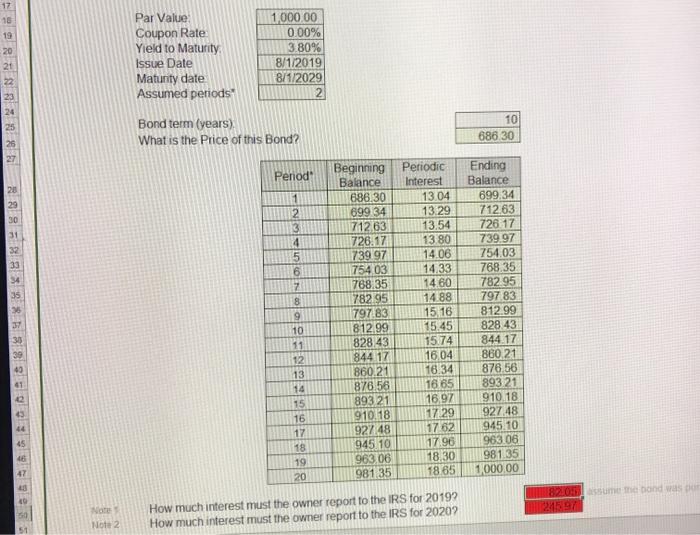

Question: how do i calculate the red boxes? 17 18 19 20 Par Value Coupon Rate Yield to Maturity Issue Date Maturity date Assumed periods 1,000.00

17 18 19 20 Par Value Coupon Rate Yield to Maturity Issue Date Maturity date Assumed periods 1,000.00 0.00% 3.80% 8/1/2019 8/1/2029 Bond term (years) What is the price of this Bond? 10 686 30 27 Penod 20 29 30 31 1 2 3 4 5 33 7 8 9 Beginning Balance 686.30 699 34 712 63 728.17 739 97 754 03 768.35 782 95 797.83 812 99 828 43 844 17 860.21 876.56 893 21 910.18 1927.48 945 10 963 06 98135 Periodic Interest 13.04 13.29 13.54 13 80 14.06 14.33 14 60 1488 15 16 15.45 15.74 16.04 18.34 16.65 16.97 17.29 1762 17.96 18.30 1865 Ending Balance 699.34 712.63 726 17 739.97 754.03 768.35 782 95 797 83 812.99 828 43 844.17 860.21 876.56 893 21 910.18 927 48 945.10 963.06 981.35 1,000.00 10 11 12 13 14 15 16 17 18 19 20 44 45 820sume the band was 245 97 How much interest must the owner report to the IRS for 20192 How much interest must the owner report to the IRS for 20202 Note 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts