Question: = Homework: Lab #8 Question 9, Problem 21-5 Part 1 of 8 HW Score: 20%, 8 of 40 points O Points: 0 of 10 Save

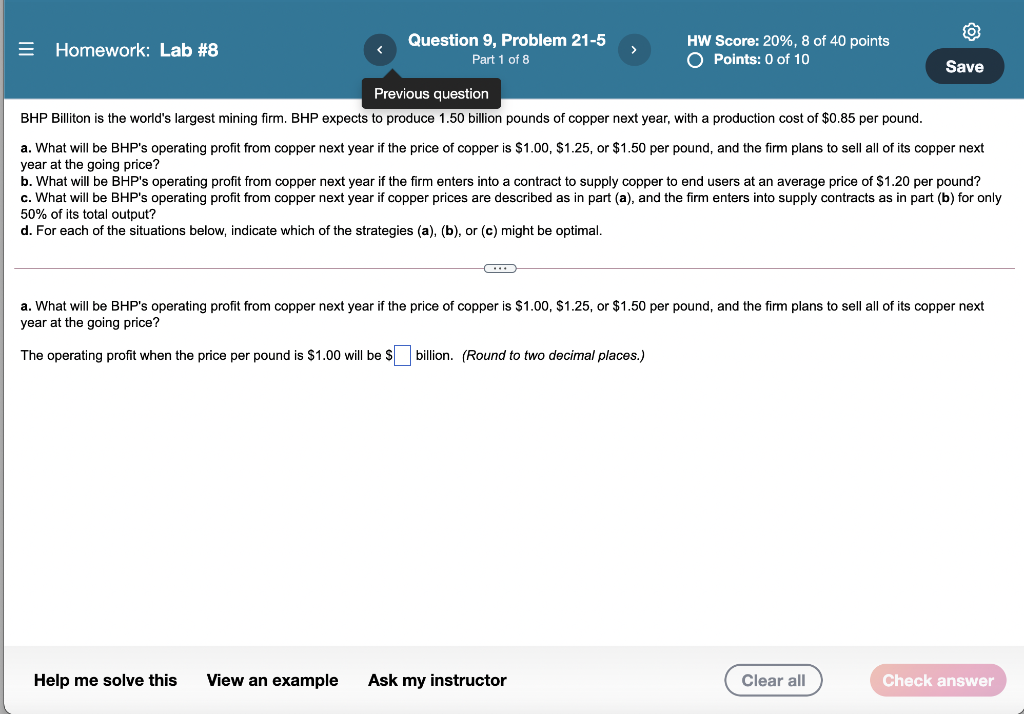

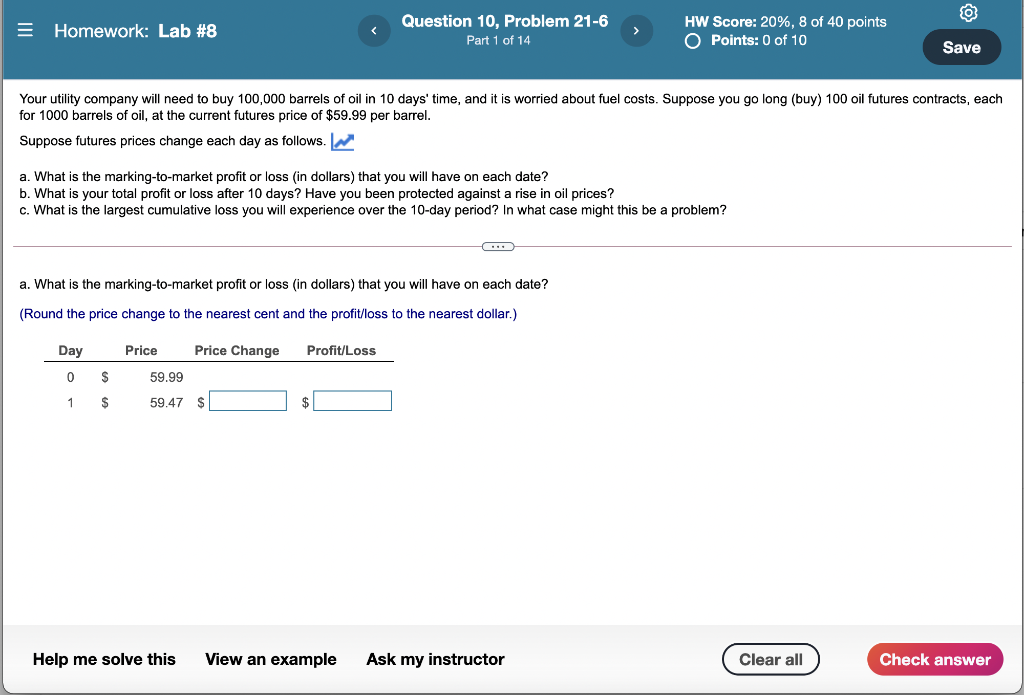

= Homework: Lab #8 Question 9, Problem 21-5 Part 1 of 8 HW Score: 20%, 8 of 40 points O Points: 0 of 10 Save Previous question BHP Billiton is the world's largest mining firm. BHP expects to produce 1.50 billion pounds of copper next year, with a production cost of $0.85 per pound. a. What will be BHP's operating profit from copper next year if the price of copper is $1.00, $1.25, or $1.50 per pound, and the firm plans to sell all of its copper next year at the going price? b. What will be BHP's operating profit from copper next year if the firm enters into a contract to supply copper to end users at an average price of $1.20 per pound? c. What will be BHP's operating profit from copper next year if copper prices are described as in part (a), and the firm enters into supply contracts as in part (b) for only 50% of its total output? d. For each of the situations below, indicate which of the strategies (a), (b), or (c) might be optimal. a. What will be BHP's operating profit from copper next year if the price of copper is $1.00, $1.25, or $1.50 per pound, and the firm plans to sell all of its copper next year at the going price? The operating profit when the price per pound is $1.00 will be s billion. (Round to two decimal places.) Help me solve this View an example Ask my instructor Clear all Check answer O = Homework: Lab #8 Question 10, Problem 21-6 Part 1 of 14 HW Score: 20%, 8 of 40 points O Points: 0 of 10 Save Your utility company will need to buy 100,000 barrels of oil in 10 days' time, and it is worried about fuel costs. Suppose you go long (buy) 100 oil futures contracts, each for 1000 barrels of oil, at the current futures price of $59.99 per barrel. Suppose futures prices change each day as follows. In a. What is the marking-to-market profit or loss (in dollars) that you will have on each date? b. What is your total profit or loss after 10 days? Have you been protected against a rise in oil prices? c. What is the largest cumulative loss you will experience over the 10-day period? In what case might this be a problem? C. a. What is the marking-to-market profit or loss (in dollars) that you will have on each date? (Round the price change to the nearest cent and the profit/loss to the nearest dollar.) Day Price Price Change Profit/Loss 0 $ 59.99 1 $ 59.47 $ $ Help me solve this View an example Ask my instructor Clear all Check answer = Homework: Lab #8 Question 9, Problem 21-5 Part 1 of 8 HW Score: 20%, 8 of 40 points O Points: 0 of 10 Save Previous question BHP Billiton is the world's largest mining firm. BHP expects to produce 1.50 billion pounds of copper next year, with a production cost of $0.85 per pound. a. What will be BHP's operating profit from copper next year if the price of copper is $1.00, $1.25, or $1.50 per pound, and the firm plans to sell all of its copper next year at the going price? b. What will be BHP's operating profit from copper next year if the firm enters into a contract to supply copper to end users at an average price of $1.20 per pound? c. What will be BHP's operating profit from copper next year if copper prices are described as in part (a), and the firm enters into supply contracts as in part (b) for only 50% of its total output? d. For each of the situations below, indicate which of the strategies (a), (b), or (c) might be optimal. a. What will be BHP's operating profit from copper next year if the price of copper is $1.00, $1.25, or $1.50 per pound, and the firm plans to sell all of its copper next year at the going price? The operating profit when the price per pound is $1.00 will be s billion. (Round to two decimal places.) Help me solve this View an example Ask my instructor Clear all Check answer O = Homework: Lab #8 Question 10, Problem 21-6 Part 1 of 14 HW Score: 20%, 8 of 40 points O Points: 0 of 10 Save Your utility company will need to buy 100,000 barrels of oil in 10 days' time, and it is worried about fuel costs. Suppose you go long (buy) 100 oil futures contracts, each for 1000 barrels of oil, at the current futures price of $59.99 per barrel. Suppose futures prices change each day as follows. In a. What is the marking-to-market profit or loss (in dollars) that you will have on each date? b. What is your total profit or loss after 10 days? Have you been protected against a rise in oil prices? c. What is the largest cumulative loss you will experience over the 10-day period? In what case might this be a problem? C. a. What is the marking-to-market profit or loss (in dollars) that you will have on each date? (Round the price change to the nearest cent and the profit/loss to the nearest dollar.) Day Price Price Change Profit/Loss 0 $ 59.99 1 $ 59.47 $ $ Help me solve this View an example Ask my instructor Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts