Question: How can I get the sum-of-the- years digits method Required information The following information applies to the questions displayed below. On January 1, 2018, Hobart

How can I get the sum-of-the- years digits method

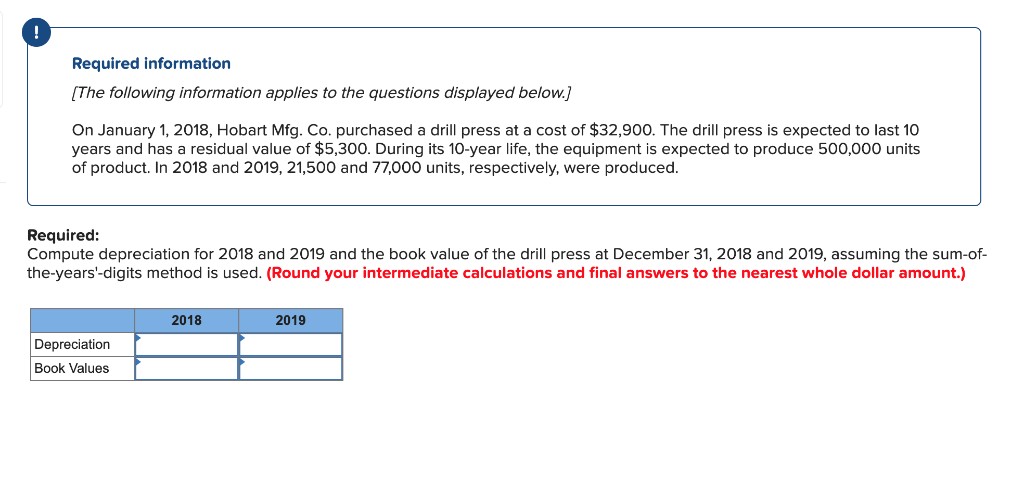

Required information The following information applies to the questions displayed below. On January 1, 2018, Hobart Mfg. Co. purchased a drill press at a cost of $32,900. The drill press is expected to last 10 years and has a residual value of $5,300. During its 10-year life, the equipment is expected to produce 500,000 units of product. In 2018 and 2019, 21,500 and 77,000 units, respectively, were produced. Required: Compute depreciation for 2018 and 2019 and the book value of the drill press at December 31, 2018 and 2019, assuming the sum-of- the-years'-digits method is used. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) 2018 2019 Depreciation Book Values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts