Question: How do I answer these questions step by step? (Process work) since the answers are bolded already 11. Delta and Epsilon are separate firms that

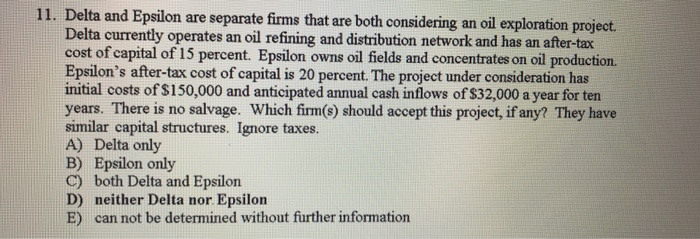

11. Delta and Epsilon are separate firms that are both considering an oil exploration project Delta currently operates an oil refining and distribution network and has an after-tax cost of capital of 15 percent. Epsilon owns oil fields and concentrates on oil production. Epsilon's after-tax cost of capital is 20 percent. The project under consideration has initial costs of $150,000 and anticipated annual cash inflows of $32,000 a year for ten years. There is no salvage. Which firm(s) should accept this project, if any? They have similar capital structures. Ignore taxes. A) Delta only B) Epsilon only C) both Delta and Epsilon D) neither Delta nor Epsilon E) can not be determined without further information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts