Question: Please provide cost of equity for abcd Homework: Problem Set 6 Save Score: 0 of 1 pt 5 of 11 (4 complete) HW Score: 29.09%,

Please provide cost of equity for abcd

Please provide cost of equity for abcd

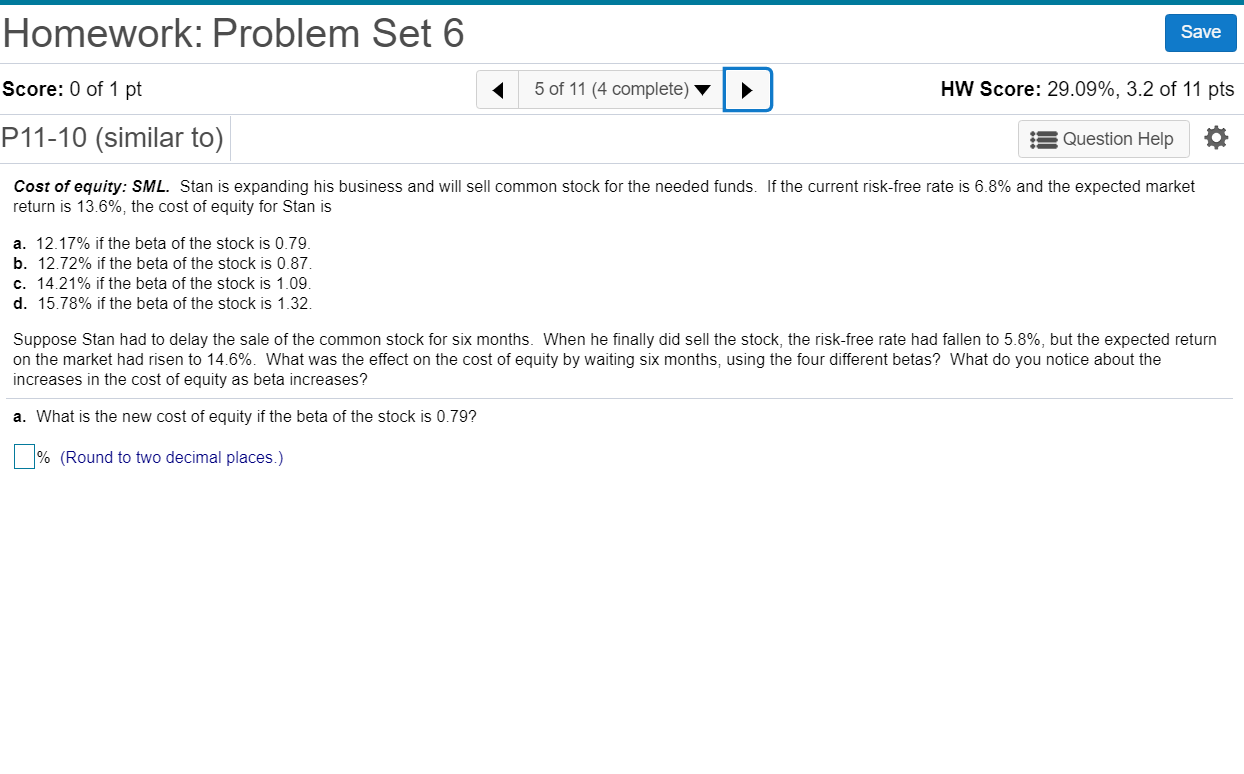

Homework: Problem Set 6 Save Score: 0 of 1 pt 5 of 11 (4 complete) HW Score: 29.09%, 3.2 of 11 pts P11-10 (similar to) :3 Question Help Cost of equity: SML. Stan is expanding his business and will sell common stock for the needed funds. If the current risk-free rate is 6.8% and the expected market return is 13.6%, the cost of equity for Stan is a. 12.17% if the beta of the stock is 0.79. b. 12.72% if the beta of the stock is 0.87. c. 14.21% if the beta of the stock is 1.09. d. 15.78% if the beta of the stock is 1.32 Suppose Stan had to delay the sale of the common stock for six months. When he finally did sell the stock, the risk-free rate had fallen to 5.8%, but the expected return on the market had risen to 14.6%. What was the effect on the cost of equity by waiting six months, using the four different betas? What do you notice about the increases in the cost of equity as beta increases? a. What is the new cost of equity if the beta of the stock is 0.79? % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts