Question: How do i answer these using the percent and wage bracket from 2020 Use (a) the percentage method and (b) the wage-bracket method to compute

How do i answer these using the percent and wage bracket from 2020

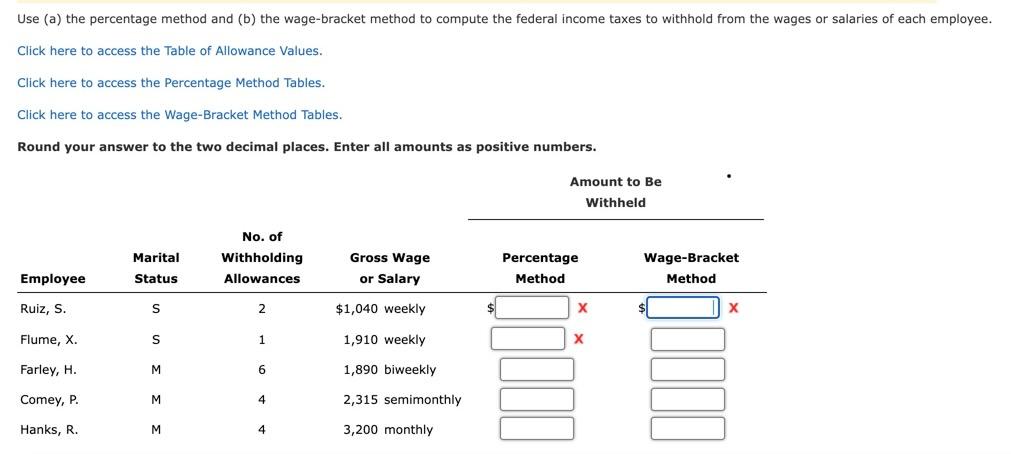

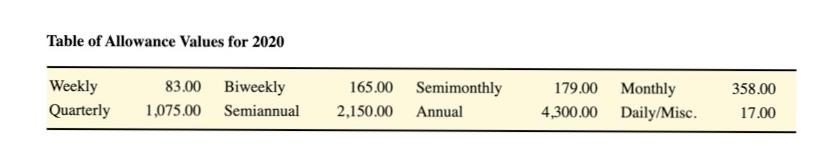

Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Click here to access the Table of Allowance Values. Click here to access the Percentage Method Tables. Click here to access the Wage-Bracket Method Tables. Round your answer to the two decimal places. Enter all amounts as positive numbers. Amount to Be Withheld Marital Status No. of Withholding Allowances Gross Wage or Salary Percentage Method Wage-Bracket Method Employee Ruiz, s. S 2 $1,040 weekly $ Flume, X. S 1 1,910 weekly Farley, H. M 6 1,890 biweekly Comey, P. M 4 2,315 semimonthly Hanks, R. M 4 3,200 monthly Table of Allowance Values for 2020 Weekly Quarterly 83.00 1,075.00 Biweekly Semiannual 165.00 Semimonthly 2.150.00 Annual 179.00 4,300.00 Monthly Daily/Misc. 358.00 17.00 Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Click here to access the Table of Allowance Values. Click here to access the Percentage Method Tables. Click here to access the Wage-Bracket Method Tables. Round your answer to the two decimal places. Enter all amounts as positive numbers. Amount to Be Withheld Marital Status No. of Withholding Allowances Gross Wage or Salary Percentage Method Wage-Bracket Method Employee Ruiz, s. S 2 $1,040 weekly $ Flume, X. S 1 1,910 weekly Farley, H. M 6 1,890 biweekly Comey, P. M 4 2,315 semimonthly Hanks, R. M 4 3,200 monthly Table of Allowance Values for 2020 Weekly Quarterly 83.00 1,075.00 Biweekly Semiannual 165.00 Semimonthly 2.150.00 Annual 179.00 4,300.00 Monthly Daily/Misc. 358.00 17.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts