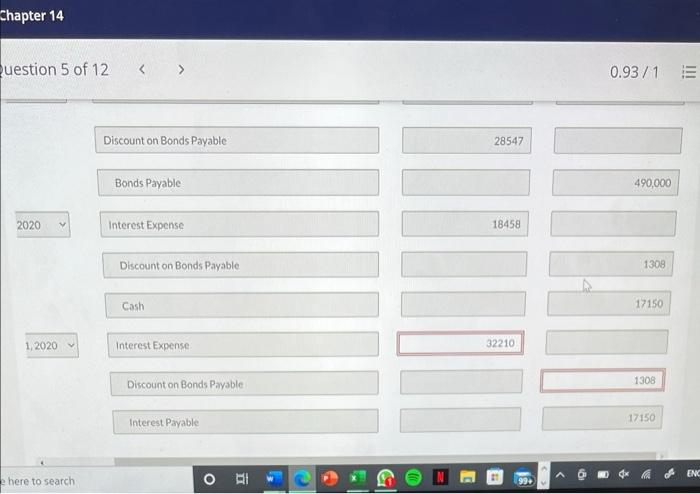

Question: How do I do this last entry? Really having some trouble. Chapter 14 Puestion 5 of 12 0.93/1 III Discount on Bonds Payable 28547 Bonds

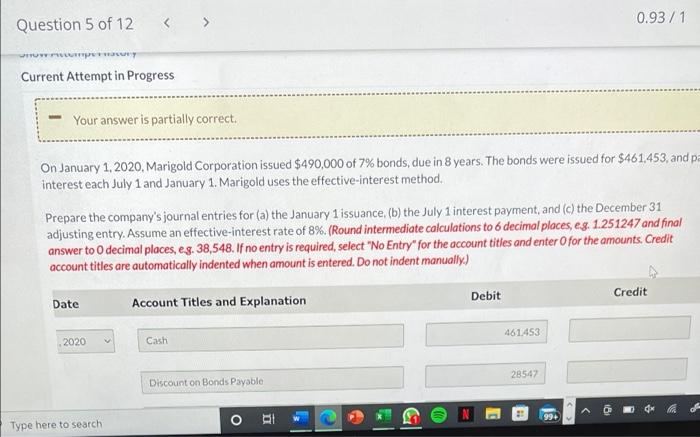

Chapter 14 Puestion 5 of 12 0.93/1 III Discount on Bonds Payable 28547 Bonds Payable 490,000 2020 Interest Expense 18458 Discount on Bonds Payable 1308 Cash 17150 1, 2020 Interest Expense 32210 Discount on Bonds Payable 1308 Interest Payable 17150 ENE here to search OBI . 99 0.93/1 Question 5 of 12 w Current Attempt in Progress Your answer is partially correct. On January 1, 2020, Marigold Corporation issued $490,000 of 7% bonds, due in 8 years. The bonds were issued for $461,453, and pa interest each July 1 and January 1. Marigold uses the effective-interest method. Prepare the company's journal entries for (a) the January 1 issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry. Assume an effective-interest rate of 8%. (Round intermediate calculations to 6 decimal places, eg. 1.251247 and final answer to O decimal places, eg. 38,548. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually) Debit Credit Date Account Titles and Explanation 461453 2020 Cash 28547 Discount on Bonds Payable O ap 99 Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts