Question: Homework: Week 5 Homework (Ch 17, 20) 0 Part 1 of 2 Score: 0 of 1 point Save Use the option data from July 23,

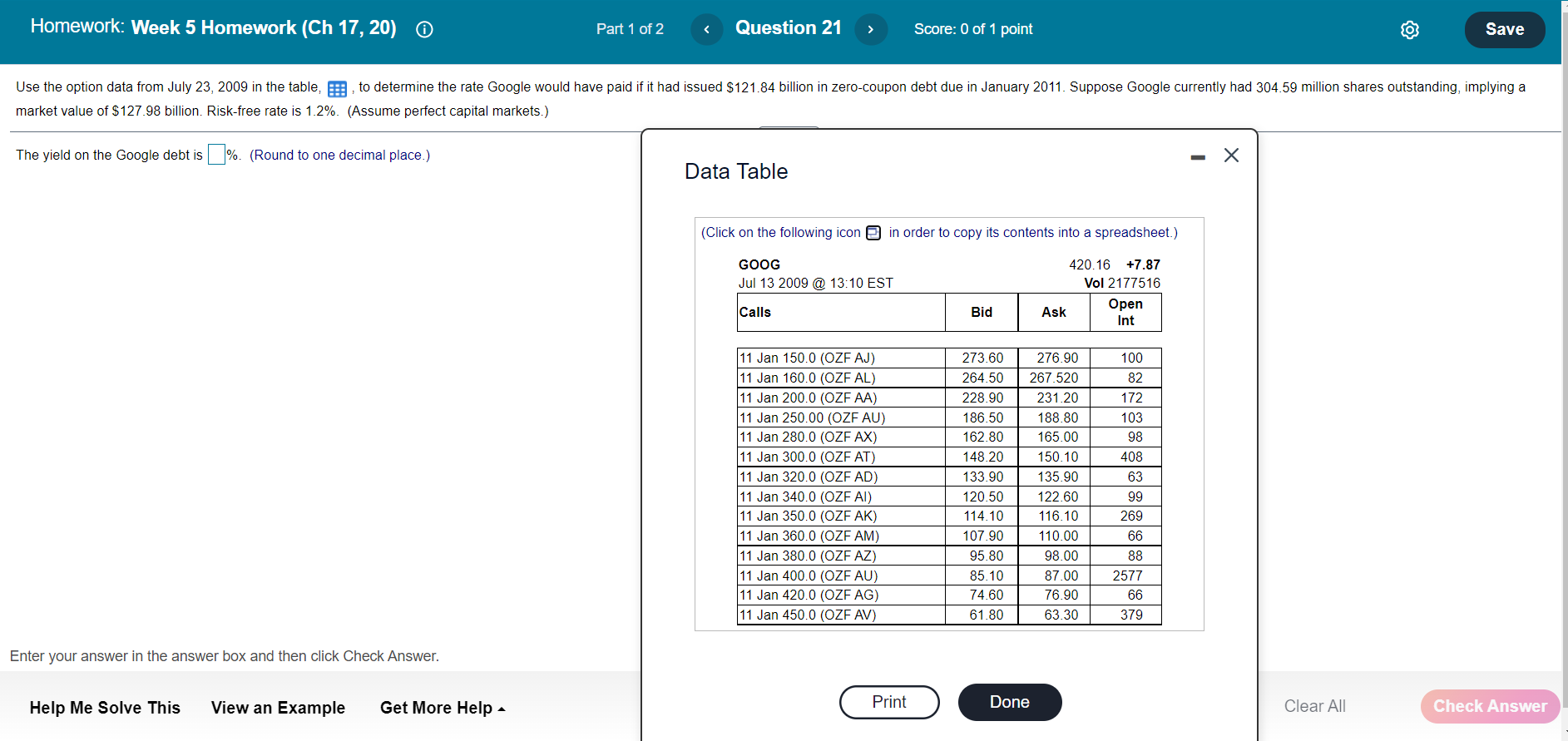

Homework: Week 5 Homework (Ch 17, 20) 0 Part 1 of 2 Score: 0 of 1 point Save Use the option data from July 23, 2009 in the table, to determine the rate Google would have paid if it had issued $121.84 billion in zero-coupon debt due in January 2011. Suppose Google currently had 304.59 million shares outstanding, implying a market value of $127.98 billion. Risk-free rate is 1.2%. (Assume perfect capital markets.) The yield on the Google debt is %. (Round to one decimal place.) x Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) GOOG Jul 13 2009 @ 13:10 EST 420.16 +7.87 Vol 2177516 Ask Open Int Calls Bid 11 Jan 150.0 (OZF AJ) 11 Jan 160.0 (OZE AL) 11 Jan 200.0 (OZF AA) 11 Jan 250.00 (OZE AU) 11 Jan 280.0 (OZF AX) 11 Jan 300.0 (OZE AT) 11 Jan 320.0 (OZF AD) 11 Jan 340.0 (OZF AI) 11 Jan 350.0 (OZE AK) 11 Jan 360.0 (OZE AM) 11 Jan 380.0 (OZE AZ) 11 Jan 400.0 (OZF AU) 11 Jan 420.0 (OZF AG) 11 Jan 450.0 (OZF AV) 273.60 264.50 228.90 186.50 162.80 148.20 133.90 120.50 114.10 107.90 95.80 85.10 74.60 61.80 276.90 267.520 231.20 188.80 165.00 150.10 135.90 122.60 116.10 110.00 98.00 87.00 76.90 63.30 100 82 172 103 98 408 63 99 269 66 88 2577 66 379 Enter your answer in the answer box and then click Check Answer. Help Me Solve This View an Example Print Get More Help - Done Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts