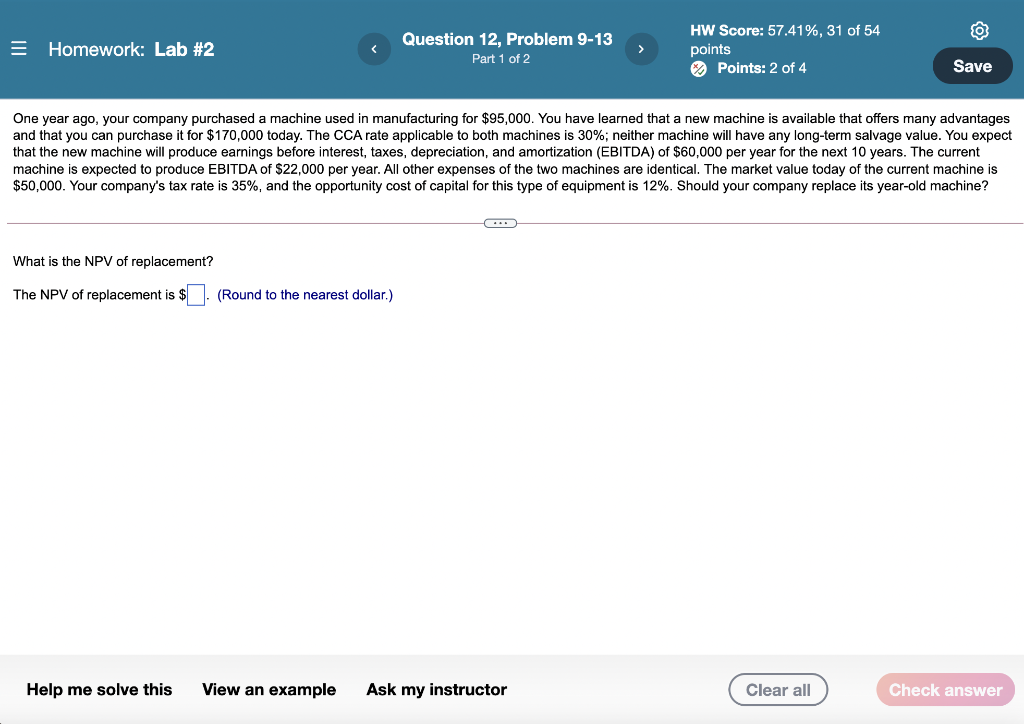

Question: = Homework: Lab #2 Question 12, Problem 9-13 Part 1 of 2 HW Score: 57.41%, 31 of 54 points Points: 2 of 4 Save One

= Homework: Lab #2 Question 12, Problem 9-13 Part 1 of 2 HW Score: 57.41%, 31 of 54 points Points: 2 of 4 Save One year ago, your company purchased a machine used in manufacturing for $95,000. You have learned that a new machine is available that offers many advantages and that you can purchase it for $170,000 today. The CCA rate applicable to both machines is 30%; neither machine will have any long-term salvage value. You expect that the new machine will produce earnings before interest, taxes, depreciation, and amortization (EBITDA) of $60,000 per year for the next 10 years. The current machine is expected to produce EBITDA of $22,000 per year. All other expenses of the two machines are identical. The market value today of the current machine is $50,000. Your company's tax rate is 35%, and the opportunity cost of capital for this type of equipment is 12%. Should your company replace its year-old machine? ... What is the NPV of replacement? The NPV of replacement is $ (Round to the nearest dollar.) Help me solve this View an example Ask my instructor Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts