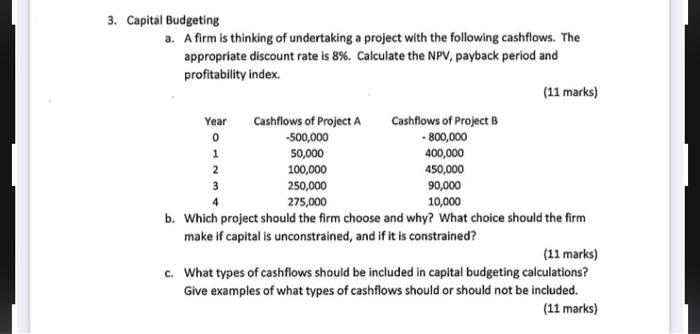

Question: please answer this step by step, thank you :)) 3. Capital Budgeting a. A firm is thinking of undertaking a project with the following cashflows.

3. Capital Budgeting a. A firm is thinking of undertaking a project with the following cashflows. The appropriate discount rate is 8%. Calculate the NPV, payback period and profitability index. (11 marks) b. Which project should the firm choose and why? What choice should the firm make if capital is unconstrained, and if it is constrained? (11 marks) c. What types of cashflows should be included in capital budgeting calculations? Give examples of what types of cashflows should or should not be included. (11 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts