Question: how do I do deductions? Complete Accounting Services has the following payroll information for the week ended December 7. State income tax is computed as

how do I do deductions?

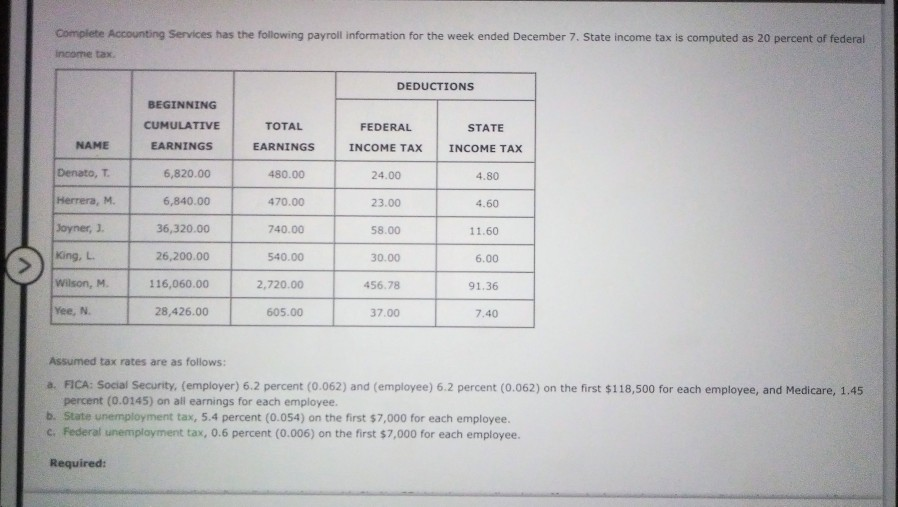

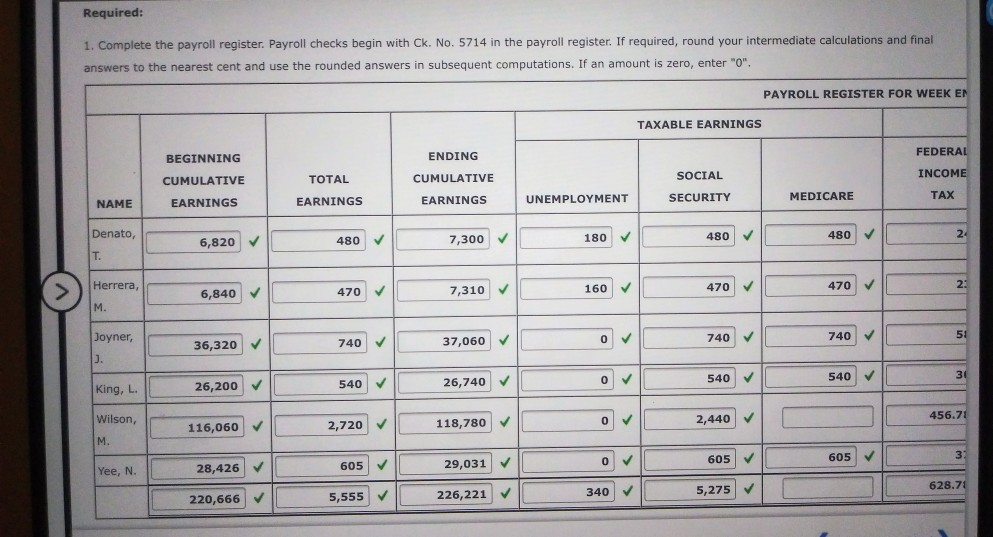

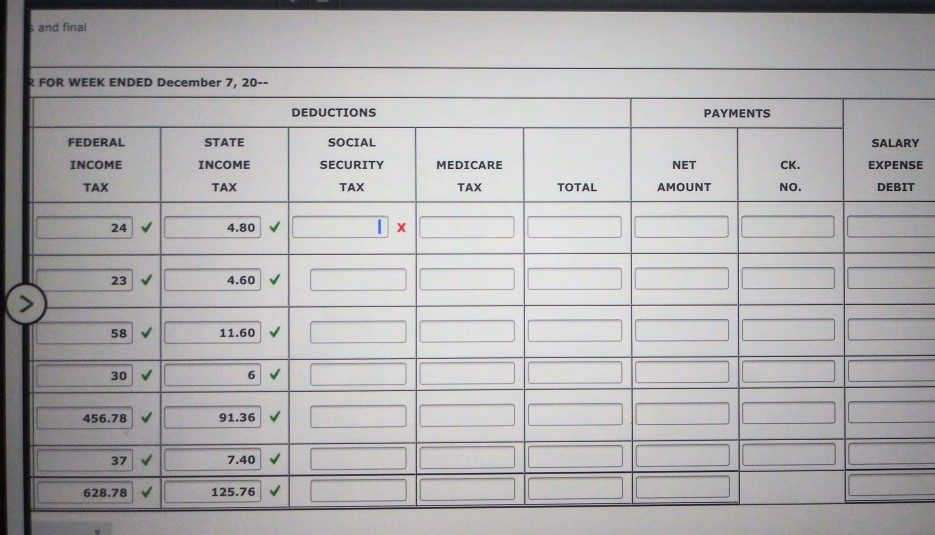

Complete Accounting Services has the following payroll information for the week ended December 7. State income tax is computed as 20 percent of federal income tax DEDUCTIONS BEGINNING CUMULATIVE TOTAL FEDERAL STATE NAME EARNINGS EARNINGS INCOME TAX INCOME TAX Denato, T. 6,820.00 480.00 24.00 4.80 Herrera, M. 6,840.00 470.00 23.00 4.60 Joyner, . 36,320.00 740.00 58.00 11.60 King, L. 26,200.00 540.00 30.00 6.00 Wilson, M. 116,060.00 2.720.00 456.78 91.36 Yee, N 28,426.00 605.00 37.00 7.40 Assumed tax rates are as follows: a. FICA: Social Security, (employer) 6.2 percent (0.062) and (employee) 6.2 percent (0.062) on the first $118,500 for each employee, and Medicare, 1.45 percent (0.0145) on all earnings for each employee. b. State unemployment tax, 5.4 percent (0.054) on the first $7,000 for each employee. c. Federal unemployment tax, 0.6 percent (0.006) on the first $7,000 for each employee. Required: Required: 1. Complete the payroll register. Payroll checks begin with Ck. No. 5714 in the payroll register. If required, round your intermediate calculations and final answers to the nearest cent and use the rounded answers in subsequent computations. If an amount is zero, enter "0". PAYROLL REGISTER FOR WEEK EN TAXABLE EARNINGS BEGINNING ENDING FEDERAL TOTAL CUMULATIVE SOCIAL CUMULATIVE INCOME NAME EARNINGS EARNINGS TAX UNEMPLOYMENT EARNINGS MEDICARE SECURITY Denato, 2 480 6,820 7,300 480 180 480 T. Herrera, > 2: 160 470 470 470 6,840 7,310 M. Joyner, 0 740 740 51 36,320 740 37,060 J. 31 540 0 o 540 26,740 King, L 26,200 540 Wilson, 0 456.71 2,440 116,060 2,720 118,780 M. 32 0 605 605 Yee, N. 29,031 28,426 605 628.71 220,666 5,555 5,275 226,221 340 and final FOR WEEK ENDED December 7, 20-- DEDUCTIONS PAYMENTS FEDERAL SOCIAL SALARY STATE INCOME INCOME SECURITY MEDICARE NET CK. EXPENSE TAX TAX TAX TAX TOTAL AMOUNT NO. DEBIT 24 4.80 1 x 23 4.60 58 11.60 30 6 456.78 91.36 37 7.40 628.78 125.76

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts