Question: How could I answer this type of question WITHOUT the use of annuity table? The professor has said that the test will not include any

How could I answer this type of question WITHOUT the use of annuity table? The professor has said that the test will not include any discount tables etc so we will have to use formulae

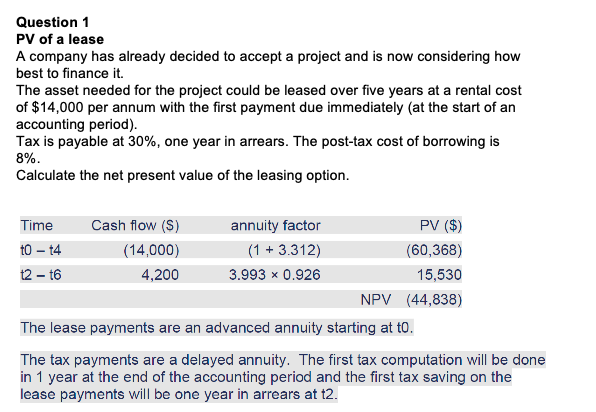

Question 1 PV of a lease A company has already decided to accept a project and is now considering how best to finance it. The asset needed for the project could be leased over five years at a rental cost of $14,000 per annum with the first payment due immediately (at the start of an accounting period). Tax is payable at 30%, one year in arrears. The post-tax cost of borrowing is 8%. Calculate the net present value of the leasing option. Time Cash flow (S) annuity factor PV ($) to t4 (14,000) (1 + 3.312) (60,368) 2 - 16 4,200 3.993 x 0.926 15,530 NPV (44,838) The lease payments are an advanced annuity starting at to. The tax payments are a delayed annuity. The first tax computation will be done in 1 year at the end of the accounting period and the first tax saving on the lease payments will be one year in arrears at t2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts