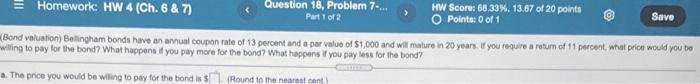

Question: Homework: HW 4 (Ch. 6 & 7) Question 18, Problem 7-... Part 1 of 2 HW Score: 68.33%, 13,67 of 20 points Points: 0 of

Homework: HW 4 (Ch. 6 & 7) Question 18, Problem 7-... Part 1 of 2 HW Score: 68.33%, 13,67 of 20 points Points: 0 of 1 Save Bond valuation) Bellingham bonds have an annual coupon rate of 13 percent and a par value of $1,000 and will mature in 20 years. If you require a return of 11 percent what prior would you be willing to pay for the bond? What happens if you pay more for the bond? What happens if you pay fest for the bond? 1. The price you would be willing to pay for the bond is $(Round to the nearest cont

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts