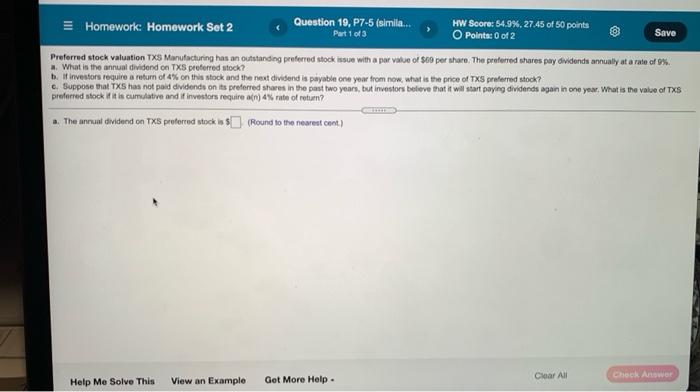

Question: Homework: Homework Set 2 Question 19, P7-5 (simila... HW Score: 54.9%, 27.45 of 50 points Save Part 1 of 3 Points: 0 of 2 Preferred

Homework: Homework Set 2 Question 19, P7-5 (simila... HW Score: 54.9%, 27.45 of 50 points Save Part 1 of 3 Points: 0 of 2 Preferred stock valuation TXS Manutacturing has an outstanding preferred stock issue with a por value of $10 per share. The preferred shares pary dividends annually at a rate of 8% b. investors require a return of 4% on this stock and the next dividend is payable one year from now, what is the price of TXs preferred stock? Suppose that TXS has not paid dividends on its preferred share in the past two years, but investors believe that it will start paying dividends again in one year. What is the value of TXS preferred stock it is cumulative and investors require an) 4% rate of return? The annunt dividend on TXS preferred stock (Round to the nearest cont.) Clear All Help Me Solve This Get More Help Check Answer View an Example

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts