Question: sub: project managment need ans part by part for each qus. the step must be shown Profitability/Capital Budgeting Techniques for Selection of Projects Problems to

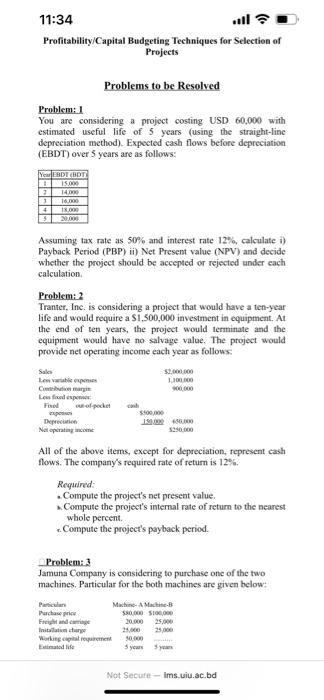

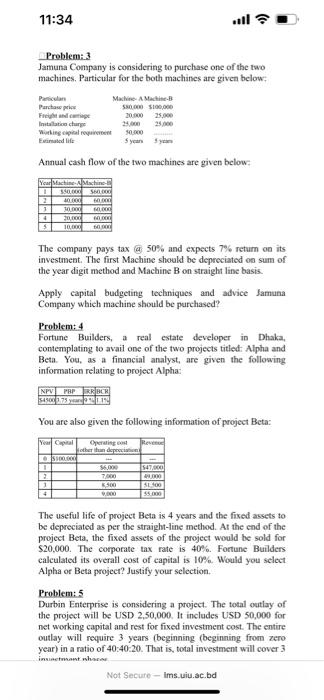

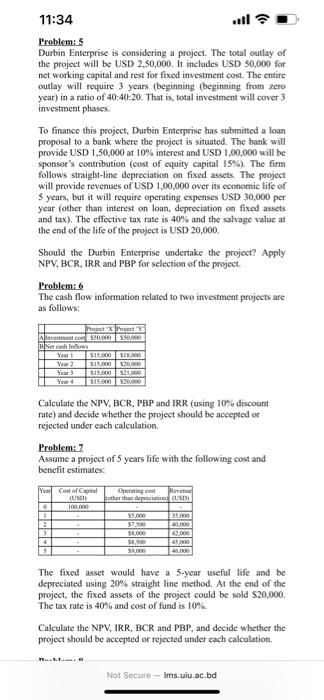

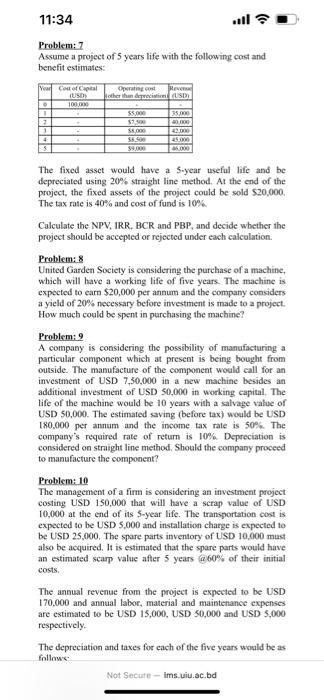

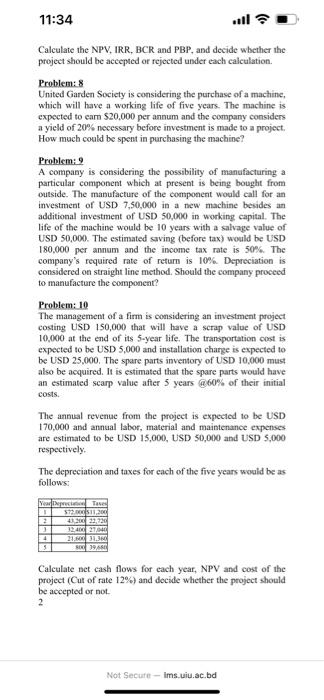

Profitability/Capital Budgeting Techniques for Selection of Projects Problems to be Resolved Problem: I You are considering a project costing USD 60,000 with estimated useful life of 5 years (using the straight-line depreciation method). Expected cash flows before depreciation (EBDT) over 5 years are as follows: Assuming tax rate as 50% and interest rate 12%, calculate i) Payback Period (PBP) ii) Net Present value (NPV) and decide whether the project should be accepted or rejected under each calculation. Problem: 2 Tranter, Inc. is considering a project that would have a ten-year life and would require a $1,500,000 investment in equipment. At the end of ten years, the project would terminate and the equipment would have no salvage valoe. The project would provide net operating income each year as follows: All of the above items, except for depreciation, represent eash flows. The company's required rate of return is 12%. Required: - Compute the project's net present value. . Compute the project's internal rate of return to the nearest whole percent. . Compute the project's payback period. Problem: 3 Jamuna Company is considering to purchase one of the two machines. Particular for the both machines are given below: Problem: 3 Jamuna Company is considering to purchase one of the two machines. Particular for the both machines are given below: Annual cash flow of the two machines are given below: The company pays tax (a) 50% and expects 7% return on its investment. The first Machine should be depreciated on sum of the year digit method and Machine B on straight line basis. Apply capital budgeting tectniques and advice Jamuna Company which machine should be purchased? Problem: 4 Fortune Builders, a real estate developer in Dhaka, contemplating to avail one of the two projects titled: Alpha and Beta. You, as a financial analyst, are given the following information relating to project Alpha: You are also given the following information of project Beta: The useful life of project Beta is 4 years and the fixed assets to be depreciated as per the straight-line method. At the end of the project Beta, the fixed assets of the project would be sold for $20,000. The corporate tax rate is 40%. Fortune Builders calculated its overall cost of capital is 10%. Would you select Alpha or Beta project? Justify your selection. Problem: 5 Durbin Enterprise is considering a project. The total outlay of the project will be USD 2,50,000. It includes USD 50,000 for net working capital and rest for fixed investment cost. The entire outlay will require 3 years (beginning (beginning from zero year) in a ratio of 404020. That is, total investment will cover 3 Problem: 5 Durbin Enterprise is considering a project. The total outlay of the project will be USD 2,50,000. It includes USD 50,000 for net working capital and rest for fixed investment cost. The entire outlay will require 3 years (beginning (beginning from xero year) in a ratio of 40:-40:-20. That is, total investment will cover 3 investment phases. To finance this project, Durbin Enterprise has submitted a loan proposal to a bank where the project is situated. The bank will provide USD 1,50,000 at 10% interest and USD 1,00,000 will be sponsor's contribution (cost of equity capital 15\%). The firm follows straight-line depreciation on fixed assets. The project will provide revenues of USD 1,00,000 over its economic life of 5 years, but it will require operating expenses USD 30,000 per year (other than interest on loan, depreciation on fixed assets and tax). The effective tax rate is 40% and the salvage value at the end of the life of the project is USD 20,000 . Should the Durbin Enterprise undertake the project? Apply NPV, BCR, IRR and PBP for selection of the project. Problem: 6 The cash flow infornation related to two investment projects are as follows: Calculate the NPV, BCR, PBP and IRR (using 10\% discount rate) and decide whether the project should be accepled or rejected under each calculation. Problem: 7 Assume a project of 5 years life with the following cost and benefit estimates: The fixed asset would have a 5-year useful life and be depreciated using 20% straight line method. At the end of the project, the fixed assets of the project could be sold $20,000. The tax rate is 40% and cost of fund is 10%. Calculate the NPV, IRR, BCR and PBP, and decide whether the project should be aceepted or rejected under each calculation. Problem: 7 Assume a project of 5 years life with the following cost and benefit estimates: The fixed asset would have a s-year useful life and be depreciated using 20% straight line method. At the end of the project, the fixed assets of the project could be sold $20,000. The tax rate is 40% and cost of fund is 10% Calculate the NPV, IRR, BCR and PBP, and decide whether the project should be accepted or rejected under each calculation. Problem: 8 United Garden Society is considering the purchase of a machine, which will have a working life of five years. The machine is expected to earn $20,000 per annum and the company considers a yield of 20% necessary before investment is made to a project. How much could be spent in purchasing the machine? Problem: 9 A company is considering the possibility of manufacturing a particular component which at present is being bought from outside. The manufacture of the componeat would call for an investment of USD 7,50,000 in a new machine besides an additional investment of USD 50,000 in working capital. The life of the machine would be 10 years with a salvage value of USD 50,000 . The estimated saving (before tax) would be USD 180,000 per annam and the income tax rate is 50%. The company's required rate of return is 10%. Depreciation is considered on straight line method. Should the company proceed to manufacture the component? Problem: 10 The management of a firm is considering an investment project costing USD 150,000 that will have a scrap value of USD 10,000 at the end of its s-year life. The transportation cost is expected to be USD 5,000 and installation charge is expected to be USD 25,000 . The spare parts inventory of USD 10,000 must also be acquired. It is estimated that the spare parts would have an estimated scarp value after 5 years a60% of their initial costs. The annual revenue from the project is expected to be USD 170,000 and annual labor, material and maintenance expenses are estimated to be USD 15,000, USD 50,000 and USD 5,000 respectively. Calculate the NPV, IRR, BCR and PBP, and decide whether the project should be accepted or rejected under each calculation. Problem: 8 United Garden Society is considering the purchase of a machine, which will have a working life of five years. The machine is expected to earn $20,000 per annum and the company considers a yield of 20% necessary before investment is made to a project. How much could be spent in purchasing the machine? Problem: 9 A company is considering the possibility of manufacturing a particular component which at present is being bought from outside. The manufacture of the component would call for an investment of USD 7,50,000 in a new machine besides an additional investment of USD 50,000 in working capital. The life of the machine would be 10 years with a salvage value of USD 50,000. The estimated saving (before tax) would be USD 180,000 per annum and the income tax rate is 50%. The company's required rate of refurn is 10%. Depreciation is considered on straight line method. Should the company proceed to manufacture the component? Problem: 10 The management of a firm is considering an investment project costing USD 150,000 that will have a scrap value of USD 10,000 at the end of its 5-year life. The transportation cost is expected to be USD 5,000 and installation charge is expected to be USD 25,000 . The spare parts inventory of USD 10,000 must also be acquired. It is estimated that the spare parts would have an estimated scarp value after 5 years (i) 60% of their initial costs. The annual revenue from the project is expected to be USD 170,000 and annual labor, material and maintenance expenses are estimated to be USD 15,000 , USD 50,000 and USD 5,000 respectively. The depreciation and taxes for each of the five years would be as follows: Calculate net cash flows for each year, NPV and cost of the project (Cut of rate 12% ) and docide whether the project should be accepted or not. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts