Question: How do I calculate the net present value and rate of return for Problem 19-17 Pg. 697 of Fundamentals of Financial Management (Brigham & Houston

How do I calculate the net present value and rate of return for Problem 19-17 Pg. 697 of Fundamentals of Financial Management (Brigham & Houston 2019)?

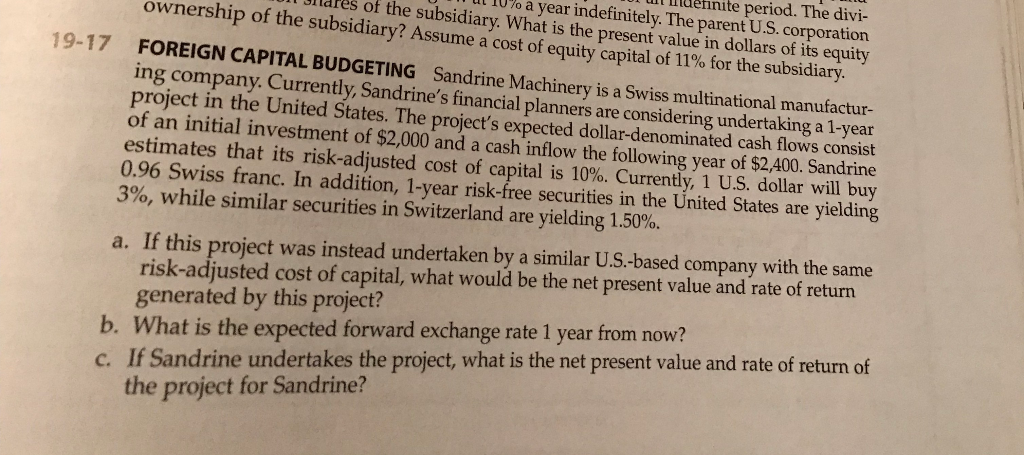

ehnite period. The divi- year indefinitely. The parent U.S. corporation of the subsidiary. What is the present value in dollars of its equity ownership of the subsidiary? Assume a cost of equity capital of 11% for the subsidiary 19-17 FOREIGN CAPITAL BUDGETING Sandrine Machinery is a Swiss multinational manufactur- ing company. Currently, Sandrine's financial planners are considering undertaking a 1-year project in the United States. The project's expected dollar-denominated cash flows consist of an initial investment of $2,000 and a cash inflow the following year of $2,400. Sandrine estimates that its risk-adjusted cost of capital is 10%. Currently, 1 U.S. dollar will buy 0.96 Swiss franc. In addition, 1-year risk-free securities in the United States are 3%, while similar securities in Switzerland are yielding 1.50%. yielding a. If this project was instead undertaken by a similar U.S.-based company with the same risk-adjusted cost of capital, what would be the net present value and rate of return generated by this project? b. What is the expected forward exchange rate 1 year from now? c. If Sandrine undertakes the project, what is the net present value and rate of return of the project for Sandrine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts