Question: Homework: Problem Set 3 Save Score: 0 of 1 pt 11 of 13 (12 complete) HW Score: 74.36%, 9.67 of 13 p X P6-16 (similar

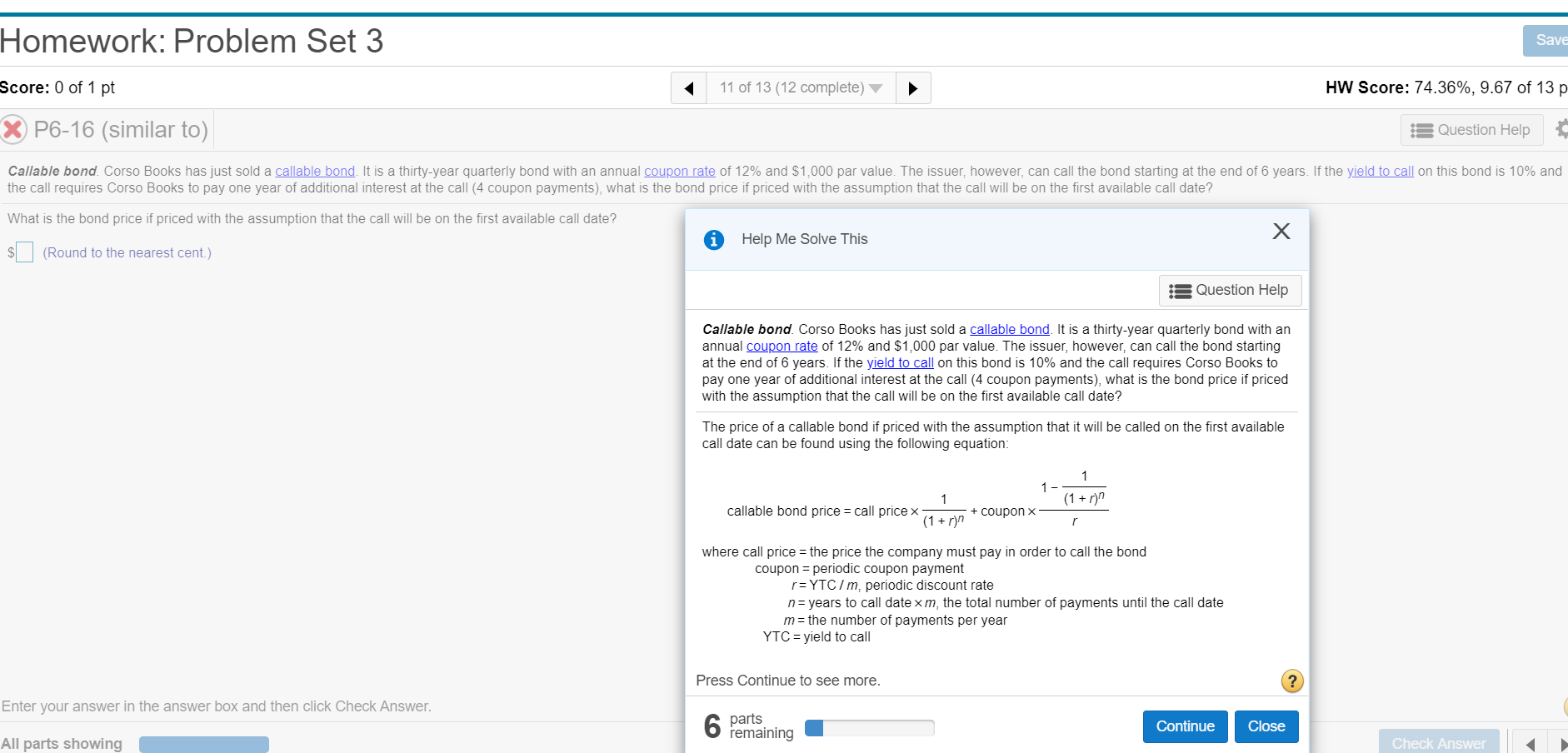

Homework: Problem Set 3 Save Score: 0 of 1 pt 11 of 13 (12 complete) HW Score: 74.36%, 9.67 of 13 p X P6-16 (similar to) Question Help Callable bond. Corso Books has just sold a callable bond. It is a thirty-year quarterly bond with an annual coupon rate of 12% and $1,000 par value. The issuer, however, can call the bond starting at the end of 6 years. If the yield to call on this bond is 10% and the call requires Corso Books to pay one year of additional interest at the call (4 coupon payments), what is the bond price if priced with the assumption that the call will be on the first available call date? What is the bond price if priced with the assumption that the call will be on the first available call date? Help Me Solve This $ (Round to the nearest cent.) s Question Help Callable bond. Corso Books has just sold a callable bond. It is a thirty-year quarterly bond with an annual coupon rate of 12% and $1,000 par value. The issuer, however, can call the bond starting at the end of 6 years. If the yield to call on this bond is 10% and the call requires Corso Books to pay one year of additional interest at the call (4 coupon payments), what is the bond price if priced with the assumption that the call will be on the first available call date? The price of a callable bond if priced with the assumption that it will be called on the first available call date can be found using the following equation: 1 - 1 an + coupon (1 + r) callable bond price = call price x where call price = the price the company must pay in order to call the bond coupon = periodic coupon payment r=YTC/m, periodic discount rate n= years to call date xm, the total number of payments until the call date m= the number of payments per year YTC = yield to call Press Continue to see more. Enter your answer in the answer box and then click Check Answer. parts remaining Continue Close All parts showing Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts