Question: How do I correct the table? I believe the labels are correct, and the final amount is correct but I'm not sure how to correct

How do I correct the table? I believe the labels are correct, and the final amount is correct but I'm not sure how to correct the parentheses. Please help, thank you.

How do I correct the table? I believe the labels are correct, and the final amount is correct but I'm not sure how to correct the parentheses. Please help, thank you.

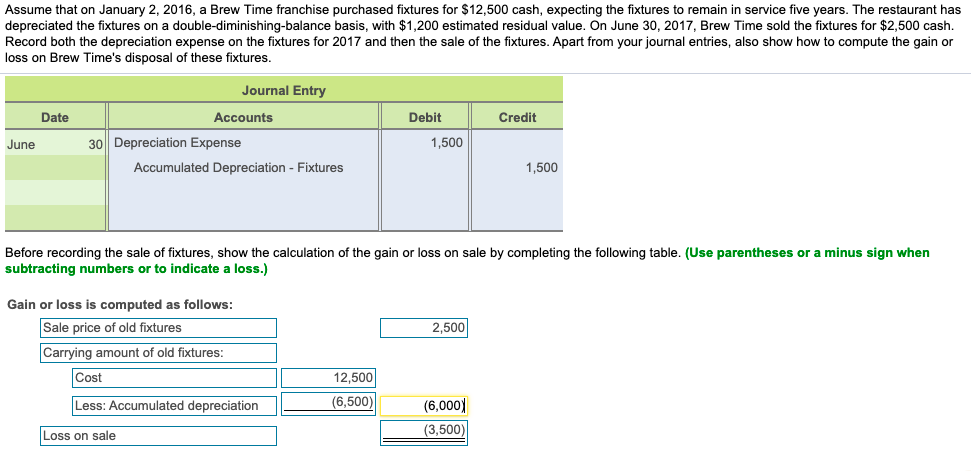

Assume that on January 2, 2016, a Brew Time franchise purchased fixtures for $12,500 cash, expecting the fixtures to remain in service five years. The restaurant has depreciated the fixtures on a double-diminishing-balance basis, with $1,200 estimated residual value. On June 30, 2017, Brew Time sold the fixtures for $2,500 cash. Record both the depreciation expense on the fixtures for 2017 and then the sale of the fixtures. Apart from your journal entries, also show how to compute the gain or loss on Brew Time's disposal of these fixtures. Credit Date June Journal Entry Accounts 30 Depreciation Expense Accumulated Depreciation - Fixtures Debit 1,500 1,500 Before recording the sale of fixtures, show the calculation of the gain or loss on sale by completing the following table. (Use parentheses or a minus sign when subtracting numbers or to indicate a loss.) Gain or loss is computed as follows: Sale price of old fixtures Carrying amount of old fixtures: 2,500 Cost 12,500 (6,500) Less: Accumulated depreciation _ (6,000) (3,500) Loss on sale

Step by Step Solution

There are 3 Steps involved in it

It looks like the image ... View full answer

Get step-by-step solutions from verified subject matter experts