Question: Hope for a fast reply. Thumbs up guaranteed! Current Attempt in Progress Buffalo Ltd. purchased a building on January 1, 2018 for $14,520,000. Buffalo accounted

Hope for a fast reply. Thumbs up guaranteed!

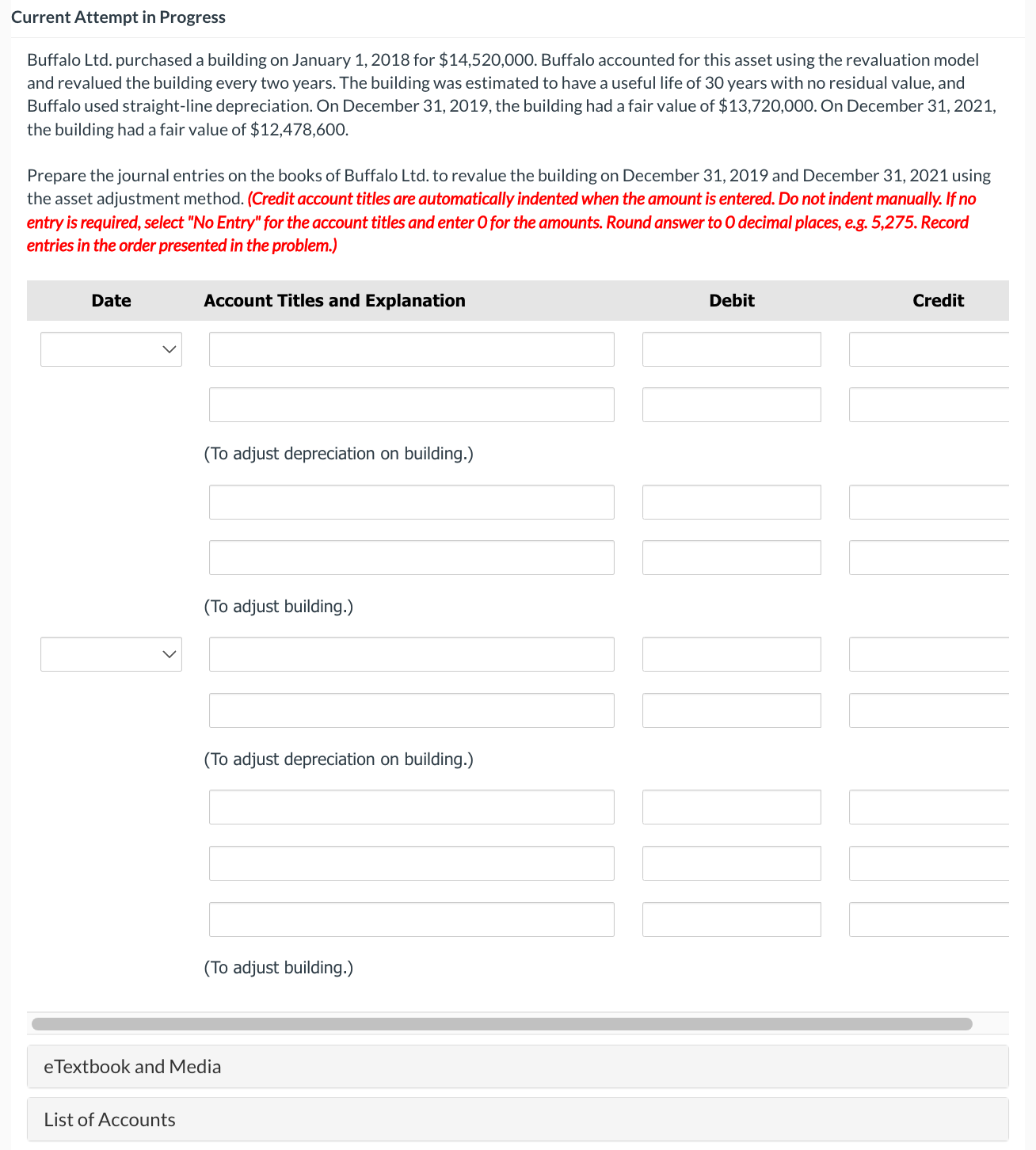

Current Attempt in Progress Buffalo Ltd. purchased a building on January 1, 2018 for $14,520,000. Buffalo accounted for this asset using the revaluation model and revalued the building every two years. The building was estimated to have a useful life of 30 years with no residual value, and Buffalo used straight-line depreciation. On December 31, 2019, the building had a fair value of $13,720,000. On December 31, 2021, the building had a fair value of $12,478,600. Prepare the journal entries on the books of Buffalo Ltd. to revalue the building on December 31, 2019 and December 31, 2021 using the asset adjustment method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts. Round answer to O decimal places, e.g. 5,275. Record entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To adjust depreciation on building.) (To adjust building.) (To adjust depreciation on building.) (To adjust building.) e Textbook and Media List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts