Question: Questions Using the above data 1. What is the cost of issuing new common stock? 2.What is the cost of issuing new preferred stock? 3.What

Questions

Using the above data

1. What is the cost of issuing new common stock?

2.What is the cost of issuing new preferred stock?

3.What is the WACC of the company using the book weights of capital structure(Assuming the company will issue new Preferred and common stocks)

4. What is the WACC of the company using the market weights of capital structure(Assuming the company will issue new Preferred and common stocks)

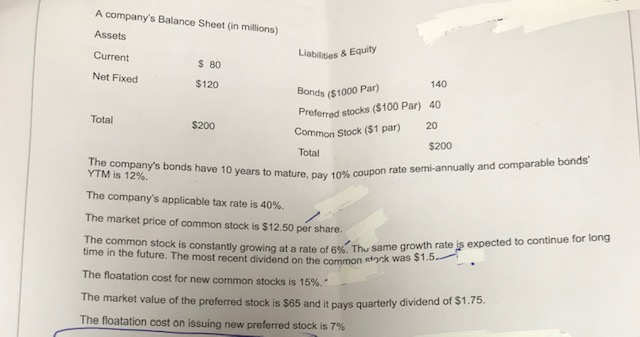

A company's Balance Sheet (in millions) Assets Current Net Fixed Liabilities & Equity s 80 $120 Bonds ($1000 Par) Proferred stocks ($100 Par) 40 Common Stock ($1 par) 20 Total 140 Total $200 $200 The company's bonds have 10 years to mature, pay 10% coupon rate semi-annually and comparable bonds. YTM is 12%. The company's applicable tax rate is 40%. The market price of common stock is $12.50 per share The common stock is constantly growing at a rate of 6%. Th same growth rate is expected to continue for long time in the future. The most recent dividend on the common The floatation cost for new common stocks is 15%. The market value of the preferred stock is $65 and it pays quarterly dividend of $1.75. The floatation cost on issuing new preferred stock is 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts