Question: Homework: Money and the Banking System Back to Assignment Attempts: Average: 12 1. Too Big to Fail and banks' ability to create money Consider

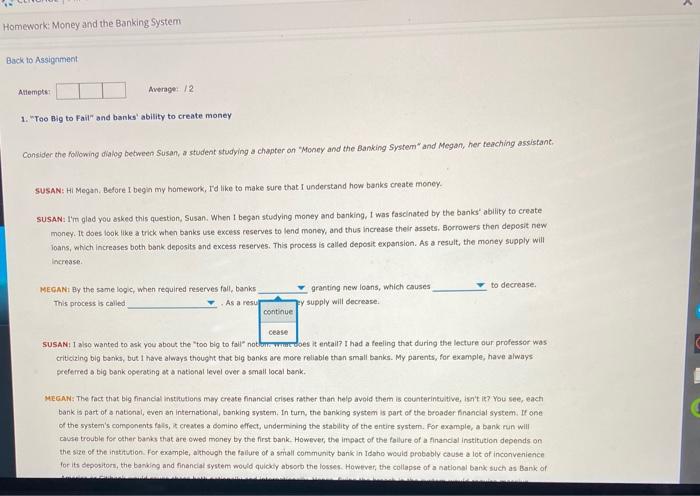

Homework: Money and the Banking System Back to Assignment Attempts: Average: 12 1. "Too Big to Fail" and banks' ability to create money Consider the following dialog between Susan, a student studying a chapter on "Money and the Banking System" and Megan, her teaching assistant. SUSAN: Hi Megan. Before I begin my homework, I'd like to make sure that I understand how banks create money. SUSAN: I'm glad you asked this question, Susan. When I began studying money and banking, I was fascinated by the banks' ability to create money. It does look like a trick when banks use excess reserves to lend money, and thus increase their assets. Borrowers then deposit new Joans, which increases both bank deposits and excess reserves. This process is called deposit expansion. As a result, the money supply will Increase. MEGAN: By the same logic, when required reserves fall, banks This process is called As a resul granting new loans, which causes supply will decrease. to decrease. continue cease SUSAN: I also wanted to ask you about the "too big to fail" notion was does it entail? I had a feeling that during the lecture our professor was criticizing big banks, but I have always thought that big banks are more reliable than small banks. My parents, for example, have always preferred a big bank operating at a national level over a small local bank. MEGAN: The fact that big financial institutions may create financial crises rather than help avoid them is counterintuitive, isn't it? You see, each bank is part of a national, even an international, banking system. In turn, the banking system is part of the broader financial system. If one of the system's components fails, it creates a domino effect, undermining the stability of the entire system. For example, a bank run will cause trouble for other banks that are owed money by the first bank. However, the impact of the failure of a financial institution depends on the size of the institution. For example, although the failure of a small community bank in Idaho would probably cause a lot of inconvenience for its depositors, the banking and financial system would quickly absorb the losses. However, the collapse of a national bank such as Bank of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts