Question: how do i do this? explain in detail Campbell, a single taxpayer, earns $400,000 in taxable income and $2,000 in interest from an investment in

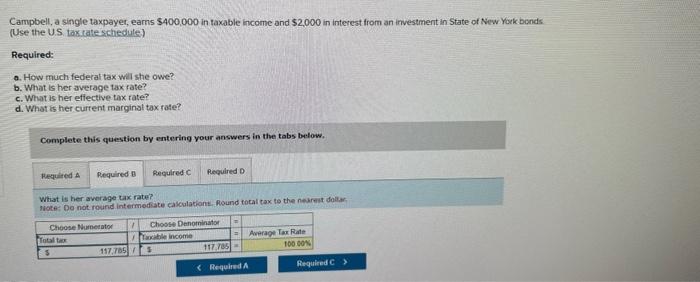

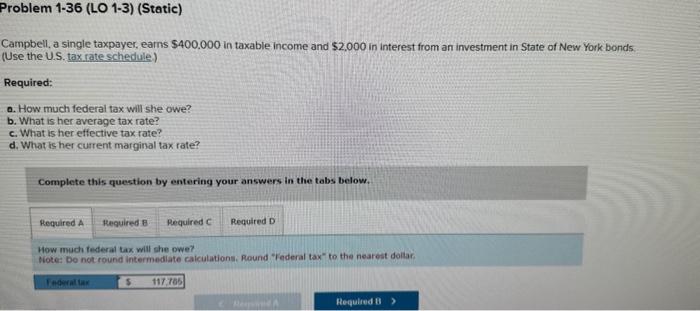

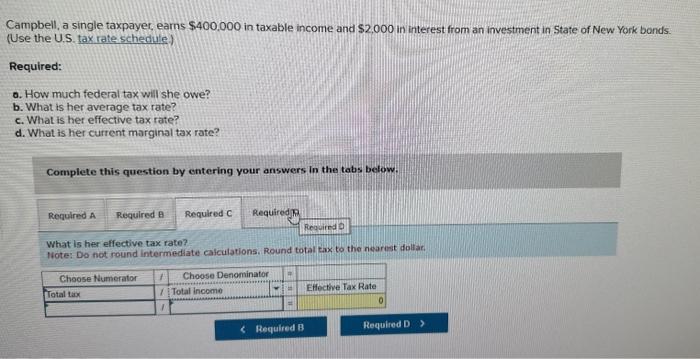

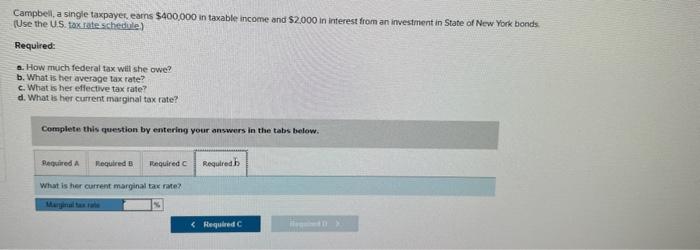

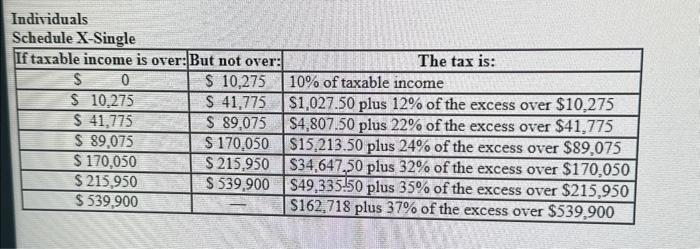

Campbell, a single taxpayer, earns $400,000 in taxable income and $2,000 in interest from an investment in State of New York bonds (Use the U.S. taxitateschedule) Required: a. How much federal tax will she owe? b. What is her average tax fate? c. What is her effective tax rate? d. What is her current marginat tax rate? Consplete this question by entering your answers in the tabs below, What is her average tax rate? gote: Do not round intermediate calculations, pound tocal tax to the nearest dollar: Campbell, a single taxpayer, earns $400.000 in taxable income and $2.000 in interest from an investment in State of New York bonds Use the U.S. tax rateschedule) Required: a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Complete this question by entering your answers in the tabs below. How much federal tax will she owe? Biote: bo not round intermediate calculations. Round "Federal tax" to the nearest dollar, Campbell, a single taxpayer, eams $400,000 in taxable income and $2,000 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule) Required: o. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Complete this question by entering your answers in the tabs below. What is her effective tax rate? Wote: Do not round intermediate cafculations. Round total tax to the nearest dollar: Campbell, a single taxpayer, earns $400.000 in taxable income and $2.000 in interest from an investment in State of New Yark bonds. (Use the US. tox rate schedule) Required: a. How much federal tax will she owe? b. What is her average tax rate? c. What is her eflective tax rate? d. What is her current marginal tax rate? Complete this question by entering your answers in the tabs below. What is her current marginal far rate? Individuals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts