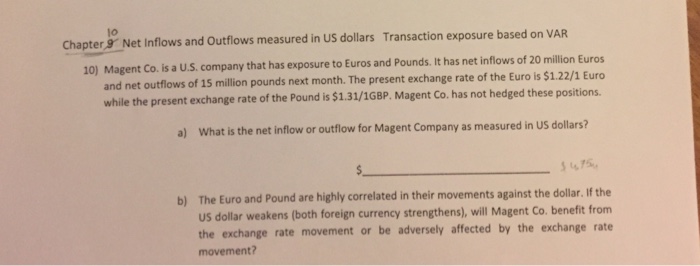

Question: Show calculation l0 Chapter Net Inflows and Outflows measured in US dollars Transaction exposure based on VAR 10) Magent Co. is a U.S. company that

l0 Chapter Net Inflows and Outflows measured in US dollars Transaction exposure based on VAR 10) Magent Co. is a U.S. company that has exposure to Euros and Pounds. it has net inflows of 20 million Euros and net outflows of 15 million pounds next month. The present exchange rate of the Euro is $1.22/1 Eureo 1.31/1GBP. Magent Co. has not hedged these positions. while the present exchange rate of the Pound is $ a) What is the net inflow or outflow for Magent Company as measured in US dollars? The Euro and Pound are highly correlated in their movements against the dollar. If the uS dollar weakens (both foreign currency strengthens), will Magent Co. benefit from the exchange rate movement or be adversely affected by the exchange rate movement? b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts