Question: Its all one question. show work please. thanks. Campbell, a single taxpayer, earns $290,000 in taxable income and $13,500 in interest from an investment in

Its all one question. show work please. thanks.

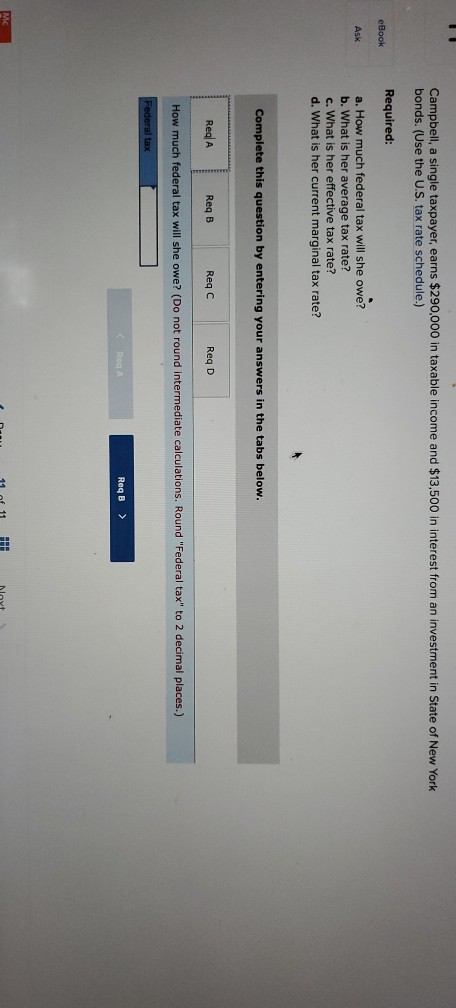

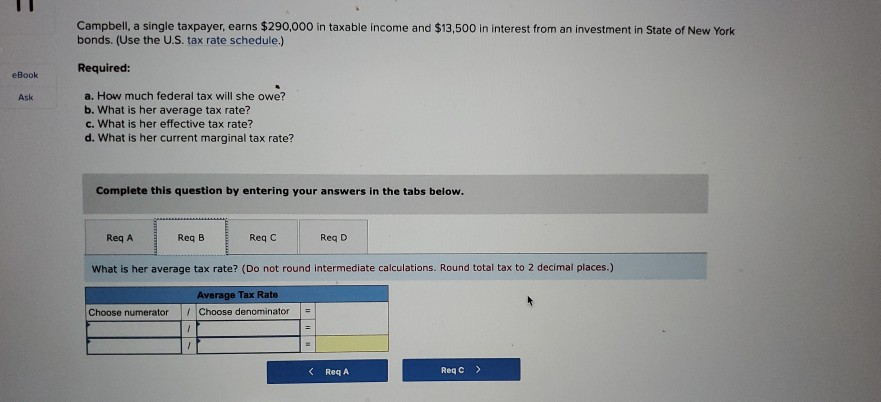

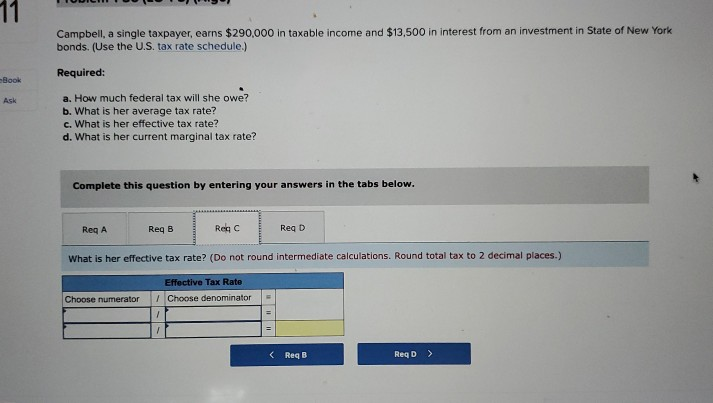

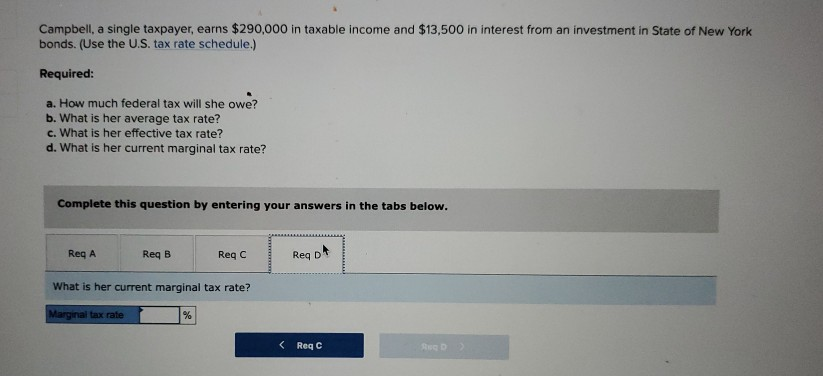

Campbell, a single taxpayer, earns $290,000 in taxable income and $13,500 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule.) Required: eBook Ask a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Complete this question by entering your answers in the tabs below. Reg A Req B Reqc Reg D How much federal tax will she owe? (Do not round intermediate calculations. Round "Federal tax" to 2 decimal places.) Federal tax K Rega ReqB > Campbell, a single taxpayer, earns $290,000 in taxable income and $13,500 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule.) eBook Ask Required: a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Complete this question by entering your answers in the tabs below. Req A Reg B Reg C Reg D What is her average tax rate? (Do not round intermediate calculations. Round total tax to 2 decimal places.) Average Tax Rate / Choose denominator Choose numerator = / 1 Campbell, a single taxpayer, earns $290,000 in taxable income and $13,500 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule.) Required: Book ASK a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Complete this question by entering your answers in the tabs below. Reg A Reg B Reg C Reg D What is her effective tax rate? (Do not round intermediate calculations. Round total tax to 2 decimal places.) Effective Tax Rate 1 Choose denominator Choose numerator 1 Campbell, a single taxpayer, earns $290,000 in taxable income and $13,500 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule.) Required: a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Complete this question by entering your answers in the tabs below. Reg A Req B Reg C Req What is her current marginal tax rate? Marginal tax rate % Campbell, a single taxpayer, earns $290,000 in taxable income and $13,500 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule.) eBook Ask Required: a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Complete this question by entering your answers in the tabs below. Req A Reg B Reg C Reg D What is her average tax rate? (Do not round intermediate calculations. Round total tax to 2 decimal places.) Average Tax Rate / Choose denominator Choose numerator = / 1 Campbell, a single taxpayer, earns $290,000 in taxable income and $13,500 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule.) Required: Book ASK a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Complete this question by entering your answers in the tabs below. Reg A Reg B Reg C Reg D What is her effective tax rate? (Do not round intermediate calculations. Round total tax to 2 decimal places.) Effective Tax Rate 1 Choose denominator Choose numerator 1 Campbell, a single taxpayer, earns $290,000 in taxable income and $13,500 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule.) Required: a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Complete this question by entering your answers in the tabs below. Reg A Req B Reg C Req What is her current marginal tax rate? Marginal tax rate %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts