Question: Hooli Inc. issues a zero coupon bond with one year to maturity, priced at $930.972500 per $1,000 face value. (b) Consider a portfolio that consists

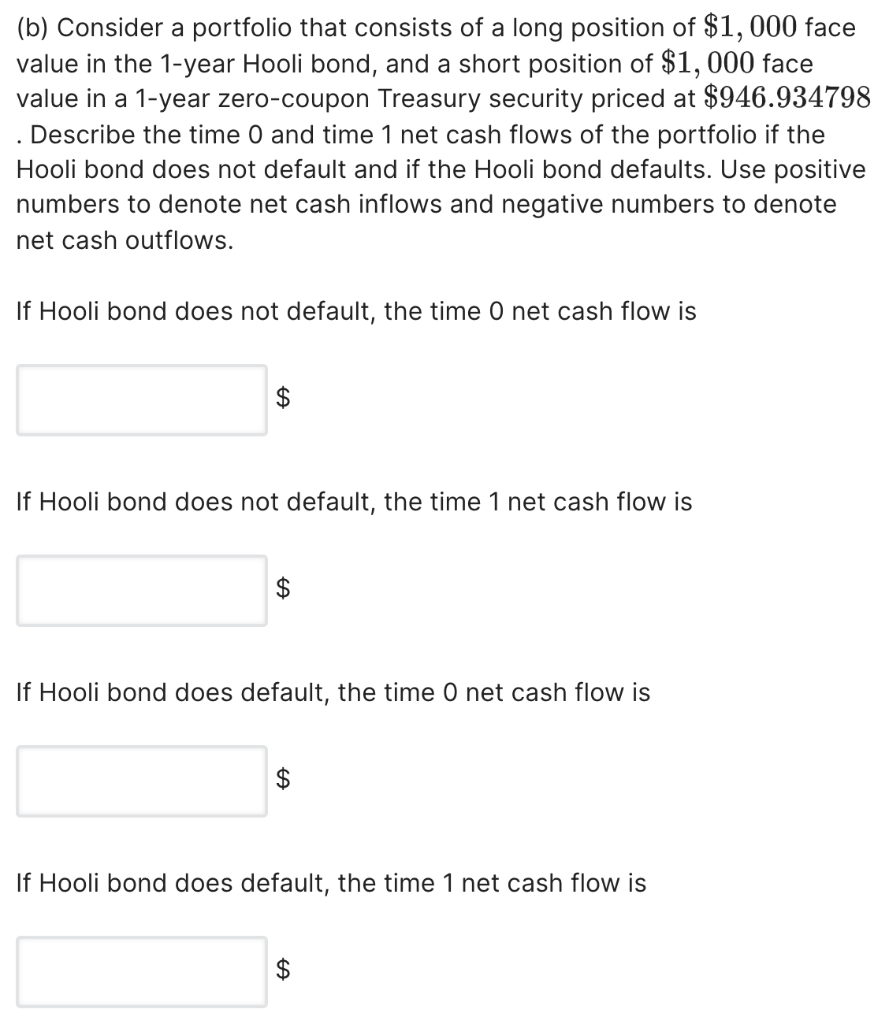

Hooli Inc. issues a zero coupon bond with one year to maturity, priced at $930.972500 per $1,000 face value. (b) Consider a portfolio that consists of a long position of $1,000 face value in the 1-year Hooli bond, and a short position of $1,000 face value in a 1-year zero-coupon Treasury security priced at $946.934798 . Describe the time 0 and time 1 net cash flows of the portfolio if the Hooli bond does not default and if the Hooli bond defaults. Use positive numbers to denote net cash inflows and negative numbers to denote net cash outflows. . If Hooli bond does not default, the time 0 net cash flow is $ If Hooli bond does not default, the time 1 net cash flow is $ If Hooli bond does default, the time 0 net cash flow is $ If Hooli bond does default, the time 1 net cash flow is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts