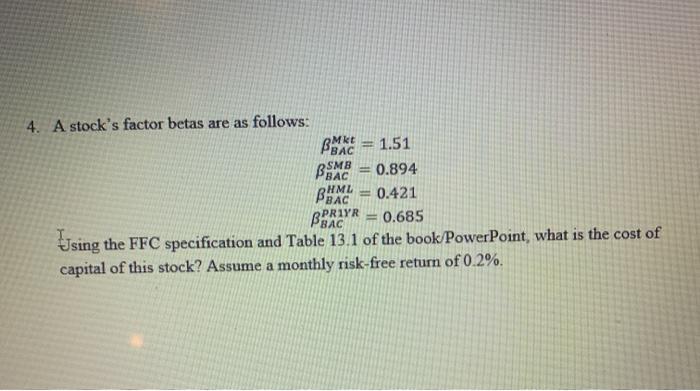

Question: hope this js the info needed to answer 4. A stock's factor betas are as follows: 1.51 BSMB 0.894 0.421 0.685 BAC BERAPR Using

hope this js the info needed to answer

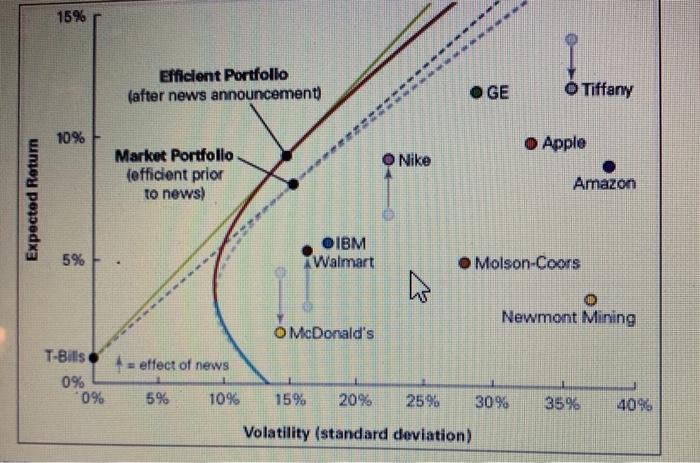

4. A stock's factor betas are as follows: 1.51 " BSMB 0.894 0.421 0.685 BAC BERAPR Using the FFC specification and Table 13.1 of the book/PowerPoint , what is the cost of capital of this stock? Assume a monthly risk-free return of 0.2%. 15% Efficient Portfolio (after news announcement) GE O Tiffany 10% O Apple Nike Market Portfolio (efficient prior to news) Amazon Expected Return 5% OIBM Walmart Molson-Coors Newmont Mining O McDonald's = effect of news T-Bills 0% 0% 5% 10% 15% 20% 259 30% 35% 4096 Volatility (standard deviation)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock