Question: How can I complete this problem by finding the first-order conditions from this non-linear programming model? (30) Consider a portfolio choice problem with a risk-free

How can I complete this problem by finding the first-order conditions from this non-linear programming model?

How can I complete this problem by finding the first-order conditions from this non-linear programming model?

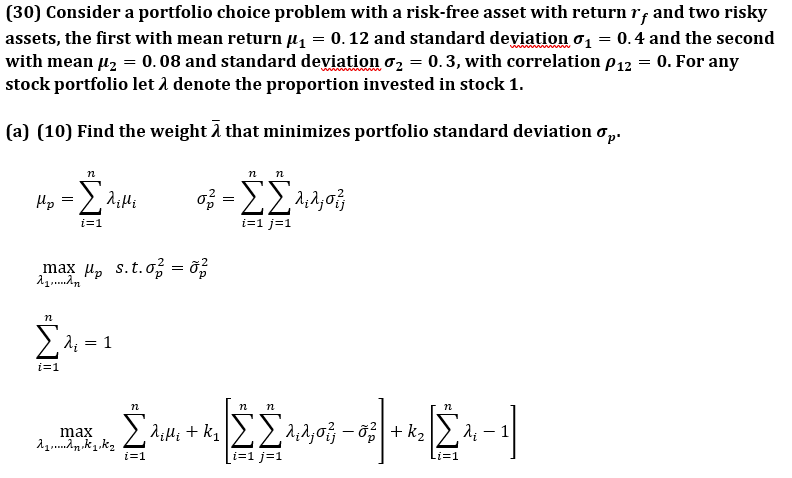

(30) Consider a portfolio choice problem with a risk-free asset with return r; and two risky assets, the first with mean return 1 = 0.12 and standard deviation 01 = 0.4 and the second with mean pz = 0.08 and standard deviation 02 = 0.3, with correlation P12 = 0. For any stock portfolio let 1 denote the proportion invested in stock 1. (a) (10) Find the weight/that minimizes portfolio standard deviation , = ,, 3 i=1 i=1 ]=1 max s.t.. = 63 .... , = 1 i=1 n max ..... k2 , 4 . , - +k. - i=1 [i=1 j=1 (30) Consider a portfolio choice problem with a risk-free asset with return r; and two risky assets, the first with mean return 1 = 0.12 and standard deviation 01 = 0.4 and the second with mean pz = 0.08 and standard deviation 02 = 0.3, with correlation P12 = 0. For any stock portfolio let 1 denote the proportion invested in stock 1. (a) (10) Find the weight/that minimizes portfolio standard deviation , = ,, 3 i=1 i=1 ]=1 max s.t.. = 63 .... , = 1 i=1 n max ..... k2 , 4 . , - +k. - i=1 [i=1 j=1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts