Question: HOSPITALITY FEASIBILITY STUDY CASE FEASIBILITY STUDY CASE - Having had good investment opportunuities in USA, with high return on equity now, your company BTT Co.,

HOSPITALITY FEASIBILITY STUDY CASE

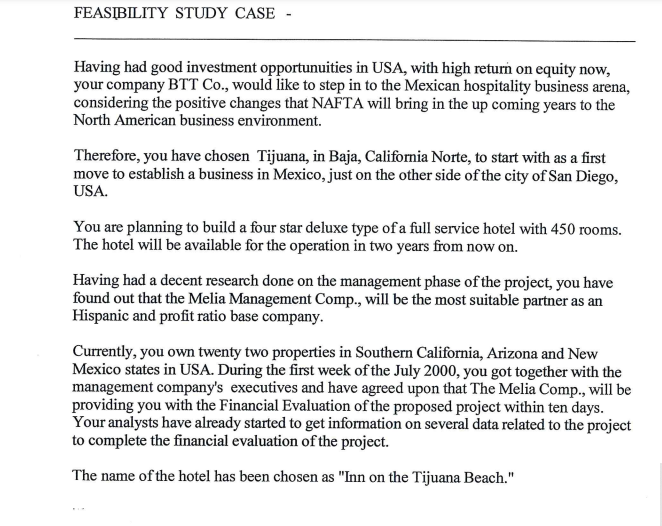

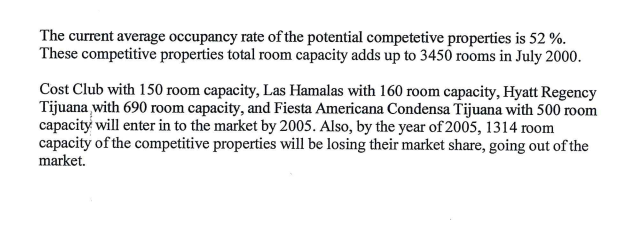

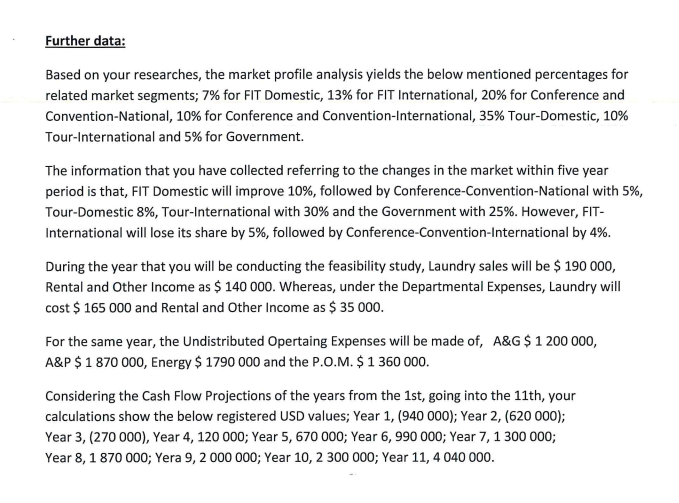

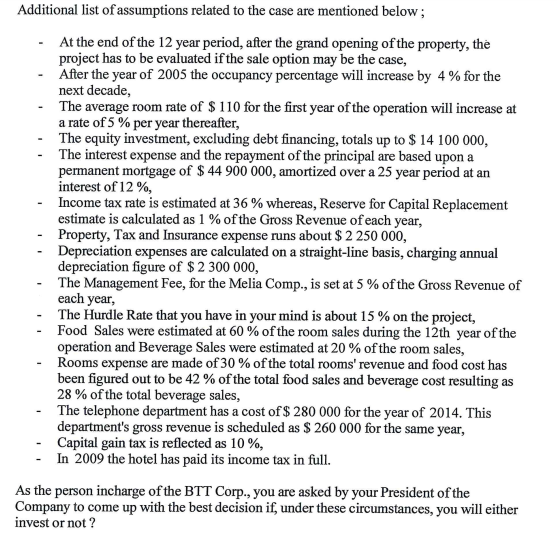

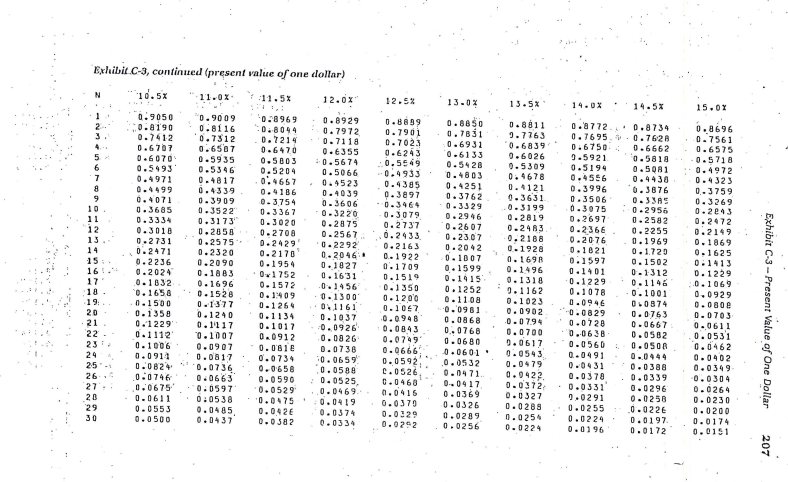

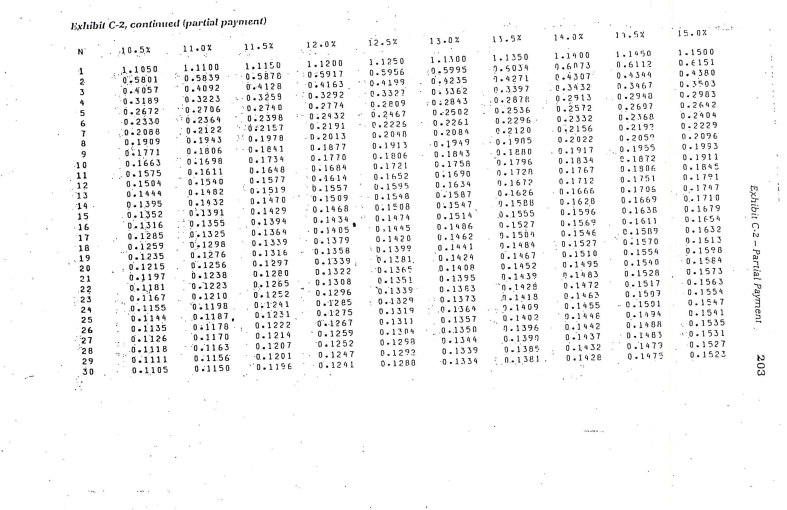

FEASIBILITY STUDY CASE - Having had good investment opportunuities in USA, with high return on equity now, your company BTT Co., would like to step in to the Mexican hospitality business arena, considering the positive changes that NAFTA will bring in the up coming years to the North American business environment. Therefore, you have chosen Tijuana, in Baja, California Norte, to start with as a first move to establish a business in Mexico, just on the other side of the city of San Diego, USA. You are planning to build a four star deluxe type of a full service hotel with 450 rooms. The hotel will be available for the operation in two years from now on. Having had a decent research done on the management phase of the project, you have found out that the Melia Management Comp., will be the most suitable partner as an Hispanic and profit ratio base company. Currently, you own twenty two properties in Southern California, Arizona and New Mexico states in USA. During the first week of the July 2000, you got together with the management company's executives and have agreed upon that The Melia Comp., will be providing you with the Financial Evaluation of the proposed project within ten days. Your analysts have already started to get information on several data related to the project to complete the financial evaluation of the project. The name of the hotel has been chosen as "Inn on the Tijuana Beach." The current average occupancy rate of the potential competetive properties is 52 %. These competitive properties total room capacity adds up to 3450 rooms in July 2000. Cost Club with 150 room capacity, Las Hamalas with 160 room capacity, Hyatt Regency Tijuana with 690 room capacity, and Fiesta Americana Condensa Tijuana with 500 room capacity will enter in to the market by 2005. Also, by the year of 2005, 1314 room capacity of the competitive properties will be losing their market share, going out of the market. Further data: Based on your researches, the market profile analysis yields the below mentioned percentages for related market segments; 7% for FIT Domestic, 13% for FIT International, 20% for Conference and Convention-National, 10% for Conference and Convention-International, 35% Tour-Domestic, 10% Tour-International and 5% for Government. The information that you have collected referring to the changes in the market within five year period is that, FIT Domestic will improve 10%, followed by Conference-Convention-National with 5%, Tour-Domestic 8%, Tour-International with 30% and the Government with 25%. However, FIT- International will lose its share by 5%, followed by Conference-Convention-International by 4%. During the year that you will be conducting the feasibility study, Laundry sales will be $ 190 000, Rental and Other Income as $ 140 000. Whereas, under the Departmental Expenses, Laundry will cost $ 165 000 and Rental and Other Income as $ 35 000. For the same year, the Undistributed Opertaing Expenses will be made of, A&G $ 1 200 000, A&P $ 1 870 000, Energy $ 1790 000 and the P.O.M. $ 1 360 000. Considering the Cash Flow Projections of the years from the 1st, going into the 11th, your calculations show the below registered USD values; Year 1, (940 000); Year 2, (620 000); Year 3, (270 000), Year 4, 120 000; Year 5, 670 000; Year 6, 990 000; Year 7, 1 300 000; Year 8,1 870 000; Yera 9, 2 000 000; Year 10,2 300 000; Year 11, 4040 000. Additional list of assumptions related to the case are mentioned below; - At the end of the 12 year period, after the grand opening of the property, the project has to be evaluated if the sale option may be the case, - After the year of 2005 the occupancy percentage will increase by 4 % for the next decade, - The average room rate of $ 110 for the first year of the operation will increase at a rate of 5% per year thereafter, - The equity investment, excluding debt financing, totals up to $ 14 100 000, - The interest expense and the repayment of the principal are based upon a permanent mortgage of $ 44 900 000, amortized over a 25 year period at an interest of 12%, Income tax rate is estimated at 36 % whereas, Reserve for Capital Replacement estimate is calculated as 1% of the Gross Revenue of each year, - Property, Tax and Insurance expense runs about $ 2 250 000, - Depreciation expenses are calculated on a straight-line basis, charging annual depreciation figure of $ 2 300 000, The Management Fee, for the Melia Comp., is set at 5 % of the Gross Revenue of each year, The Hurdle Rate that you have in your mind is about 15% on the project, Food Sales were estimated at 60% of the room sales during the 12th year of the operation and Beverage Sales were estimated at 20 % of the room sales, Rooms expense are made of 30% of the total rooms' revenue and food cost has been figured out to be 42% of the total food sales and beverage cost resulting as 28 % of the total beverage sales, The telephone department has a cost of $ 280 000 for the year of 2014. This department's gross revenue is scheduled as $ 260 000 for the same year, - Capital gain tax is reflected as 10%, In 2009 the hotel has paid its income tax in full. As the person incharge of the BTT Corp., you are asked by your President of the Company to come up with the best decision if, under these circumstances, you will either invest or not? 1. You are supposed to complete Exhibit (1) and Exhibit (2) in order to evaluate the Market Profile, drawing conclusions, 2. Also, you have to complete the Capital Investment Analysis going through the necessary steps ( ignore the Short Term Cash Flow Projection for the case ), 3. Having done your calculations, decide either to have Going-in or Fall-back positions and why? Exhibit.C-3, continued (present value of one dollar) 10.5x 11.0X 11.5% 12.0X" N 12.5% 13.0% 13.5% 14.0% 14.5% 15.07 5 7 0.9050 0.8190 0.7412 0.6707 0.6070 0.5493 0.4971 0.4499 0.4071 0.3685 0.3334 0.3018 0.2731 0.2471 0.2236 0.2024 0.1832 0.1658 0.1500 0.1358 0.1229 0.1112 0.1006 0.0911 0.082 0.0746 0.0675' 0.0611 0.0553 0.0500 9 10 11 12 13 14 15 16 17 18 19: 20 21 22 23 24 2.5 26 27 20 29 30 0.9009 0.8116 0.7312 0.6587 0.5935 0.5346 0.4817 0.4339 0.3909 0.3522 0.3173 0.2858 0.2575 0.2320 0.2090 0.1883 0.1696 0.1528 0.1377 0.1240 0.1117 0.1007 0.0907 0.0817 0.0736 0.0663 0.0597 0:0538 0.0485 0.0437 028 969 0.8044 0.7214 0.6470 0.5003 0.5204 0.4657 0.4186 0.3.75 4 0.3367 0.3020 0.2708 0.2429 0.2170 0.1954 0x1752 0.1572 0.1409 0.1264 0.1134 0.1017 0.0912 0.081 0.0734 0.0656 0.0590 0.0529 0.0475 0.042 0.382 0.8929 0.7972 0.7118 0.6355 10.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.2875 0.2567 0.2292 0.2046 0.1027 0.1631 .0.1456 0.1300 0.1161 0.1037 0.0926 0.0826 0.0736 0.0659 0.0588 : 0.0525 ..0.0469 0.0419 0.0374 0.0334 0.8839 0.7901 0.702.3 0.6243 0.5549 -0.4933 0.4385 0.3897 0.3464 0.3079 0.2737 0.2433 0.2163 0.1922 0.1709 0.1519 0.1350 0.1200 0.107 0.0948 0.0843 0.0749 0.0666 0.0592 C.0526 0.0460 0.0416 0.0379 0.0329 0.0252 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 0.3329 0.2946 0.2607 0.23.07 0.2042 0.1007 0..1599 0.1415 0.1252 0.1108 0.0981 0.0868 0.0768 0.0680 0.0601 0.0532 0.0471 0.0417 0.0369 0.0326 0.0289 0.0256 0.8811 9.7763 0.6839 0.6026 0.5309 0.4678 0.1121 0.3631 0.3199 0.2819 0.2483 0.2188 0.1928 0.1698 0.1496 0.1318 9.1162 0.1023 0.0902 0.0794 0.0700 0.0617 0.0543 0.0479 0.0422 0.0372 0.0327 0.0288 0.0254 0.0224 0.8772 0.8734 0.7695.0.0.7628 0.6750 0.6662 9.5921 0.5818 0.5194 0.5081 0.4556 0.4430 0.3996 0.3876 0.3506 0.335 0.3075 0.2956 0.2697 0.2582 0.2366 0.2255 0.2076 0.1969 0.1021 0.1.729 0.1597 0.1502 0.1401 0.1312 0.1229 0.1146 0.1078 0.1001 0.0946 0.0374 -0.0829 0.0763 0.0720 0.0667 0.0638 0.0582 0.0560 0.050 0.0491 0.0444 0.0431 0.0388 0.0378 0.0339 0.0331 0.0296 9.0291 0.0258 0.0255 0.0226 0.0224 0.0197 0.0196 0.0172 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.-3759 0.3269 0.2243 0.2472 0.2149 0.1869 0.1625 0.1413 0.1229 0.1069 0.0929 0.080 e 0.0703 0.0611 0.0531 0.0462 0.0402 0.0349 0.0304 0.0264 0.0230 0.0200 0.0174 0.0151 .. Exhibit C-3 - Present Value of One Dollar . . 207 Exhibit C-2, continued (partial paynient) 11.52 i5.0% 12.0% 11.52 12.52 13.52 N 10.52 11.0% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 16 1.1050 0.5801 0.4057 0.3189 0.2672 -0.2330 0.2008 0.1909 0:1771 0.1663 0.1575 0.1504 1.1100 0.5839 0.4092 0.3223 0.2706 10.2364 0.2122 0.1943 0.1806 0.1998 0.1611 0.1540 0.1902 0.1432 0.1391 0.1355 0.1325 0.1296 0.1276 0.1256 0.1238 0.1223 0.1210 0.1190 0.1187 0.1178 0.1170 0.1163 0.11.56 0.1150 0.1395 0.1352 0.1316 0.1285 0.1259 0.1235 0.1215 0.1197 0.1181 0.1167 0.1155 0.1144 0.1135 0.1126 .0.111B 0.1111 0.1105 1.1150 0.5870 0.4128 0.3259 0.2740 0.2398 0:2157 10.1978 0.1841 0.1734 0.1648 0.1572 0.1519 0.1470 0.1429 0.1394 0.1364 0.1339 0.1316 0.1297 0.1200 0.1265 0.1252 0.1241 0.1231 0.1222 0.1214 0.1207 -0.1 201 -0.1196 1.1200 0.5917 -0.4163 0.3292 0.2774 :- 0.2932 0.2191 0.2013 0.1877 0.1770 0.1684 0.1614 0.1557 0.1509 0.1468 0.1434 0.1405 0.1379 0.1358 0.1339 0.1322 0.1308 0.1296 0.12 es 0.1275 0.1267 0.1259 0.1252 0.1247 0.1241 1. 1250 0.5956 0.4199 0.3327 0.2009 0.2467 0.2225 0.2040 0.1913 0.1806 0.1721 0.1692 0.1595 0.1548 0.1508 0.1974 0.1945 0.1420 0.1399 0.1981 0.1365 0.135 0.1339 0.1329 0.1319 0.131) 0.134 0.1258 0.1291 0.1288 13.02 1.1.300 9.5995 0.9235 0.5362 0:2843 0.2502 0.2261 0.2084 0.1949 0.1843 0.1758 0.1690 0.1634 0.1587 0.1547 0.1514 0.1986 0.1462 0.1441 0.1424 0.140 0.1395 0.1363 10.1373 1.0.136 0.1357 0.1350 0.1344 0.1339 -0.1334 1.1350 9.5034 1.4271 0.3397 0.2876 0.2536 0.2296 0.2120 0.1985 9.100 0.1796 0.1721 0.1672 0.1626 9.1508 0.1555 0.1527 9.1509 9.14B 4 0.1467 0.1452 0.1439 0.1426 1.1419 9.1409 0.1402 1.1396 0.1399 0.1385 0.1381. 1.1400 9.6073 0.4307 0.3432 0.2913 0.2572 0.2332 0.2156 0.2022 0.1917 0.1834 0.1767 0.1712 0.1666 0.1620 0.1596 0.1569 0.1546 0.1527 0.1510 0.1495 0.1483 0.1472 @.1463 0.1455 9.1446 0.1442 0.1437 0.132 0.142 1.1950 0.6112 0.1344 2.3467 0.2943 0.2697 0.2368 0.219? 0.2059 0.1955 0.1872 3.1906 0.1751 0.1705 0.1669 0.1636 0.1611 0.1589 0.1570 0.1554 0.1540 0.1528 0.1517 0.1592 -0.1591 0.1494 0.1488 0.1483 0.1472 0.143 1.1500 0.6151 0.4380 0.3503 0.2983 0.2642 0.2404 0.2229 0.2096 0.1993 0.1911 0.1845 0.1791 0.3747 0.1710 0.1579 0.1654 0.1632 0.1513 0.1598 0.1584 0.1573 0.1563 0.1554 0.1547 0.1541 10.1535 -0.1531 0.1527 0.1523 Exhibit C.2 - Partial Payment 20 21 22 23 . 26 27 28 29 30 203 FEASIBILITY STUDY CASE - Having had good investment opportunuities in USA, with high return on equity now, your company BTT Co., would like to step in to the Mexican hospitality business arena, considering the positive changes that NAFTA will bring in the up coming years to the North American business environment. Therefore, you have chosen Tijuana, in Baja, California Norte, to start with as a first move to establish a business in Mexico, just on the other side of the city of San Diego, USA. You are planning to build a four star deluxe type of a full service hotel with 450 rooms. The hotel will be available for the operation in two years from now on. Having had a decent research done on the management phase of the project, you have found out that the Melia Management Comp., will be the most suitable partner as an Hispanic and profit ratio base company. Currently, you own twenty two properties in Southern California, Arizona and New Mexico states in USA. During the first week of the July 2000, you got together with the management company's executives and have agreed upon that The Melia Comp., will be providing you with the Financial Evaluation of the proposed project within ten days. Your analysts have already started to get information on several data related to the project to complete the financial evaluation of the project. The name of the hotel has been chosen as "Inn on the Tijuana Beach." The current average occupancy rate of the potential competetive properties is 52 %. These competitive properties total room capacity adds up to 3450 rooms in July 2000. Cost Club with 150 room capacity, Las Hamalas with 160 room capacity, Hyatt Regency Tijuana with 690 room capacity, and Fiesta Americana Condensa Tijuana with 500 room capacity will enter in to the market by 2005. Also, by the year of 2005, 1314 room capacity of the competitive properties will be losing their market share, going out of the market. Further data: Based on your researches, the market profile analysis yields the below mentioned percentages for related market segments; 7% for FIT Domestic, 13% for FIT International, 20% for Conference and Convention-National, 10% for Conference and Convention-International, 35% Tour-Domestic, 10% Tour-International and 5% for Government. The information that you have collected referring to the changes in the market within five year period is that, FIT Domestic will improve 10%, followed by Conference-Convention-National with 5%, Tour-Domestic 8%, Tour-International with 30% and the Government with 25%. However, FIT- International will lose its share by 5%, followed by Conference-Convention-International by 4%. During the year that you will be conducting the feasibility study, Laundry sales will be $ 190 000, Rental and Other Income as $ 140 000. Whereas, under the Departmental Expenses, Laundry will cost $ 165 000 and Rental and Other Income as $ 35 000. For the same year, the Undistributed Opertaing Expenses will be made of, A&G $ 1 200 000, A&P $ 1 870 000, Energy $ 1790 000 and the P.O.M. $ 1 360 000. Considering the Cash Flow Projections of the years from the 1st, going into the 11th, your calculations show the below registered USD values; Year 1, (940 000); Year 2, (620 000); Year 3, (270 000), Year 4, 120 000; Year 5, 670 000; Year 6, 990 000; Year 7, 1 300 000; Year 8,1 870 000; Yera 9, 2 000 000; Year 10,2 300 000; Year 11, 4040 000. Additional list of assumptions related to the case are mentioned below; - At the end of the 12 year period, after the grand opening of the property, the project has to be evaluated if the sale option may be the case, - After the year of 2005 the occupancy percentage will increase by 4 % for the next decade, - The average room rate of $ 110 for the first year of the operation will increase at a rate of 5% per year thereafter, - The equity investment, excluding debt financing, totals up to $ 14 100 000, - The interest expense and the repayment of the principal are based upon a permanent mortgage of $ 44 900 000, amortized over a 25 year period at an interest of 12%, Income tax rate is estimated at 36 % whereas, Reserve for Capital Replacement estimate is calculated as 1% of the Gross Revenue of each year, - Property, Tax and Insurance expense runs about $ 2 250 000, - Depreciation expenses are calculated on a straight-line basis, charging annual depreciation figure of $ 2 300 000, The Management Fee, for the Melia Comp., is set at 5 % of the Gross Revenue of each year, The Hurdle Rate that you have in your mind is about 15% on the project, Food Sales were estimated at 60% of the room sales during the 12th year of the operation and Beverage Sales were estimated at 20 % of the room sales, Rooms expense are made of 30% of the total rooms' revenue and food cost has been figured out to be 42% of the total food sales and beverage cost resulting as 28 % of the total beverage sales, The telephone department has a cost of $ 280 000 for the year of 2014. This department's gross revenue is scheduled as $ 260 000 for the same year, - Capital gain tax is reflected as 10%, In 2009 the hotel has paid its income tax in full. As the person incharge of the BTT Corp., you are asked by your President of the Company to come up with the best decision if, under these circumstances, you will either invest or not? 1. You are supposed to complete Exhibit (1) and Exhibit (2) in order to evaluate the Market Profile, drawing conclusions, 2. Also, you have to complete the Capital Investment Analysis going through the necessary steps ( ignore the Short Term Cash Flow Projection for the case ), 3. Having done your calculations, decide either to have Going-in or Fall-back positions and why? Exhibit.C-3, continued (present value of one dollar) 10.5x 11.0X 11.5% 12.0X" N 12.5% 13.0% 13.5% 14.0% 14.5% 15.07 5 7 0.9050 0.8190 0.7412 0.6707 0.6070 0.5493 0.4971 0.4499 0.4071 0.3685 0.3334 0.3018 0.2731 0.2471 0.2236 0.2024 0.1832 0.1658 0.1500 0.1358 0.1229 0.1112 0.1006 0.0911 0.082 0.0746 0.0675' 0.0611 0.0553 0.0500 9 10 11 12 13 14 15 16 17 18 19: 20 21 22 23 24 2.5 26 27 20 29 30 0.9009 0.8116 0.7312 0.6587 0.5935 0.5346 0.4817 0.4339 0.3909 0.3522 0.3173 0.2858 0.2575 0.2320 0.2090 0.1883 0.1696 0.1528 0.1377 0.1240 0.1117 0.1007 0.0907 0.0817 0.0736 0.0663 0.0597 0:0538 0.0485 0.0437 028 969 0.8044 0.7214 0.6470 0.5003 0.5204 0.4657 0.4186 0.3.75 4 0.3367 0.3020 0.2708 0.2429 0.2170 0.1954 0x1752 0.1572 0.1409 0.1264 0.1134 0.1017 0.0912 0.081 0.0734 0.0656 0.0590 0.0529 0.0475 0.042 0.382 0.8929 0.7972 0.7118 0.6355 10.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.2875 0.2567 0.2292 0.2046 0.1027 0.1631 .0.1456 0.1300 0.1161 0.1037 0.0926 0.0826 0.0736 0.0659 0.0588 : 0.0525 ..0.0469 0.0419 0.0374 0.0334 0.8839 0.7901 0.702.3 0.6243 0.5549 -0.4933 0.4385 0.3897 0.3464 0.3079 0.2737 0.2433 0.2163 0.1922 0.1709 0.1519 0.1350 0.1200 0.107 0.0948 0.0843 0.0749 0.0666 0.0592 C.0526 0.0460 0.0416 0.0379 0.0329 0.0252 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 0.3329 0.2946 0.2607 0.23.07 0.2042 0.1007 0..1599 0.1415 0.1252 0.1108 0.0981 0.0868 0.0768 0.0680 0.0601 0.0532 0.0471 0.0417 0.0369 0.0326 0.0289 0.0256 0.8811 9.7763 0.6839 0.6026 0.5309 0.4678 0.1121 0.3631 0.3199 0.2819 0.2483 0.2188 0.1928 0.1698 0.1496 0.1318 9.1162 0.1023 0.0902 0.0794 0.0700 0.0617 0.0543 0.0479 0.0422 0.0372 0.0327 0.0288 0.0254 0.0224 0.8772 0.8734 0.7695.0.0.7628 0.6750 0.6662 9.5921 0.5818 0.5194 0.5081 0.4556 0.4430 0.3996 0.3876 0.3506 0.335 0.3075 0.2956 0.2697 0.2582 0.2366 0.2255 0.2076 0.1969 0.1021 0.1.729 0.1597 0.1502 0.1401 0.1312 0.1229 0.1146 0.1078 0.1001 0.0946 0.0374 -0.0829 0.0763 0.0720 0.0667 0.0638 0.0582 0.0560 0.050 0.0491 0.0444 0.0431 0.0388 0.0378 0.0339 0.0331 0.0296 9.0291 0.0258 0.0255 0.0226 0.0224 0.0197 0.0196 0.0172 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.-3759 0.3269 0.2243 0.2472 0.2149 0.1869 0.1625 0.1413 0.1229 0.1069 0.0929 0.080 e 0.0703 0.0611 0.0531 0.0462 0.0402 0.0349 0.0304 0.0264 0.0230 0.0200 0.0174 0.0151 .. Exhibit C-3 - Present Value of One Dollar . . 207 Exhibit C-2, continued (partial paynient) 11.52 i5.0% 12.0% 11.52 12.52 13.52 N 10.52 11.0% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 16 1.1050 0.5801 0.4057 0.3189 0.2672 -0.2330 0.2008 0.1909 0:1771 0.1663 0.1575 0.1504 1.1100 0.5839 0.4092 0.3223 0.2706 10.2364 0.2122 0.1943 0.1806 0.1998 0.1611 0.1540 0.1902 0.1432 0.1391 0.1355 0.1325 0.1296 0.1276 0.1256 0.1238 0.1223 0.1210 0.1190 0.1187 0.1178 0.1170 0.1163 0.11.56 0.1150 0.1395 0.1352 0.1316 0.1285 0.1259 0.1235 0.1215 0.1197 0.1181 0.1167 0.1155 0.1144 0.1135 0.1126 .0.111B 0.1111 0.1105 1.1150 0.5870 0.4128 0.3259 0.2740 0.2398 0:2157 10.1978 0.1841 0.1734 0.1648 0.1572 0.1519 0.1470 0.1429 0.1394 0.1364 0.1339 0.1316 0.1297 0.1200 0.1265 0.1252 0.1241 0.1231 0.1222 0.1214 0.1207 -0.1 201 -0.1196 1.1200 0.5917 -0.4163 0.3292 0.2774 :- 0.2932 0.2191 0.2013 0.1877 0.1770 0.1684 0.1614 0.1557 0.1509 0.1468 0.1434 0.1405 0.1379 0.1358 0.1339 0.1322 0.1308 0.1296 0.12 es 0.1275 0.1267 0.1259 0.1252 0.1247 0.1241 1. 1250 0.5956 0.4199 0.3327 0.2009 0.2467 0.2225 0.2040 0.1913 0.1806 0.1721 0.1692 0.1595 0.1548 0.1508 0.1974 0.1945 0.1420 0.1399 0.1981 0.1365 0.135 0.1339 0.1329 0.1319 0.131) 0.134 0.1258 0.1291 0.1288 13.02 1.1.300 9.5995 0.9235 0.5362 0:2843 0.2502 0.2261 0.2084 0.1949 0.1843 0.1758 0.1690 0.1634 0.1587 0.1547 0.1514 0.1986 0.1462 0.1441 0.1424 0.140 0.1395 0.1363 10.1373 1.0.136 0.1357 0.1350 0.1344 0.1339 -0.1334 1.1350 9.5034 1.4271 0.3397 0.2876 0.2536 0.2296 0.2120 0.1985 9.100 0.1796 0.1721 0.1672 0.1626 9.1508 0.1555 0.1527 9.1509 9.14B 4 0.1467 0.1452 0.1439 0.1426 1.1419 9.1409 0.1402 1.1396 0.1399 0.1385 0.1381. 1.1400 9.6073 0.4307 0.3432 0.2913 0.2572 0.2332 0.2156 0.2022 0.1917 0.1834 0.1767 0.1712 0.1666 0.1620 0.1596 0.1569 0.1546 0.1527 0.1510 0.1495 0.1483 0.1472 @.1463 0.1455 9.1446 0.1442 0.1437 0.132 0.142 1.1950 0.6112 0.1344 2.3467 0.2943 0.2697 0.2368 0.219? 0.2059 0.1955 0.1872 3.1906 0.1751 0.1705 0.1669 0.1636 0.1611 0.1589 0.1570 0.1554 0.1540 0.1528 0.1517 0.1592 -0.1591 0.1494 0.1488 0.1483 0.1472 0.143 1.1500 0.6151 0.4380 0.3503 0.2983 0.2642 0.2404 0.2229 0.2096 0.1993 0.1911 0.1845 0.1791 0.3747 0.1710 0.1579 0.1654 0.1632 0.1513 0.1598 0.1584 0.1573 0.1563 0.1554 0.1547 0.1541 10.1535 -0.1531 0.1527 0.1523 Exhibit C.2 - Partial Payment 20 21 22 23 . 26 27 28 29 30 203

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts