Question: = Homework: Lab 09 Question 3, Problem 15-5 (algorithmic) Part 1 of 2 HW Score: 20%, 1 of 5 points Points: 0 of 1 Save

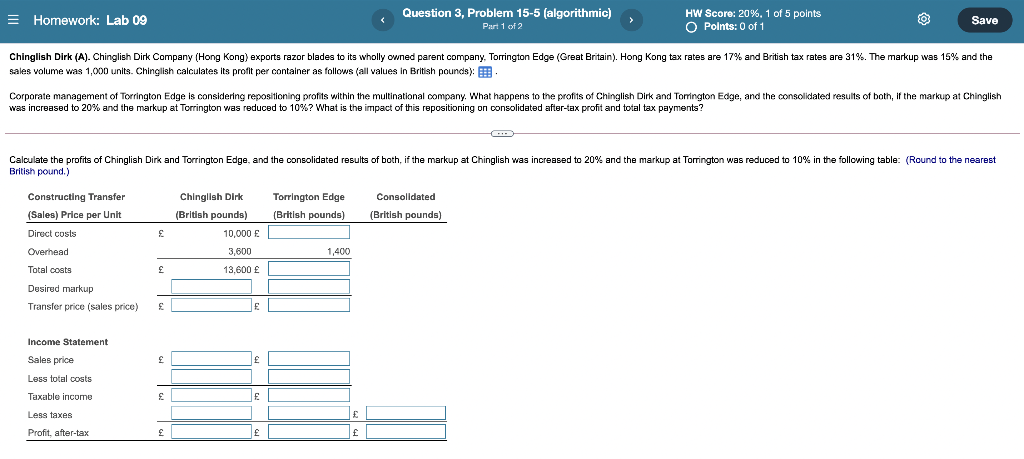

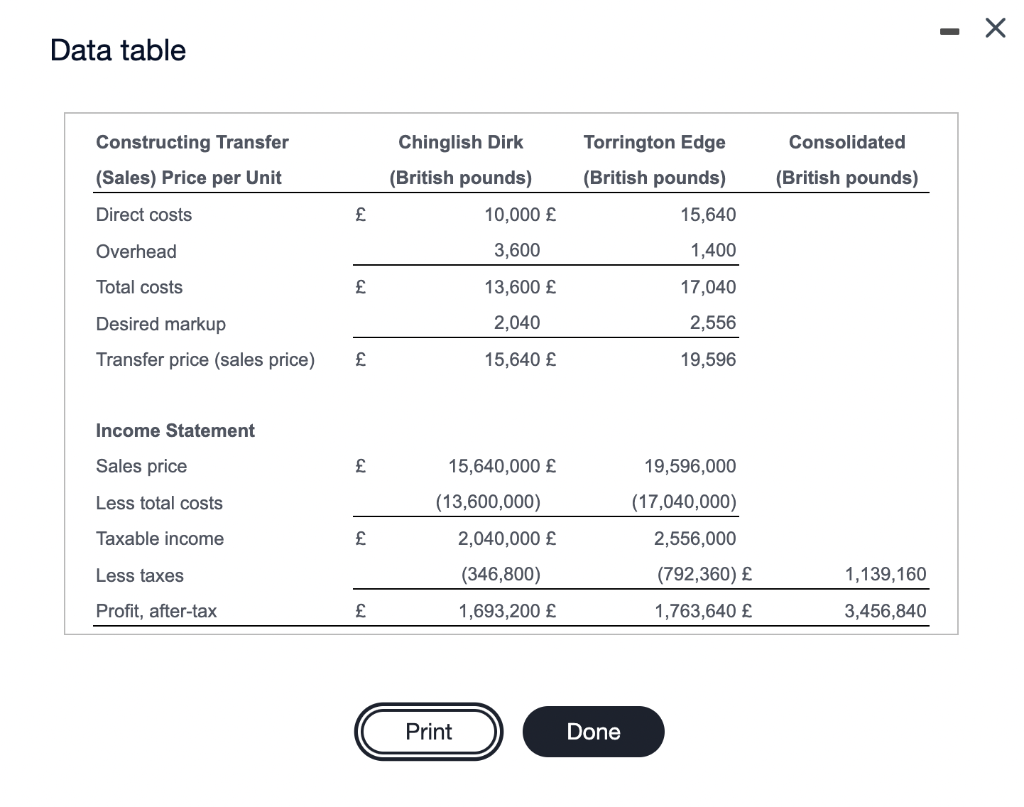

= Homework: Lab 09 Question 3, Problem 15-5 (algorithmic) Part 1 of 2 HW Score: 20%, 1 of 5 points Points: 0 of 1 Save Chinglish Dirk (A). Chinglish Dirk Company (Hong Kong) exports razor blades to its wholly owned parent company, Torrington Edge (Great Britain). Hong Kong tax rates are 17% and British tax rates are 31%. The markup was 15% and the sales volume was 1,000 units. Chinglish calculates its profit per container as follows (all values in British pounds): B. Corporate management of Torrington Edge is considering repositioning profits within the multinational company. What happens to the profits of Chinglish Dirk and Torrington Edge, and the consolidated results of both, if the markup at Chinglish was increased to 20% and the markup at Torrington was reduced to 10%? What is the impact of this repositioning on consolidated after-tax profit and total tax payments? Calculate the profits of Chinglish Dirk and Torrington Edge, and the consolidated results of both, if the markup at Chinglish was increased to 20% and the markup at Torrington was reduced to 10% in the following table: (Round to the nearest British pound.) Constructing Transfer (Sales) Price per Unit Direct costs Torrington Edge (British pounds) Consolidated (British pounds) Chinglish Dirk (British pounds) 10,000 3,600 Overhead 1,400 Total costs 13,600 Desired markup Transfer price (sales price) f E Income Statement Sales price Less total costs Taxable income F Less taxes Profit, after-tax Data table Consolidated Constructing Transfer (Sales) Price per Unit Chinglish Dirk (British pounds) 10,000 Torrington Edge (British pounds) 15,640 (British pounds) Direct costs Overhead 3,600 1,400 Total costs 13,600 17,040 2,040 2,556 Desired markup Transfer price (sales price) 15,640 19,596 Income Statement Sales price 15,640,000 19,596,000 Less total costs (13,600,000) (17,040,000) Taxable income 2,040,000 2,556,000 Less taxes (346,800) 1,139,160 (792,360) 1,763,640 Profit, after-tax 1,693,200 3,456,840 Print Done = Homework: Lab 09 Question 3, Problem 15-5 (algorithmic) Part 1 of 2 HW Score: 20%, 1 of 5 points Points: 0 of 1 Save Chinglish Dirk (A). Chinglish Dirk Company (Hong Kong) exports razor blades to its wholly owned parent company, Torrington Edge (Great Britain). Hong Kong tax rates are 17% and British tax rates are 31%. The markup was 15% and the sales volume was 1,000 units. Chinglish calculates its profit per container as follows (all values in British pounds): B. Corporate management of Torrington Edge is considering repositioning profits within the multinational company. What happens to the profits of Chinglish Dirk and Torrington Edge, and the consolidated results of both, if the markup at Chinglish was increased to 20% and the markup at Torrington was reduced to 10%? What is the impact of this repositioning on consolidated after-tax profit and total tax payments? Calculate the profits of Chinglish Dirk and Torrington Edge, and the consolidated results of both, if the markup at Chinglish was increased to 20% and the markup at Torrington was reduced to 10% in the following table: (Round to the nearest British pound.) Constructing Transfer (Sales) Price per Unit Direct costs Torrington Edge (British pounds) Consolidated (British pounds) Chinglish Dirk (British pounds) 10,000 3,600 Overhead 1,400 Total costs 13,600 Desired markup Transfer price (sales price) f E Income Statement Sales price Less total costs Taxable income F Less taxes Profit, after-tax Data table Consolidated Constructing Transfer (Sales) Price per Unit Chinglish Dirk (British pounds) 10,000 Torrington Edge (British pounds) 15,640 (British pounds) Direct costs Overhead 3,600 1,400 Total costs 13,600 17,040 2,040 2,556 Desired markup Transfer price (sales price) 15,640 19,596 Income Statement Sales price 15,640,000 19,596,000 Less total costs (13,600,000) (17,040,000) Taxable income 2,040,000 2,556,000 Less taxes (346,800) 1,139,160 (792,360) 1,763,640 Profit, after-tax 1,693,200 3,456,840 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts