Question: How can I improve this answer? (help me with more stepsotes on what I am precisely doing etc.) This was the overall assignment : B)

How can I improve this answer? (help me with more stepsotes on what I am precisely doing etc.)

This was the overall assignment :

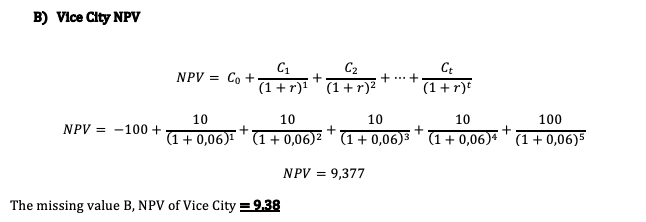

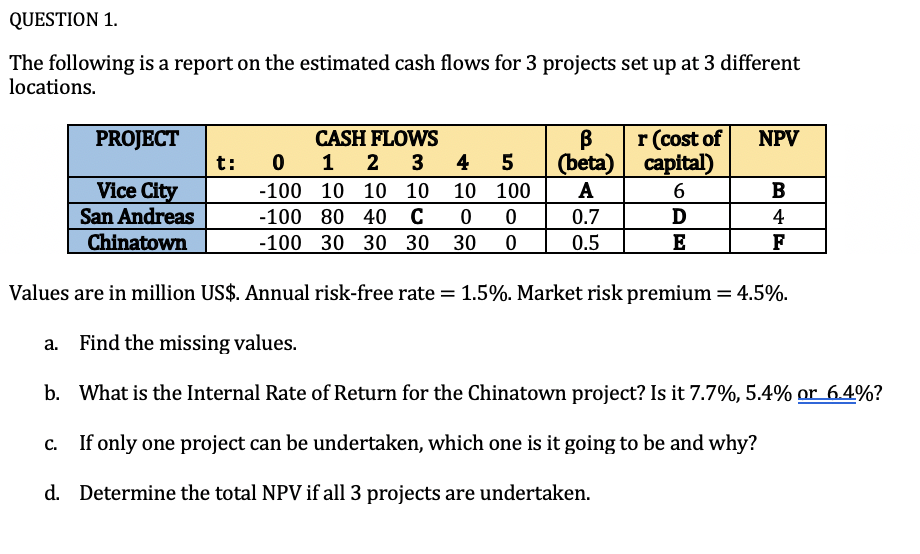

B) Vice Clty NPV NPV=C0+(1+r)1C1+(1+r)2C2++(1+r)tCtNPV=100+(1+0,06)110+(1+0,06)210+(1+0,06)310+(1+0,06)410+(1+0,06)5100NPV=9,377 The missing value B, NPV of Vice City 9,38 The following is a report on the estimated cash flows for 3 projects set up at 3 different locations. Values are in million US\$. Annual risk-free rate =1.5%. Market risk premium =4.5%. a. Find the missing values. b. What is the Internal Rate of Return for the Chinatown project? Is it 7.7%,5.4% or 6.4% ? c. If only one project can be undertaken, which one is it going to be and why? d. Determine the total NPV if all 3 projects are undertaken

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts