Question: how do i answer questions one and two? based on the information presented in the excel spreadsheet how would i answer questions one and two

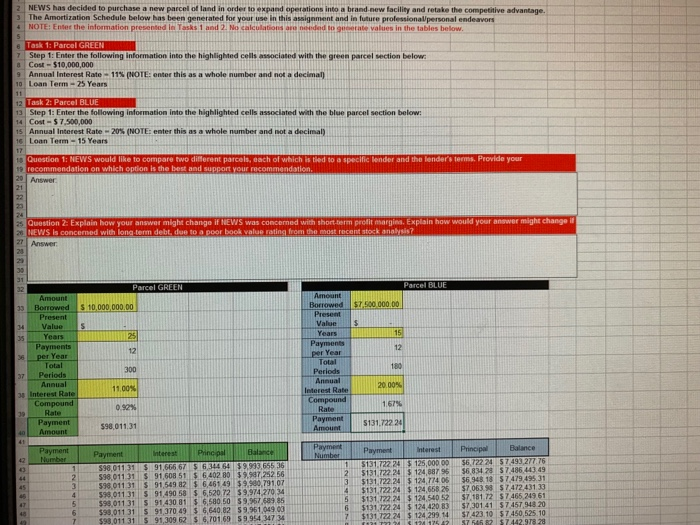

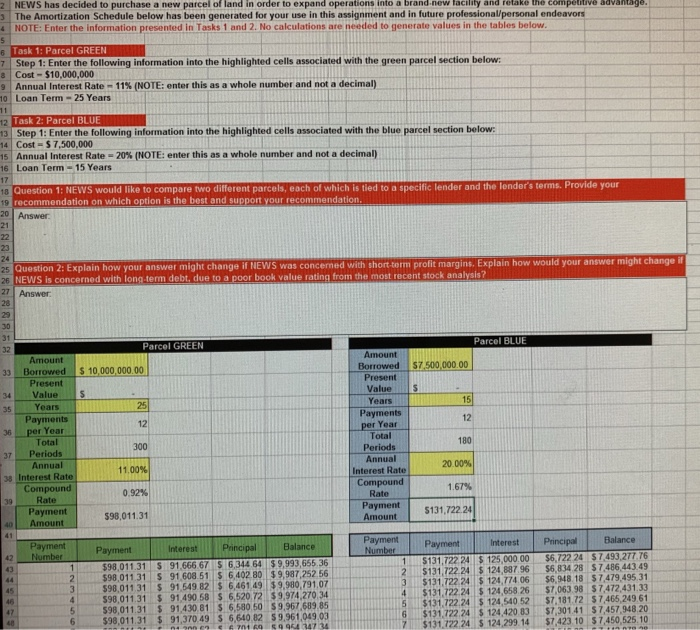

NEWS has decided to purchase a new parcel of land in order to expand operations into a brand.new facility and retake the competitive advantage. The Amortization Schedule below has been generated for your use in this assignment and in future prolessional/personal endeavons NOTE: Enter the information presened le Tasks 1 and 2 No selcolations orn mendad to wrate values in the tables below g information into the highlighted cells associated with the green parcel section below Step 1: Enter the Cost-$10,000,000 Annual Interest Rate-11% (NOTE: enter this as a whole number and not a decimal o Loan Term- 25 Years Step 1: Enter the following information into the highlighted cells associated with the blue parcel section below Cost-$7,500,000 Annual Interest Rate-20% (NOTE: enter this as a whole number and not a decimal, Loan Tem-15 Years ent parcels, each of which is tled to a specific lender and the lender's terms. Provide your Question 1: NEWS would like to compare two 20 Answer Question 2 Explain how your answer might change if NEWS was concerned with short erm prolit margies. Explain how woula your answer moghi change NEWS is concerned with long-term debt, due to a poor book value rating from the most recent stock analysis? Borrowed $7.500 000.00 000,000.00 3 Borrowed Present ValueS Present 4ValueS Payments Total Annual Compound Payment 12 per Year Total 180 300 11 00% 092% $98,011.31 Periods Periods s Interest Rate Rate 20 Rate Compound Rate 167% Payment $131,722 24 3,277.76 $131.722 24 s 125,000 00 $6,722 24 57 98,011 31 $ 91,666.67 6.344 645$ 9,993,655.36 $98,011 31 91,608 51 $ 6402 80 9,987 252 56 2I$131 722 24 $124887 9656 834 28 57.486443 49 3$131.722 24 $ 124,774 06$6.948 18 $7.479 495.31 4$131,722.24 $ 124,658 26 57,0638 S 7 472 431.33 131 722 24 $ 124.540 52 $7.181.72 $7,465,249 61 6 $131,22 24 $124.420 83$7,301 41 $7.457 948 20 $131 722 24 $ 124 299 14 $7,423.10 $7450,525.10 598,011 31 S 91,549 82 6,46149 $9,980,791 4598 011 31 5 91,490 58 $ 6,520 72 $9.974.270 5$98,011 31 $ 91,430 81 $ 6,58050 $9.967 689 85 6 $98,011 31 91,37049 6640.82 59 961 049 03 7$98,011 31 5 91,309 62 $ 6,701.69 59.954 347 34 into a brand-new facility and retake the competitive advantage NEWS has decided to purchase a new parcel of land in order to expand operations The Amortization Schedule below has been generated for your use in this assignment and in future professional/personal endeavors NOTE: Enter the information presented in Tasks 1 and 2. No calculations are needed to generate values in the tables below. Task 1: Parcel GREEN Step 1: Enter the following information into the highlighted cells associated with the green parcel section below Cost-$10,000,000 Annual Interest Rate-11% (NOTE: enter this as a whole number and not a decimal) Loan Term-25 Years Task 2: Parcel BLUE Step : Enter the following information into the highlighted cells associated with the blue parcel section below: 14 Cost-$ 7,500,000 Annual Interest Rate-20% (NOTE: enter this as a whole number and not a decimal) Loan Term-15 Years 6 Question 1: NEWS would like to compare two different parcels, each of which is tied to a specific lender and the lender's terms. Provide your recommendation on which option is the best and support your recommendation 20 Answer 21 Question 2: Explain how your answer might change if NEWS was concerned with short-torm profit margins. Explain how would your answer NEWS is concerned with long-term debt, due to a poor book value rating from the most recent stock analysis might change i 27 Answer 28 Parcel BLUE Parcel GREEN Amount Amount Present Years Borrowed $7.500,000.00 33 Borrowed $ 10,000,000.00 Present ValueS 4Value Years Payments per Year Total Periods Annual Interest Rate Compound Rate 25 12 180 2000% 1.67% Payment S131,722.24 Payments Total Annual Compound Payment Yeal 36 300 37 Periods 11.00% 38 Interest R 0 92% Rate $98,011.31 Payment PaymentInterest Principal Balance $131.722 24 $ 125,000.00$6,722 24 $7,493,277.76 2 $131,722 24 $ 124,88796 $6,834 28 $7.486,44349 3$131.722 24 $ 124,774.06 $6,948 18 $7,479,495.31 131.722 24 124,658 26 $7,063.98 $7,472,431.33 598,011.31 S 91,666 67 $ 6,344 64 S 9,993,655.36 2$98,011.31 $ 91,608 51$ 6,402 80 $9,987,252 56 $98,011.31 $ 91,549 82 $ 6,461 49 $9,980,791,07 4598,011.31 91,490 58 $ 6,520,72 $9,974.270.34 5598,011.31 91,430,81 $ 6,580 50 59.967.689 85 $98,011.31 91,370.49 $ 6,64082 $9.961,049 03 5 $131 722.24 $ 124,540 52 $7.181.72 $7,465,249 61 $131, 722 24 124.420 83$7,301.41 $7,457,948 20 7$131.122 24 $ 124,299 14 $7,423 10 $7,450,525.10 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts