Question: Homework: Lab 10 Question 5, Problem 16-8 (algorithmic) Part 1 of 10 > HW Score: 10%, 1 of 10 points O Points: 0 of 1

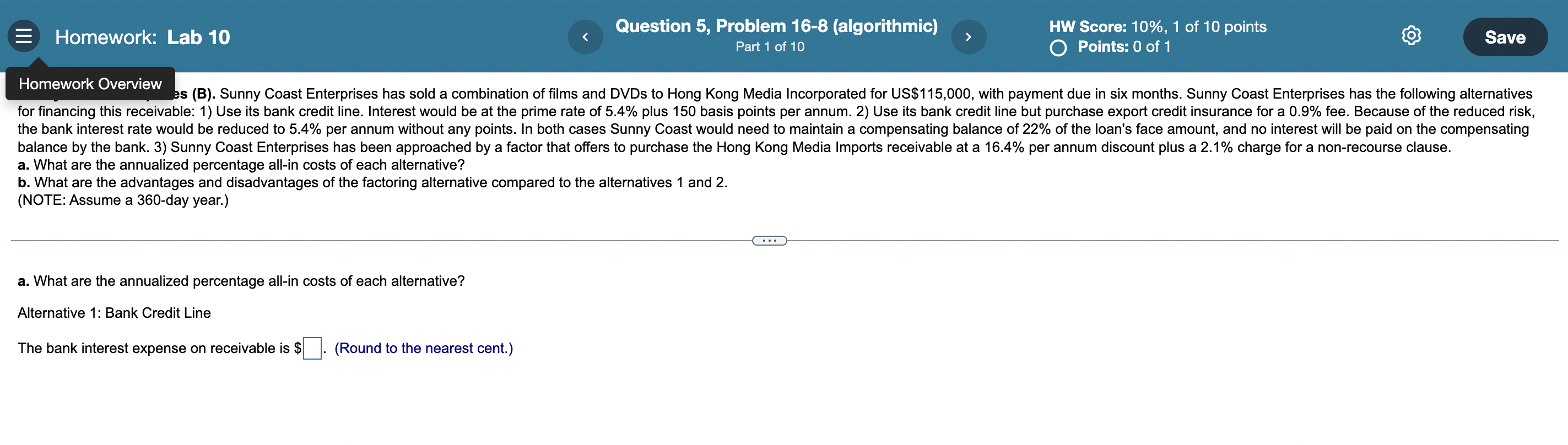

Homework: Lab 10 Question 5, Problem 16-8 (algorithmic) Part 1 of 10 > HW Score: 10%, 1 of 10 points O Points: 0 of 1 Save Homework Overview es (B). Sunny Coast Enterprises has sold a combination of films and DVDs to Hong Kong Media Incorporated for US$115,000, with payment due in six months. Sunny Coast Enterprises has the following alternatives for financing this receivable: 1) Use its bank credit line. Interest would be at the prime rate of 5.4% plus 150 basis points per annum. 2) Use its bank credit line but purchase export credit insurance for a 0.9% fee. Because of the reduced risk, the bank interest rate would be reduced to 5.4% per annum without any points. In both cases Sunny Coast would need to maintain a compensating balance of 22% of the loan's face amount, and no interest will be paid on the compensating balance by the bank. 3) Sunny Coast Enterprises has been approached by a factor that offers to purchase the Hong Kong Media Imports receivable at a 16.4% per annum discount plus a 2.1% charge for a non-recourse clause. a. What are the annualized percentage all-in costs of each alternative? b. What are the advantages and disadvantages of the factoring alternative compared to the alternatives 1 and 2. (NOTE: Assume a 360-day year.) a. What are the annualized percentage all-in costs of each alternative? Alternative 1: Bank Credit Line The bank interest expense on receivable is $. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts