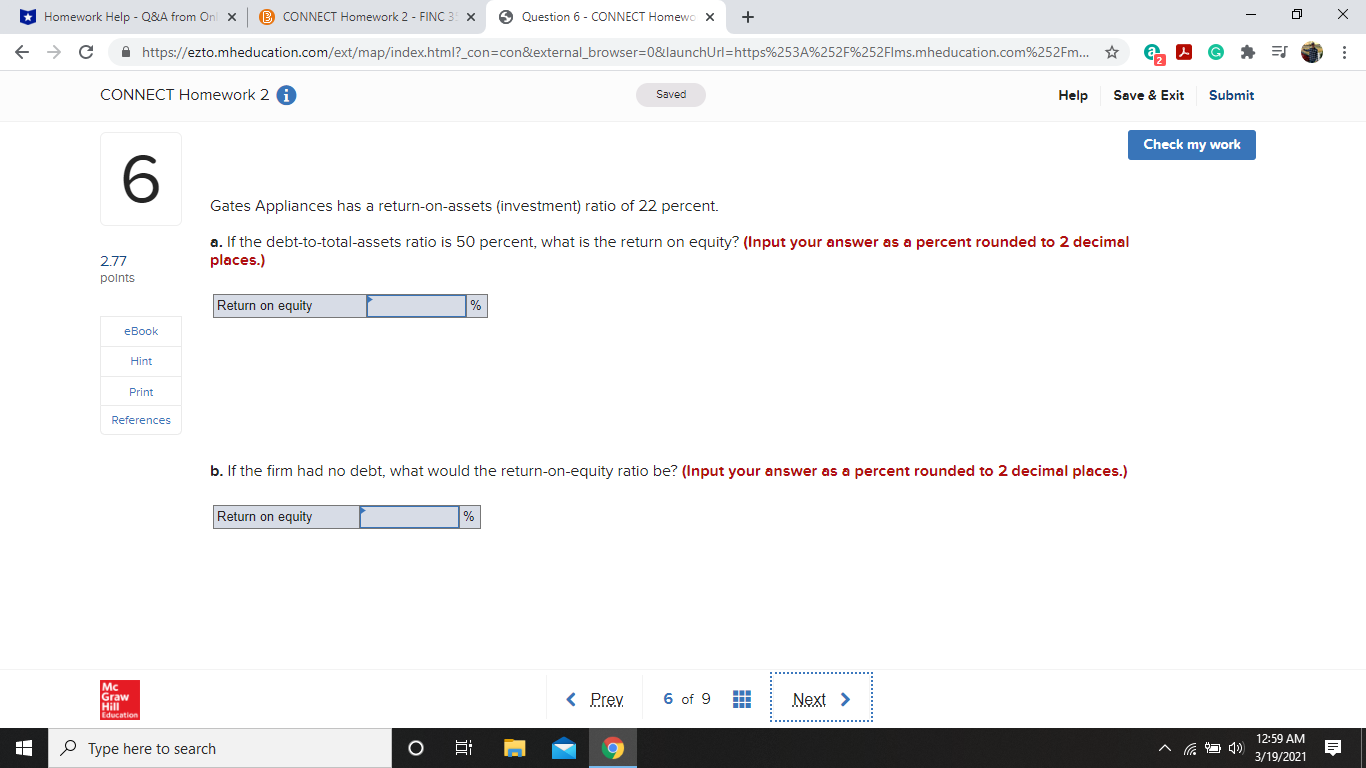

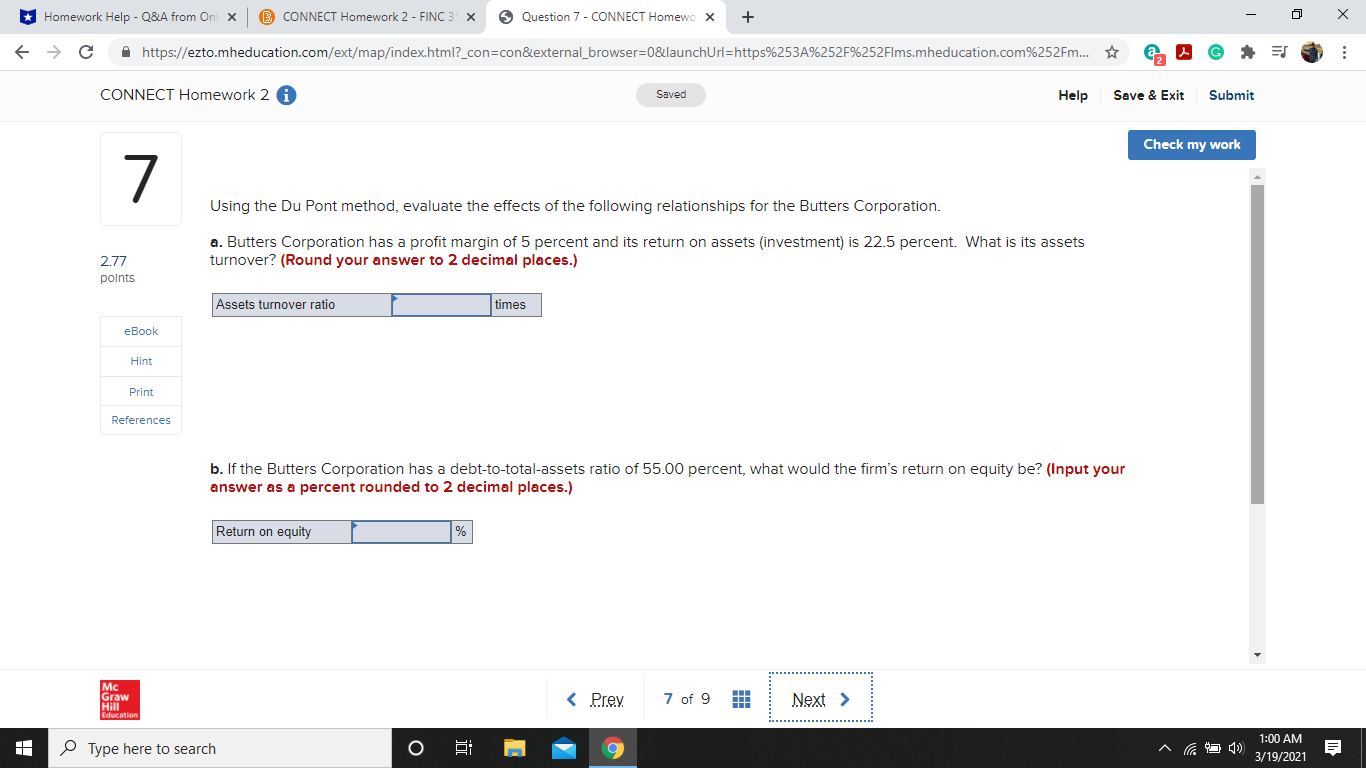

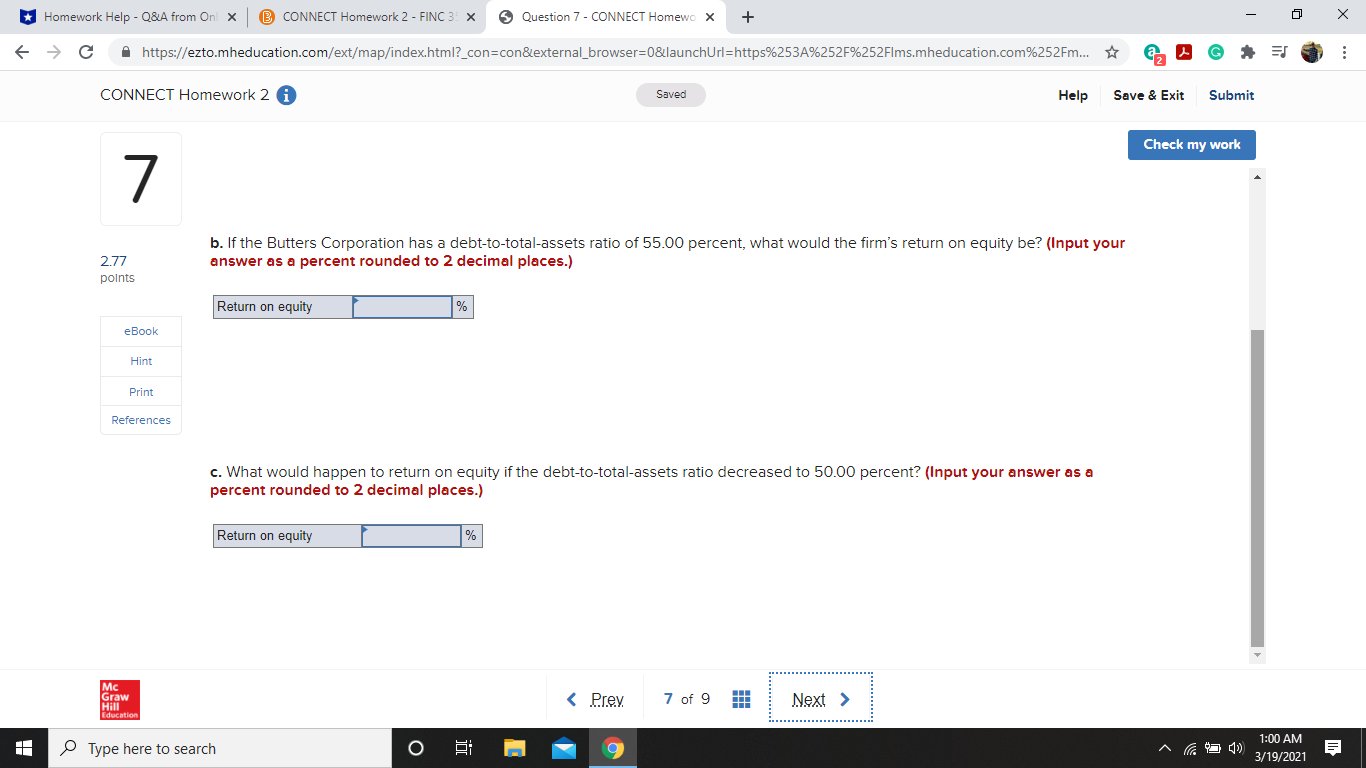

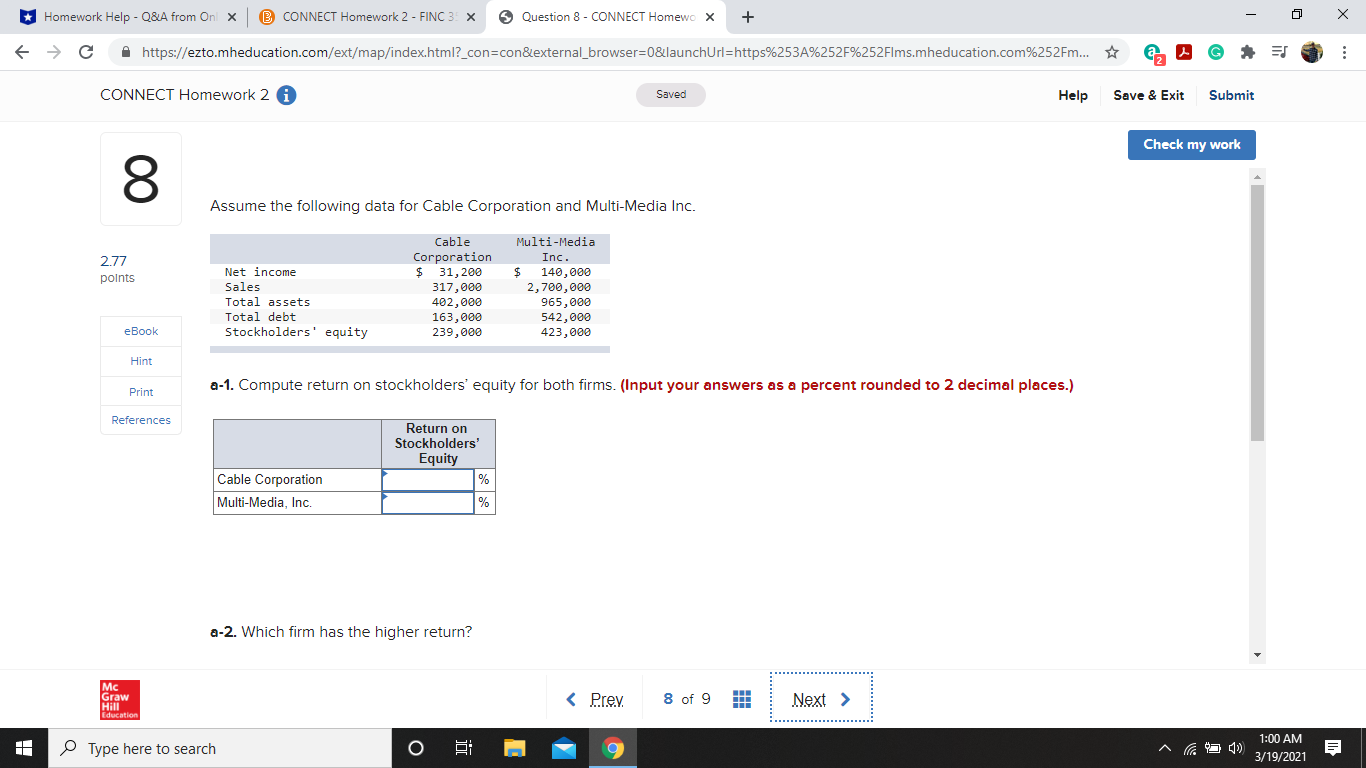

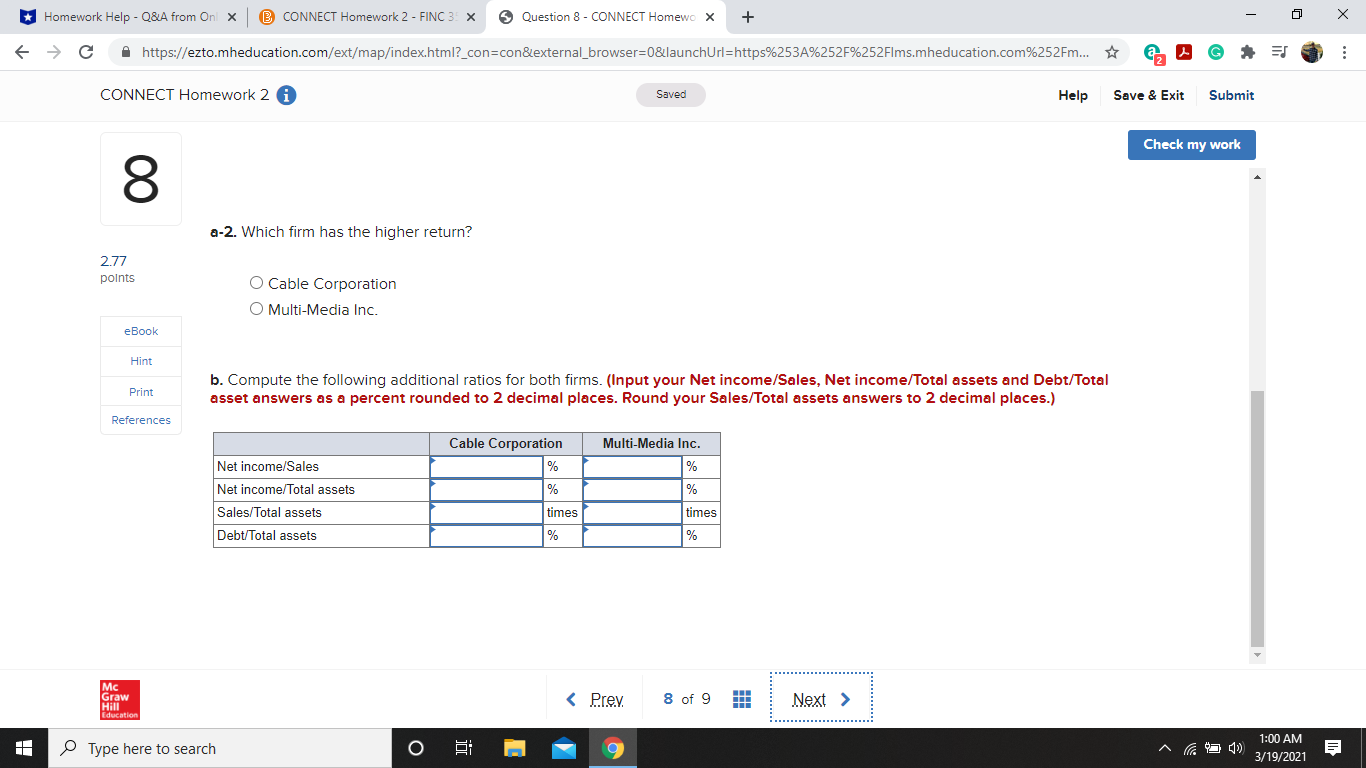

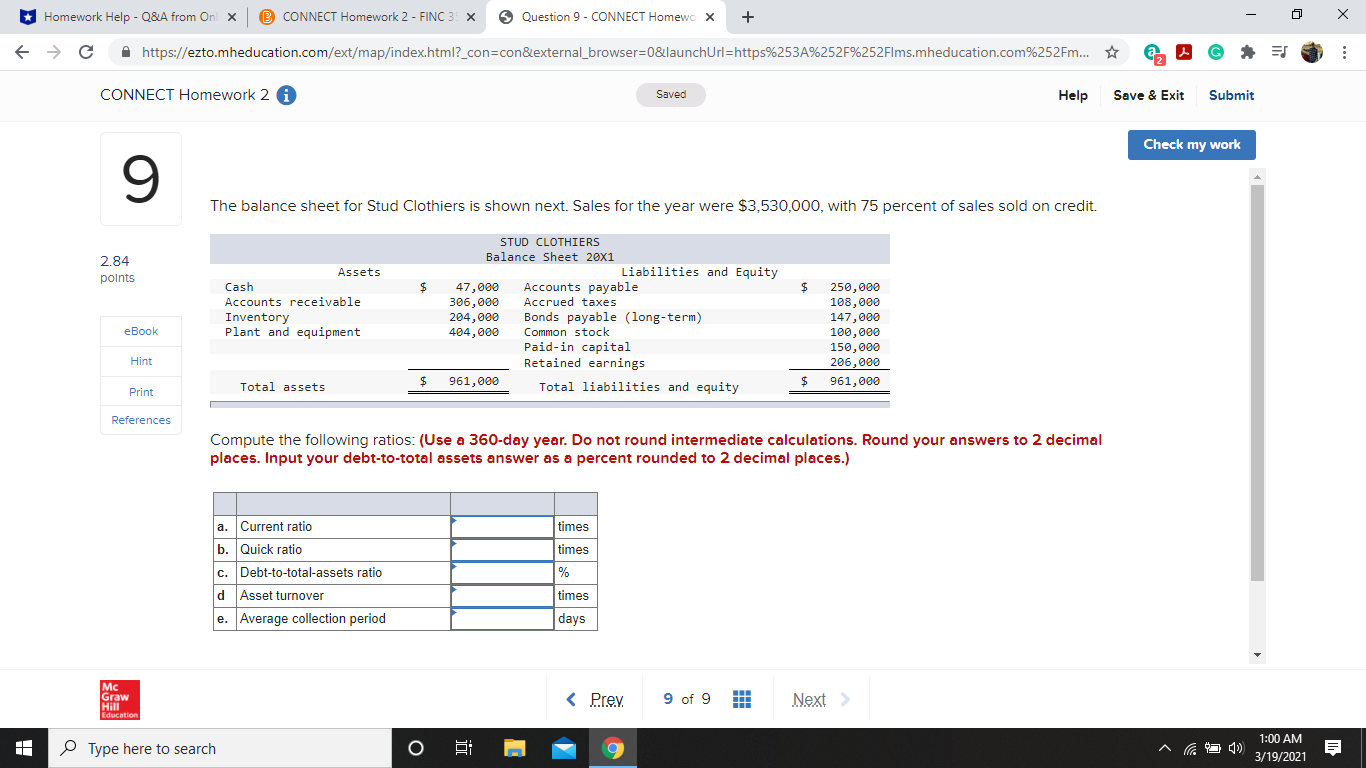

*Homework Help - Q&A from Onl x @ CONNECT Homework 2 - FINC 3: X 5 Question 1 - CONNECT Homewo X + X > C A https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252FIms.mheducation.com%252Fm... * . .. CONNECT Homework 2 Saved Help Save & Exit Submit Check my work Low Carb Diet Supplement Inc. has two divisions. Division A has a profit of $178,000 on sales of $2,680,000. Division B is able to make only $32,600 on sales of $386,000. 2.77 a. Compute the profit margins (return on sales) for each division. (Input your answers as a percent rounded to 2 decimal places.) points Profit Margin eBook Division A % Division B % Hint Print References b. Based on the profit margins (returns on sales), which division is superior? O Division A O Division B Mc Graw Hill Prey. 1 of 9 Next > ducation Type here to search 12:59 AM O 3/19/2021* Homework Help - Q&A from Onl x @ CONNECT Homework 2 - FINC 3: X 5 Question 2 - CONNECT Homewo X + X > C A https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252FIms.mheducation.com%252Fm... * . .. CONNECT Homework 2 Saved Help Save & Exit Submit Check my work 2 Database Systems is considering expansion into a new product line. Assets to support expansion will cost $350,000. It is estimated that Database can generate $1,950,000 in annual sales, with an 4 percent profit margin. 2.77 What would net income and return on assets (investment) be for the year? (Input your return on assets answer as a percent rounded points to 2 decimal places.) eBook Net income Hint Return on assets % Print References Mc Graw Hill ducation Type here to search O 12:59 AM 3/19/2021*Homework Help - Q&A from Onl x @ CONNECT Homework 2 - FINC 3: X 5 Question 3 - CONNECT Homewo X + X > C A https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252FIms.mheducation.com%252Fm... * . .. CONNECT Homework 2 Saved Help Save & Exit Submit Check my work 3 Dr. Zhivago Diagnostics Corp.'s income statement for 20X1 is as follows: Sales $ 2, 660,000 Cost of goods sold 1, 700, 000 2.77 Gross profit $ 960,000 points Selling and administrative expense 327,000 Operating profit $ 633,000 Interest expense 57,000 Income before taxes $ 576,000 eBook Taxes (30%) 172, 800 Hint Income after taxes $ 403, 200 Print References a. Compute the profit margin for 20X1. (Input the profit margin as a percent rounded to 2 decimal places.) Profit margin b. Assume that in 20X2, sales increase by 10 percent and cost of goods sold increases by 20 percent. The firm is able to keep all other expenses the same. Assume a tax rate of 30 percent on income before taxes. What is income after taxes and the profit margin for 20X2? (Input the profit margin as a percent rounded to 2 decimal places.) 20X2 Mc Graw Hill C A https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252FIms.mheducation.com%252Fm... * . .. CONNECT Homework 2 Saved Help Save & Exit Submit Check my work 3 - - -> - - Selling and administrative expense 327,000 Operating profit $ 633, 000 Interest expense 57,000 Income before taxes $ 576,000 Taxes (30%) 172, 800 2.77 Income after taxes $ 403, 200 points eBook a. Compute the profit margin for 20X1. (Input the profit margin as a percent rounded to 2 decimal places.) Hint Profit margin Print References b. Assume that in 20X2, sales increase by 10 percent and cost of goods sold increases by 20 percent. The firm is able to keep all other expenses the same. Assume a tax rate of 30 percent on income before taxes. What is income after taxes and the profit margin for 20X2? (Input the profit margin as a percent rounded to 2 decimal places.) 20X2 Income after taxes Profit margin % Mc Graw Hill ducation Type here to search 12:59 AM O 3/19/2021* Homework Help - Q&A from Onl x @ CONNECT Homework 2 - FINC 3: X 5 Question 4 - CONNECT Homewo X + X > C A https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252FIms.mheducation.com%252Fm... * . .. CONNECT Homework 2 Saved Help Save & Exit Submit Check my work 4 Easter Egg and Poultry Company has $1,450,000 in assets and $658,000 of debt. It reports net income of $166,000. 2.77 a. What is the firm's return on assets? (Enter your answer as a percent rounded to 2 decimal places.) points Return on assets % eBook Hint Print References b. What is its return on stockholders' equity? (Enter your answer as a percent rounded to 2 decimal places.) Return on equity % Mc Graw Hill ducation Type here to search 12:59 AM O 3/19/2021* Homework Help - Q&A from Onl x @ CONNECT Homework 2 - FINC 3: X 5 Question 4 - CONNECT Homewo X + X > C A https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252FIms.mheducation.com%252Fm... * . .. CONNECT Homework 2 Saved Help Save & Exit Submit Check my work 4 2.77 b. What is its return on stockholders' equity? (Enter your answer as a percent rounded to 2 decimal places.) points Return on equity % eBook Hint Print References c. If the firm has an asset turnover ratio of 2.5 times, what is the profit margin (return on sales)? (Enter your answer as a percent rounded to 2 decimal places.) Profit margin % Mc Graw Hill ducation Type here to search 12:59 AM O 3/19/2021* Homework Help - Q&A from Onl x @ CONNECT Homework 2 - FINC 3: X 5 Question 5 - CONNECT Homewo X + X > C A https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252FIms.mheducation.com%252Fm... * . .. CONNECT Homework 2 Saved Help Save & Exit Submit Check my work 5 Baker Oats had an asset turnover of 1.5 times per year. a. If the return on total assets (investment) was 6.4 percent, what was Baker's profit margin? (Input your answer as a percent rounded 2.77 to 1 decimal place.) points Profit margin % eBook Hint Print References b. The following year, on the same level of assets, Baker's assets turnover declined to 1.6 times and its profit margin was 4 percent. How did the return on total assets change from that of the previous year? O Increased O Decreased O No change Mc Graw Hill ducation 12:59 AM Type here to search O 3/19/2021*Homework Help - Q&A from Onl x @ CONNECT Homework 2 - FINC 3: x 5 Question 6 - CONNECT Homewo X + X > C A https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252FIms.mheducation.com%252Fm... > . .. CONNECT Homework 2 Saved Help Save & Exit Submit Check my work 6 Gates Appliances has a return-on-assets (investment) ratio of 22 percent. a. If the debt-to-total-assets ratio is 50 percent, what is the return on equity? (Input your answer as a percent rounded to 2 decimal 2.77 places.) points Return on equity % eBook Hint Print References b. If the firm had no debt, what would the return-on-equity ratio be? (Input your answer as a percent rounded to 2 decimal places.) Return on equity % Mc Graw Hill ducation Type here to search 12:59 AM O 3/19/2021* Homework Help - Q&A from Onl x @ CONNECT Homework 2 - FINC 3! X Question 7 - CONNECT Homewo X + X > C A https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%2530%252F%252FIms.mheducation.com%252Fm... > . .. CONNECT Homework 2 Saved Help Save & Exit Submit Check my work 7 Using the Du Pont method, evaluate the effects of the following relationships for the Butters Corporation. a. Butters Corporation has a profit margin of 5 percent and its return on assets (investment) is 22.5 percent. What is its assets 2.77 turnover? (Round your answer to 2 decimal places.) points Assets turnover ratio times eBook Hint Print References b. If the Butters Corporation has a debt-to-total-assets ratio of 55.00 percent, what would the firm's return on equity be? (Input your answer as a percent rounded to 2 decimal places.) Return on equity % Mc Graw Hill ducation Type here to search 1:00 AM O 3/19/2021* Homework Help - Q&A from Onl x @ CONNECT Homework 2 - FINC 3! X Question 7 - CONNECT Homewo X + X > C A https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252FIms.mheducation.com%252Fm... * . .. CONNECT Homework 2 Saved Help Save & Exit Submit Check my work 7 b. If the Butters Corporation has a debt-to-total-assets ratio of 55.00 percent, what would the firm's return on equity be? (Input your 2.77 answer as a percent rounded to 2 decimal places.) points Return on equity % eBook Hint Print References c. What would happen to return on equity if the debt-to-total-assets ratio decreased to 50.00 percent? (Input your answer as a percent rounded to 2 decimal places.) Return on equity % Mc Graw Hill ducation Type here to search 1:00 AM O 3/19/2021*Homework Help - Q&A from Onl x @ CONNECT Homework 2 - FINC 3: X 5 Question 8 - CONNECT Homewo X + X > C A https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252FIms.mheducation.com%252Fm... * . .. CONNECT Homework 2 Saved Help Save & Exit Submit Check my work 8 Assume the following data for Cable Corporation and Multi-Media Inc. Cable Multi-Media 2.77 Corporation Inc Net income $ 31, 200 140, 000 points Sales 317, 000 2, 700, 000 Total assets 402,000 965,000 Total debt 163, 000 542,000 eBook Stockholders' equity 239, 000 423, 000 Hint Print a-1. Compute return on stockholders' equity for both firms. (Input your answers as a percent rounded to 2 decimal places.) References Return on Stockholders' Equity Cable Corporation % Multi-Media, Inc. % a-2. Which firm has the higher return? Mc Graw 8 of 9 Next > Hill C A https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252FIms.mheducation.com%252Fm... * . .. CONNECT Homework 2 Saved Help Save & Exit Submit Check my work 8 a-2. Which firm has the higher return? 2.77 points O Cable Corporation O Multi-Media Inc. eBook Hint b. Compute the following additional ratios for both firms. (Input your Net income/Sales, Net income/Total assets and Debt/Total Print asset answers as a percent rounded to 2 decimal places. Round your Sales/Total assets answers to 2 decimal places.) References Cable Corporation Multi-Media Inc. Net income/Sales % % Net income/Total assets % Sales/Total assets times times Debt/Total assets Mc Graw Hill ducation Type here to search 1:00 AM O 3/19/2021*Homework Help - Q&A from Onl x @ CONNECT Homework 2 - FINC 3: X 5 Question 9 - CONNECT Homewo X + X > C A https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252FIms.mheducation.com%252Fm... * . .. CONNECT Homework 2 Saved Help Save & Exit Submit Check my work 9 The balance sheet for Stud Clothiers is shown next. Sales for the year were $3,530,000, with 75 percent of sales sold on credit. STUD CLOTHIERS 2.84 Balance Sheet 20X1 points Assets Liabilities and Equity Cash $ 47,000 Accounts payable $ 250,000 Accounts receivable 306, 000 Accrued taxes 108, 000 Inventory 204, 000 Bonds payable (long-term) 147,000 eBook Plant and equipment 404, 000 Common stock 100, 000 Paid-in capital 150, 000 Hint Retained earnings 206,000 $ 961, 000 961, 000 Print Total assets Total liabilities and equity $ References Compute the following ratios: (Use a 360-day year. Do not round intermediate calculations. Round your answers to 2 decimal places. Input your debt-to-total assets answer as a percent rounded to 2 decimal places.) a. Current ratio times b. Quick ratio times C. Debt-to-total-assets ratio d Asset turnover times e. Average collection period days Mc Graw ducation 1:00 AM Type here to search O 3/19/2021