Question: how do i answer question 2 2. Look at the first basic balance sheet in question 1. If you invest $20 in ADVERI $2 to

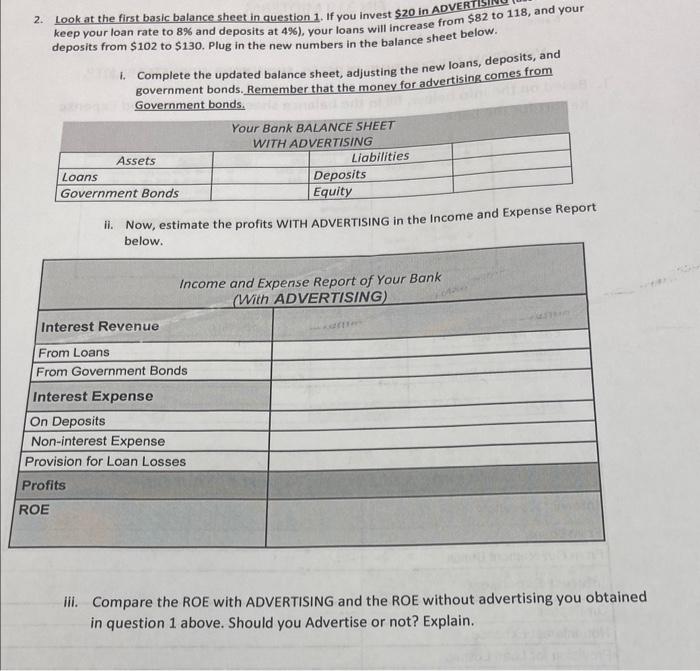

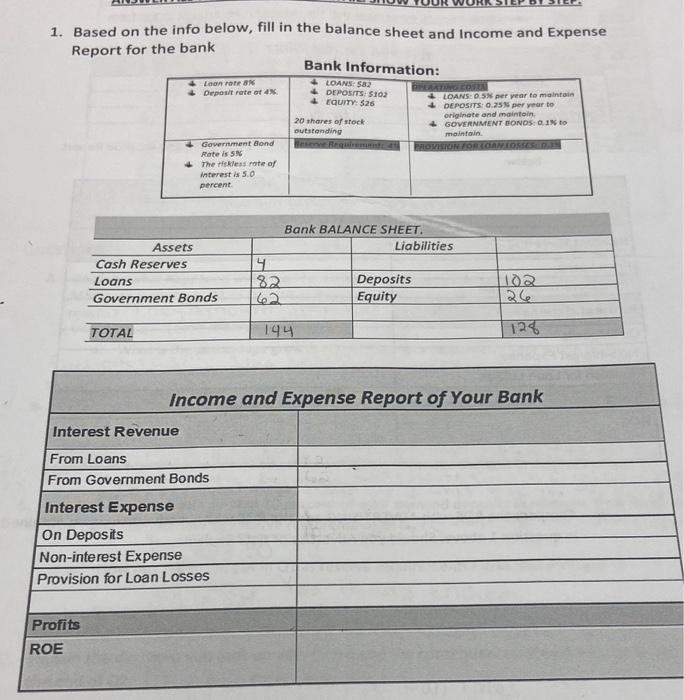

2. Look at the first basic balance sheet in question 1. If you invest $20 in ADVERI $2 to 118 , and your keep your loan rate to 8% and deposits at 4% ), your loans will increase from $ below. deposits from $102 to $130. Plug in the new numbers in the balance sheet below. i. Complete the updated balance sheet, adjusting the new loans, deposits, and government bonds. Remember that the monev for advertising comes from Government bonds. ii. Now, estimate the profits WITH ADVERTISING in the Income and Expense Report below. iii. Compare the ROE with ADVERTISING and the ROE without advertising you obtained in question 1 above. Should you Advertise or not? Explain. 1. Based on the info below, fill in the balance sheet and Income and Expense Report for the bank 2. Look at the first basic balance sheet in question 1. If you invest $20 in ADVERI $2 to 118 , and your keep your loan rate to 8% and deposits at 4% ), your loans will increase from $ below. deposits from $102 to $130. Plug in the new numbers in the balance sheet below. i. Complete the updated balance sheet, adjusting the new loans, deposits, and government bonds. Remember that the monev for advertising comes from Government bonds. ii. Now, estimate the profits WITH ADVERTISING in the Income and Expense Report below. iii. Compare the ROE with ADVERTISING and the ROE without advertising you obtained in question 1 above. Should you Advertise or not? Explain. 1. Based on the info below, fill in the balance sheet and Income and Expense Report for the bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts