Question: how can i answer b 11) (6 pts).Magent Co. is a U.S. company that has exposure to has het outflows of SF200 million and to

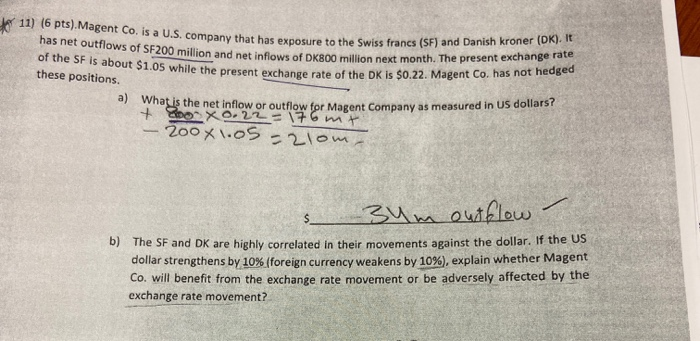

11) (6 pts).Magent Co. is a U.S. company that has exposure to has het outflows of SF200 million and to pre million next month. The presente of the SF is about $1.05 while the present exchange rate these positions. a) What is the net inflow or outflow for Magent Company as measured in US dolla + 0 X 0.22 176 mt - 200x1.05 -zlom e Swiss francs (SF) and Danish kroner (DK). It while the present exchange rate of the DK is $0.22. Magent Co. has not hedged on next month. The present exchange rate 34m outflow ? b) The SF and DK are highly correlated in their movements arainst the dollar. If the OS dollar strengthens by 10% (foreign currency weakens by 10%), explain whether Magent Co. will benefit from the exchange rate movement or be adversely affected by the exchange rate movement? 11) (6 pts).Magent Co. is a U.S. company that has exposure to has het outflows of SF200 million and to pre million next month. The presente of the SF is about $1.05 while the present exchange rate these positions. a) What is the net inflow or outflow for Magent Company as measured in US dolla + 0 X 0.22 176 mt - 200x1.05 -zlom e Swiss francs (SF) and Danish kroner (DK). It while the present exchange rate of the DK is $0.22. Magent Co. has not hedged on next month. The present exchange rate 34m outflow ? b) The SF and DK are highly correlated in their movements arainst the dollar. If the OS dollar strengthens by 10% (foreign currency weakens by 10%), explain whether Magent Co. will benefit from the exchange rate movement or be adversely affected by the exchange rate movement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts