Question: Homework Question 6 , P 9 - 3 3 ( similar to ) Part 1 of 8 HW Score: 3 0 . 3 6 %

Homework

Question P similar to

Part of

HW Score: of points

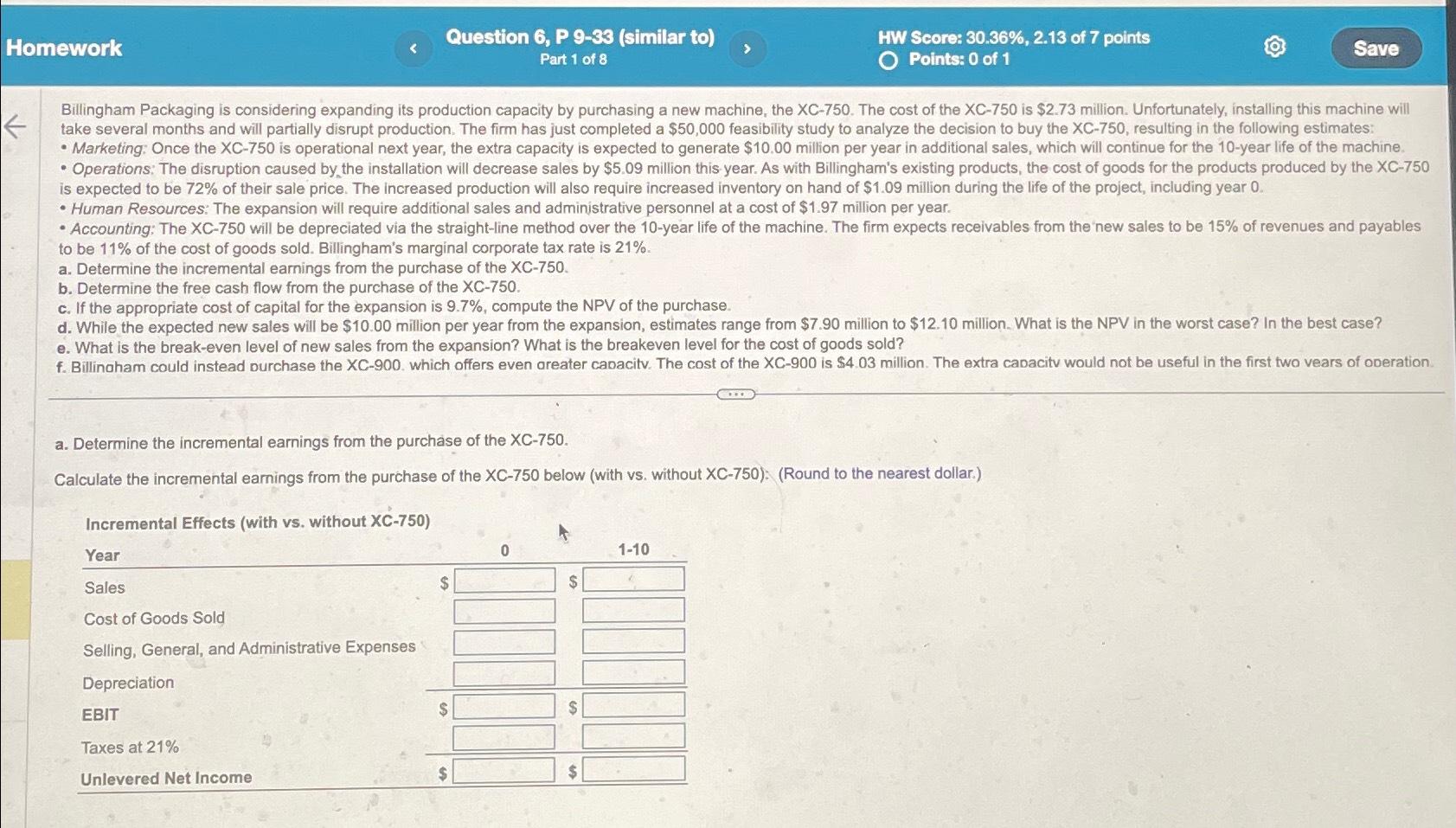

Points: of is expected to be of their sale price. The increased production will also require increased inventory on hand of $ million during the life of the project, including year

Human Resources: The expansion will require additional sales and administrative personnel at a cost of $ million per year. to be of the cost of goods sold. Billingham's marginal corporate tax rate is

a Determine the incremental earnings from the purchase of the XC

b Determine the free cash flow from the purchase of the

c If the appropriate cost of capital for the expansion is compute the NPV of the purchase.

e What is the breakeven level of new sales from the expansion? What is the breakeven level for the cost of goods sold?

a Determine the incremental earnings from the purchase of the

Calculate the incremental earnings from the purchase of the XC below with vs without XC: Round to the nearest dollar.

Incremental Effects with vs without XC

Year

Sales

$

Cost of Goods Sold

Selling, General, and Administrative Expenses

Depreciation

EBIT

Taxes at

Unlevered Net Income

table$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock