Question: How do i do this in excel based on the instructions and the data given in excel? Exercise 1: Return on Investment (ROI) for an

How do i do this in excel based on the instructions and the data given in excel?

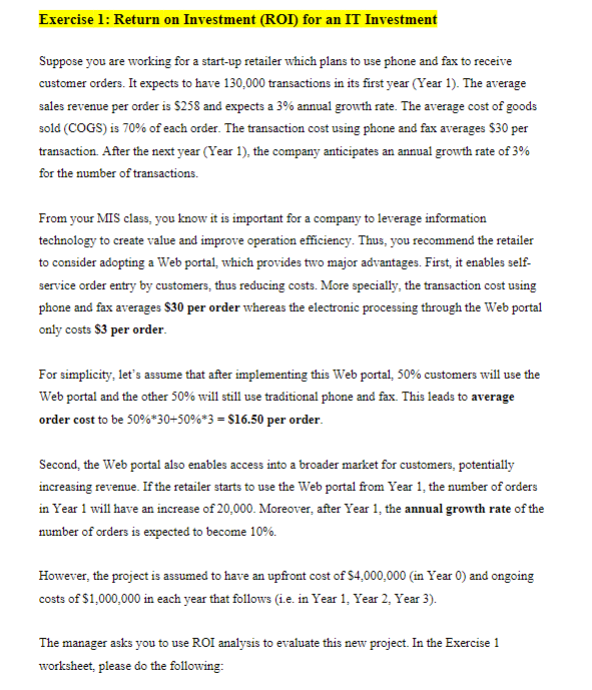

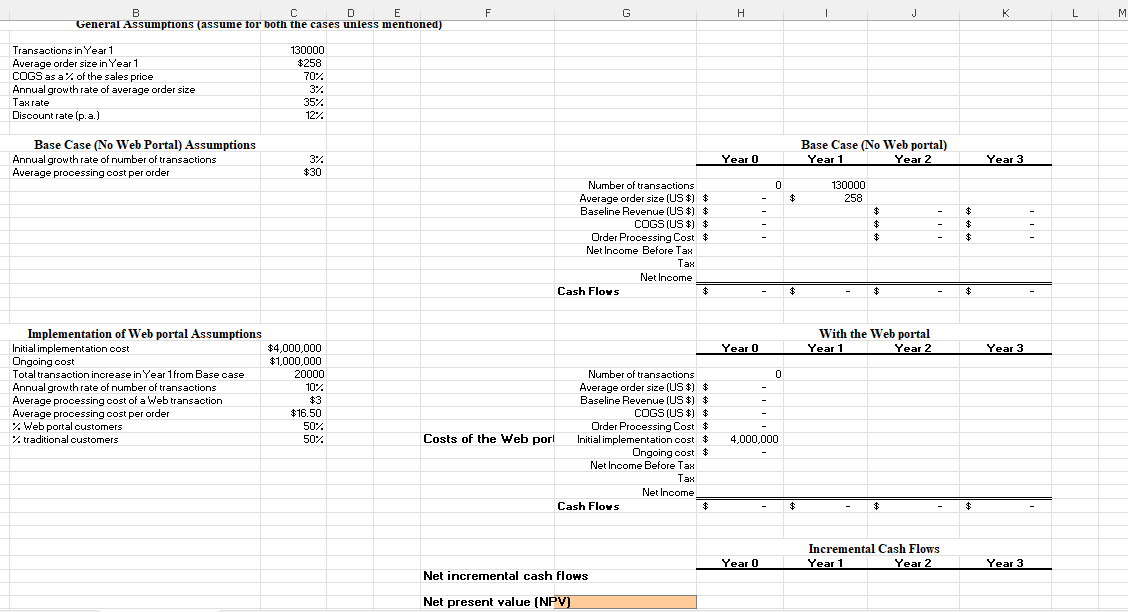

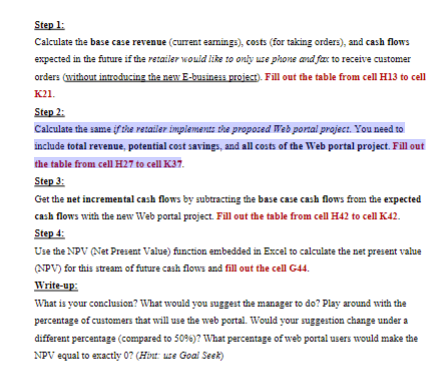

Exercise 1: Return on Investment (ROI) for an IT Investment Suppose you are working for a start-up retailer which plans to use phone and fax to receive customer orders. It expects to have 130,000 transactions in its first year (Year 1). The average sales revenue per order is $258 and expects a 3% annual growth rate. The average cost of goods sold (COGS) is 70% of each order. The transaction cost using phone and fax averages $30 per transaction. After the next year (Year 1), the company anticipates an annual growth rate of 3% for the number of transactions. From your MIS class, you know it is important for a company to leverage information technology to create value and improve operation efficiency. Thus, you recommend the retailer to consider adopting a Web portal, which provides two major advantages. First, it enables selfservice order entry by customers, thus reducing costs. More specially, the transaction cost using phone and fax averages $30 per order whereas the electronic processing through the Web portal only costs $3 per order. For simplicity, let's assume that after implementing this Web portal, 50% customers will use the Web portal and the other 50% will still use traditional phone and fax. This leads to average order cost to be 50%30+50%3=$16.50 per order. Second, the Web portal also enables access into a broader market for customers, potentially increasing revenue. If the retailer starts to use the Web portal from Year 1 , the number of orders in Year 1 will have an increase of 20,000 . Moreover, after Year 1 , the annual growth rate of the number of orders is expected to become 10%. However, the project is assumed to have an upfront cost of $4,000,000 (in Year 0 ) and ongoing costs of $1,000,000 in each year that follows (i.e. in Year 1, Year 2, Year 3). The manager asks you to use ROI analysis to evaluate this new project. In the Exercise 1 worksheet, please do the following: General Assumptions (assume tor both the cases unless mentioned) \begin{tabular}{lr} Transactions in Year 1 & 130000 \\ \hline Average order size in Year 1 & $258 \\ \hline CDGS as a of the sales price & 70% \\ \hline Annual growth rate of average order size & 3% \\ \hline Tan rate & 35% \\ \hline Discount rate (p.a.) & 12% \end{tabular} Base Case (No Web Portal) Assumptions Base Case (No Web portal) Annual growth rate of number of transactions Year1Year2Year3 Average processing cost per order 3% Implementation of Web portal Assumptions Net incremental cash flows Net present value [NPV] Step 1: Calculate the base case revenue (current earnings), costs (for taking orders), and cash flows expected in the future if the retailer wowld like to only ure phone and fax to receive customer orders (without introducing the new E-businefs project). Fill out the table from cell H13 to cell K21. Step 2: Calculate the same if the retailer inplemenus the proposed Web poral project. You need to include total revenue, potential cost savings, and all costs of the Web portal project. Fill out the table from cell H27 to cell K37. Step 3: Get the net incremental cash flows by subtracting the base case cash flows from the expected casb flows with the new Web portal project. Fill out the table from cell H42 to cell K42. Step 4: Uie the NPV (Net Preseat Value) function embedded in Ercel to calculate the net present value (NPV) for this strtam of future cakk flows and fill out the cell G44. Write-up: What is your conclusion? What would you ruggent the manager to do? Play around with the percentage of customers that will use the web portal. Would your suggention change under a different percentage (compared to 5096)? What percentage of web portal users would make the NPV equal to exactly 0? (Hivt: we Goal Seek)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts