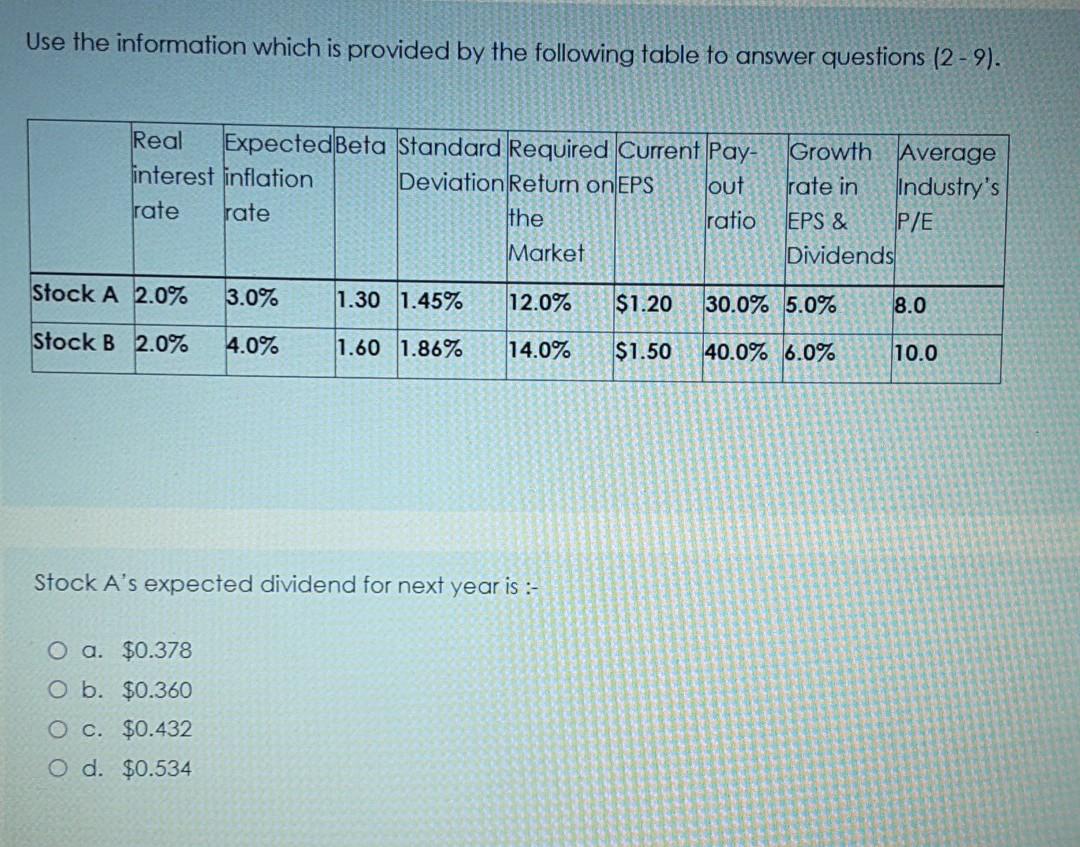

Question: Use the information which is provided by the following table to answer questions (2-9). Real ExpectedBeta Standard Required Current Pay- linterest inflation Deviation Return on

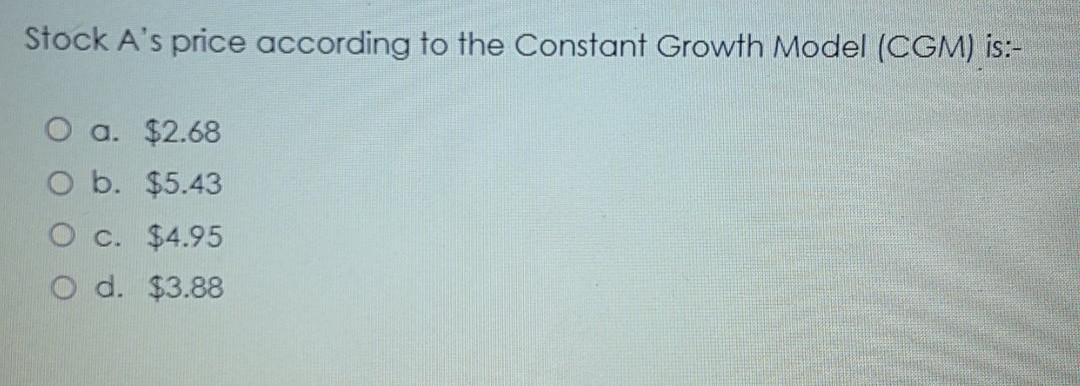

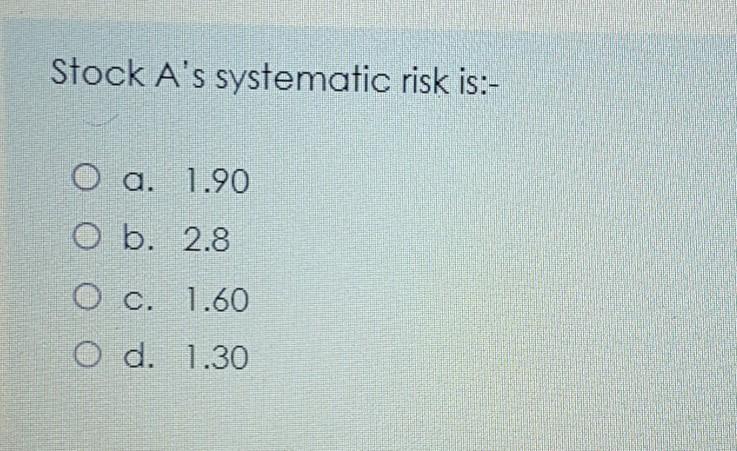

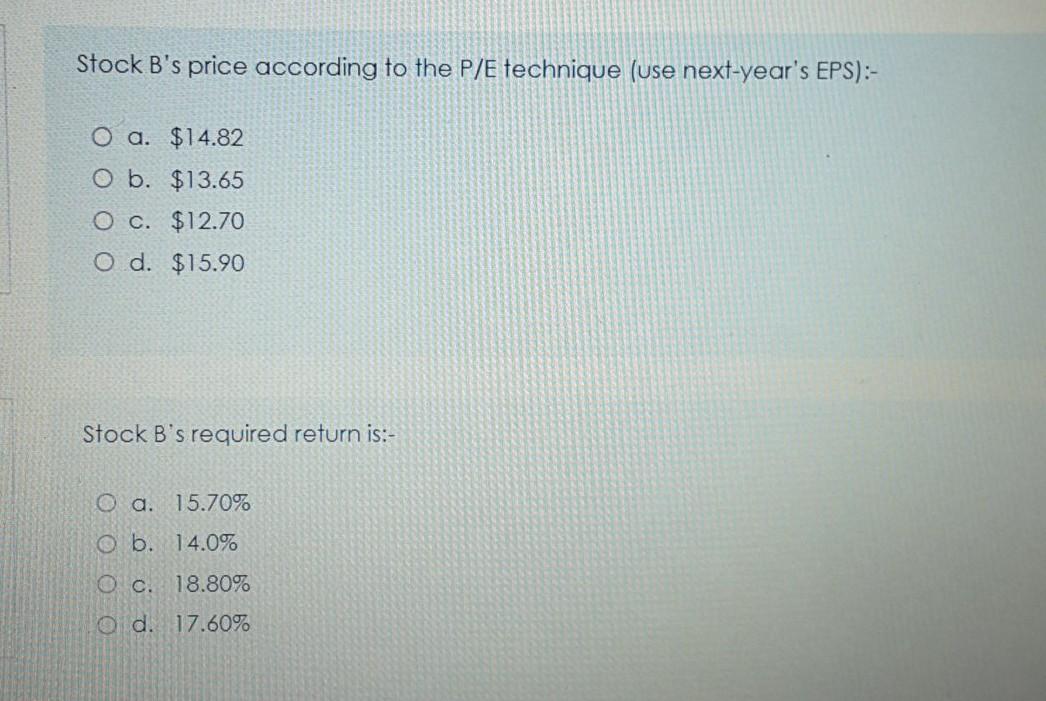

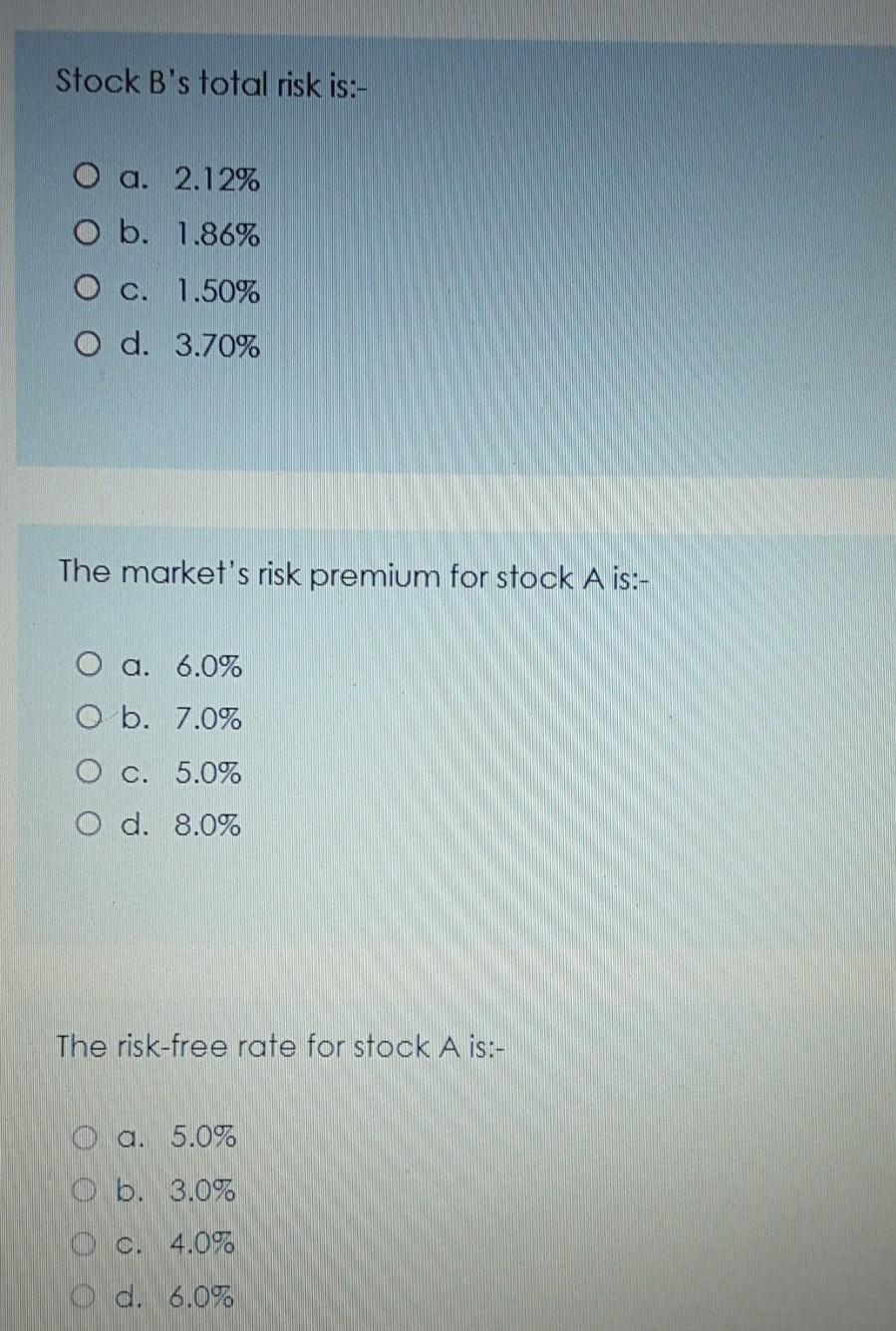

Use the information which is provided by the following table to answer questions (2-9). Real ExpectedBeta Standard Required Current Pay- linterest inflation Deviation Return on EPS out rate rate the ratio Market Growth Average rate in Industry's EPS & P/E Dividends Stock A 2.0% 3.0% 1.30 1.45% 12.0% $1.20 30.0% 5.0% 8.0 Stock B 2.0% 4.0% 1.60 1.86% 14.0% $1.50 40.0% 6.0% 10.0 Stock A's expected dividend for next year is :- O a. $0.378 O b. $0.360 O c. $0.432 O d. $0.534 Stock A's price according to the Constant Growth Model (CGM) is:- a. $2.68 O b. $5.43 O c. $4.95 O d. $3.88 Stock A's systematic risk is:- O a. 1.90 O b. 2.8 O c. 1.60 O d. 1.30 Stock B's price according to the P/E technique (use next-year's EPS):- O a. $14.82 O b. $13.65 O c. $12.70 O d. $15.90 Stock B's required return is:- O a. 15.70% O b. 14.0% O c. 18.80% O d. 17.60% Stock B's total risk is:- O a. 2.12% O b. 1.86% O c. 1.50% O d. 3.70% The market's risk premium for stock A is:- O a. 6.0% b. 7.0% O c. 5.0% O d. 8.0% The risk-free rate for stock A is :- O a. 5.0% b. 3.0% O c. 4.0% Od. 6.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts