Question: Houston Inc. is considering a project which involves building a new refrigerated warehouse which will cost $7,000,000 at t = 0 and which is expected

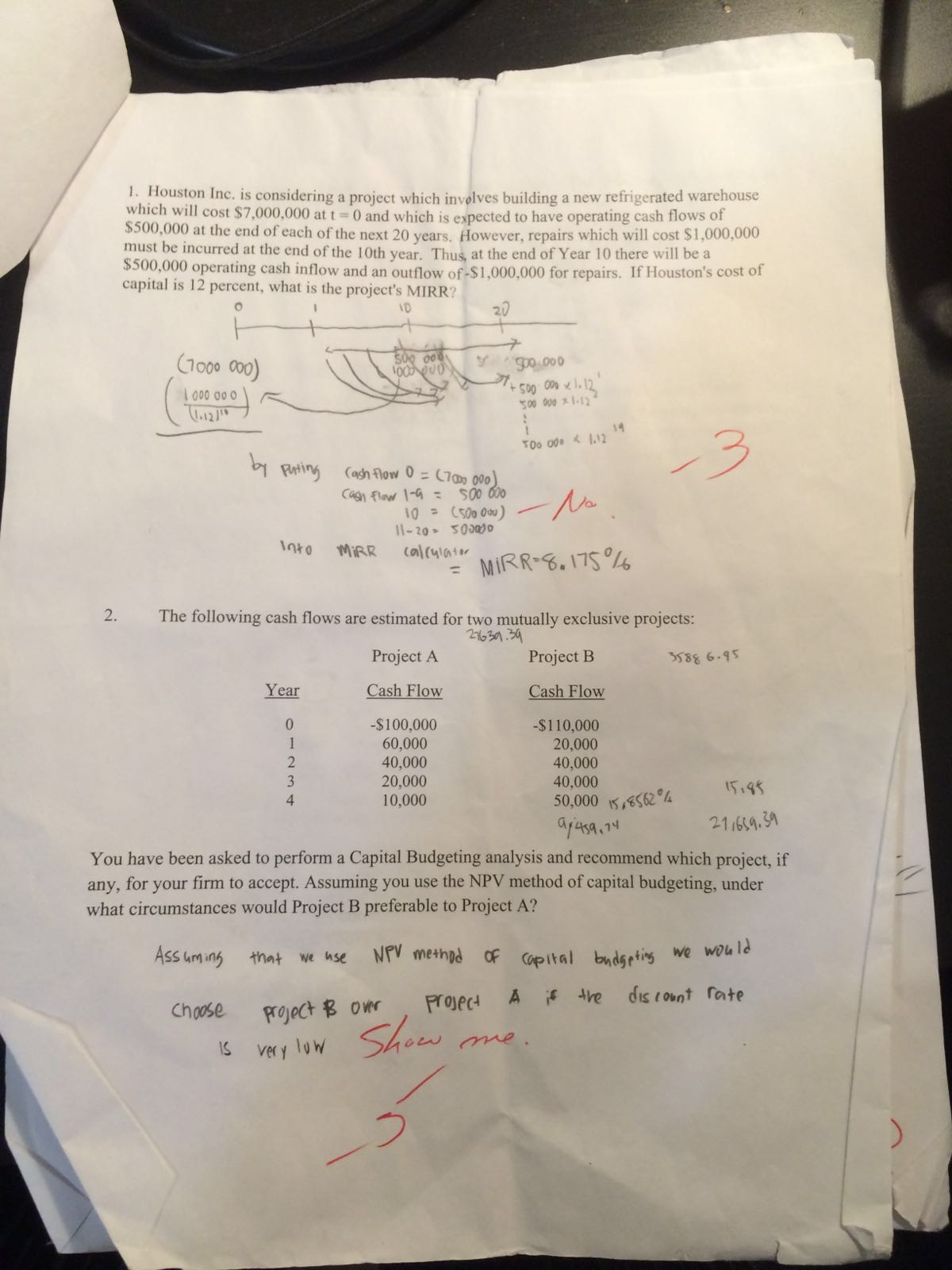

Houston Inc. is considering a project which involves building a new refrigerated warehouse which will cost $7,000,000 at t = 0 and which is expected to have operating cash flows of $500,000 at the end of each of the next 20 years. However, repairs which will cost $1,000,000 must be incurred at the end of the 10th year. Thus, at the end of Year 10 there will be a $500,000 operating cash inflow and an outflow of -$1,000.000 for repairs. If Houston's cost of capital is 12 percent, what is the project's MIRR? by putting (cash flow 0 = (700 000) (cash flow 1-9 = 500 000 10 = (500 000) 11-20 = 500 000 into MiRR calculate = MiRR = 8.175% The following cash flows are estimated for two mutually exclusive projects: You have been asked to perform a Capital Budgeting analysis and recommend which project, if any, for your firm to accept. Assuming you use the NPV method of capital budgeting, under what circumstances would Project B preferable to Project A? Assuming that we use NPV method of capital budgeting we would choose project B our project A is the discount rate is very low

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts