Question: please solve this example of fully question, fully solved Homework: Lab #2 Question 11, Problem 8-26 Part 1 of 7 > HW Score: 32.68%, 17.65

please solve this

please solve this  example of fully question, fully solved

example of fully question, fully solved

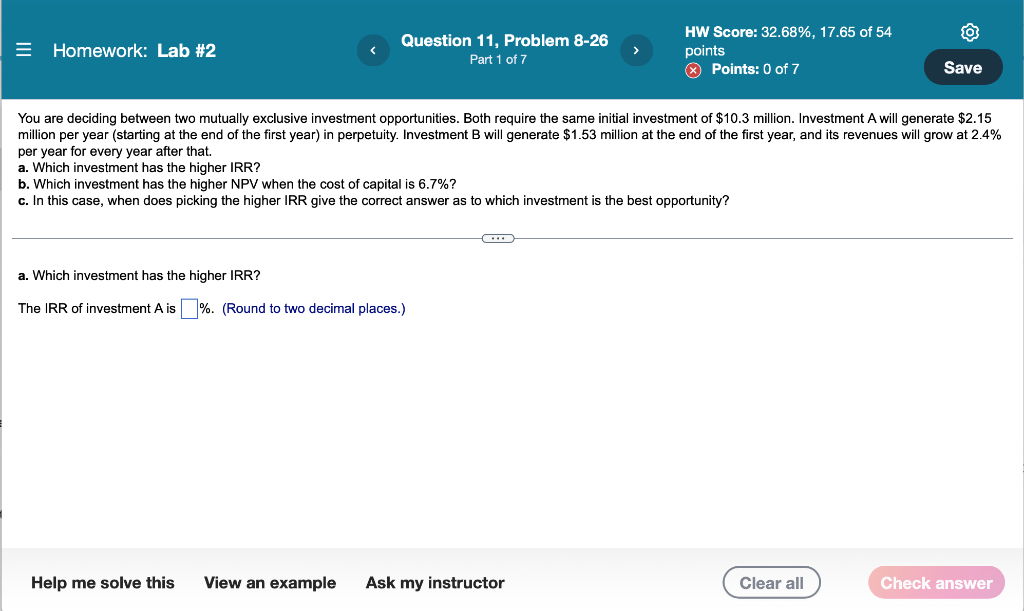

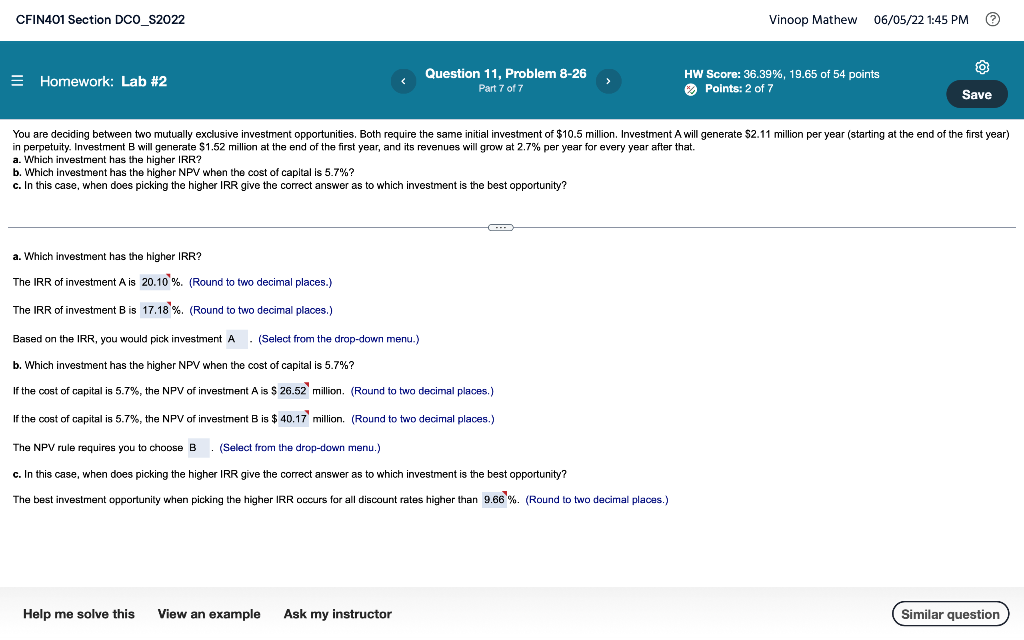

Homework: Lab #2 Question 11, Problem 8-26 Part 1 of 7 > HW Score: 32.68%, 17.65 of 54 points Points: 0 of 7 Save You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $10.3 million. Investment A will generate $2.15 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.53 million at the end of the first year, and its revenues will grow at 2.4% per year for every year after that. Which investment has the higher IRR? b. Which investment has the higher NPV when the cost of capital is 6.7%? c. In this case, when does picking the higher IRR give the correct answer as to which investment is the best opportunity? a. Which investment has the higher IRR? The IRR of investment A is %. (Round to two decimal places.) Help me solve this Check answer View an example Ask my instructor Clear all CFIN401 Section DCO_S2022 Vinoop Mathew O Homework: Lab #2 Question 11, Problem 8-26 Part 7 of 7 > HW Score: 36.39%, 19.65 of 54 points Points: 2 of 7 Save You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $10.5 million. Investment A will generate $2.11 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.52 million at the end of the first year, and its revenues will grow at 2.7% per year for every year after that. a. Which investment has the higher IRR? b. Which investment has the higher NPV when the cost of capital is 5.7%? c. In this case, when does picking the higher IRR give the correct answer as to which investment is the best opportunity? C a. Which investment has the higher IRR? The IRR of investment A is 20.10 %. (Round to two decimal places.) The IRR of investment B is 17.18 %. (Round to two decimal places.) Based on the IRR, you would pick investment A (Select from the drop-down menu.) b. Which investment has the higher NPV when the cost of capital is 5.7%? If the cost of capital is 5.7%, the NPV of investment A is $ 26.52 million. (Round to two decimal places.) If the cost of capital is 5.7%, the NPV of investment B is $40.17 million. (Round to two decimal places.) The NPV rule requires you to choose B (Select from the drop-down menu.) c. In this case, when does picking the higher IRR give the correct answer as to which investment is the best opportunity? The best investment opportunity when picking the higher IRR occurs for all discount rates higher than 9.66 %. (Round to two decimal places.) Help me solve this View an example Ask my instructor Similar question 06/05/22 1:45 PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts