Question: Homework Questions for Required Return on a Stock 1. Explain what the required rate of return means. 2. Standard Deviation measures total risk. larger

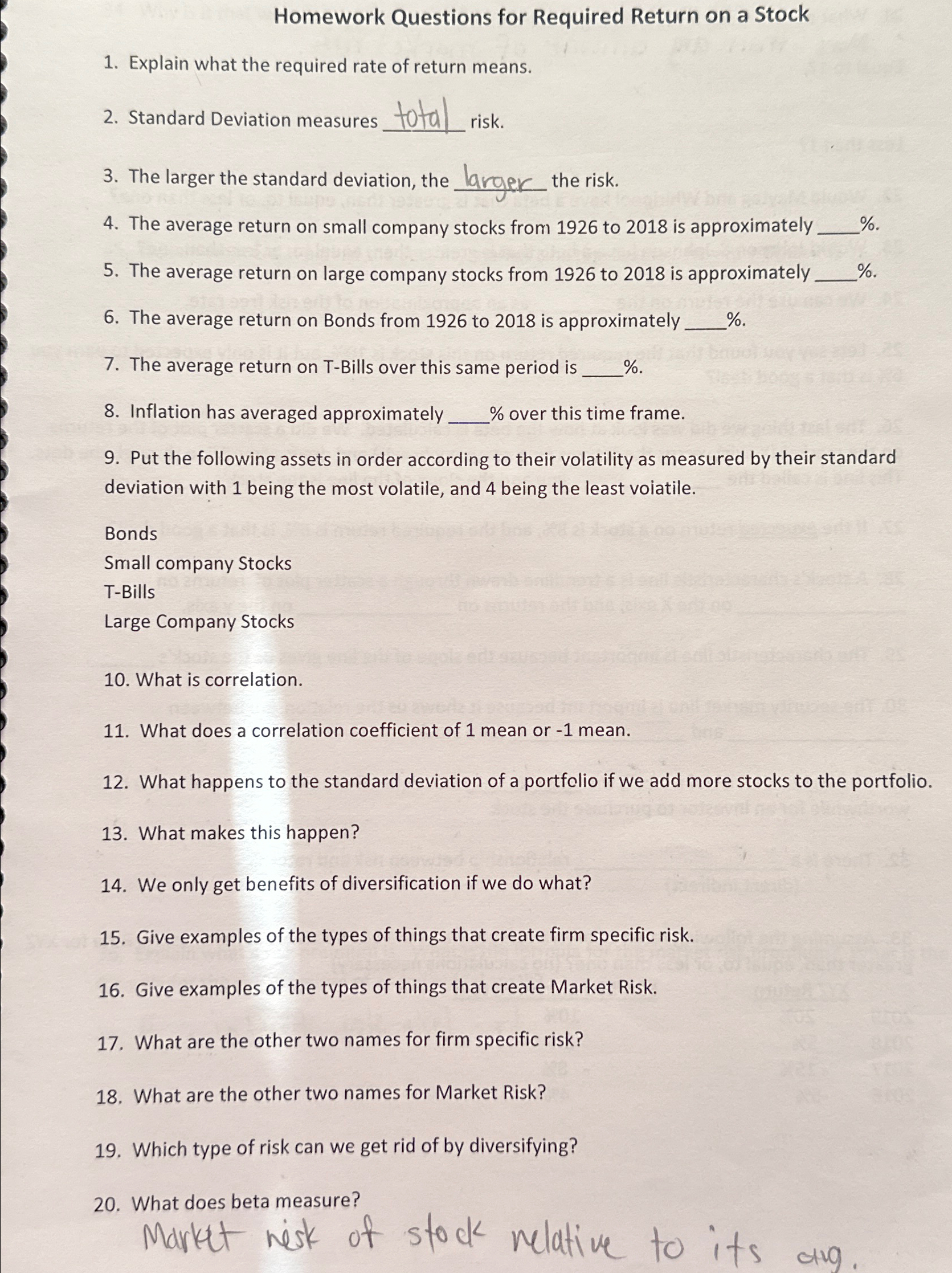

Homework Questions for Required Return on a Stock 1. Explain what the required rate of return means. 2. Standard Deviation measures total risk. larger the risk. 3. The larger the standard deviation, the larger 4. The average return on small company stocks from 1926 to 2018 is approximately %. 5. The average return on large company stocks from 1926 to 2018 is approximately. to noticab 6. The average return on Bonds from 1926 to 2018 is approximately %. 7. The average return on T-Bills over this same period is %. 8. Inflation has averaged approximately % over this time frame. %. 9. Put the following assets in order according to their volatility as measured by their standard deviation with 1 being the most volatile, and 4 being the least volatile. Bonds Small company Stocks T-Bills Large Company Stocks 10. What is correlation. 11. What does a correlation coefficient of 1 mean or -1 mean. 12. What happens to the standard deviation of a portfolio if we add more stocks to the portfolio. 13. What makes this happen? 14. We only get benefits of diversification if we do what? 15. Give examples of the types of things that create firm specific risk. 16. Give examples of the types of things that create Market Risk. 17. What are the other two names for firm specific risk? 18. What are the other two names for Market Risk? 19. Which type of risk can we get rid of by diversifying? 20. What does beta measure? Market risk of stock relative to its dig.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts