Question: 19. Lail Inc accounts for bad debts using the allowance method. On June 1, Lail Inc wrote off Andrew Green's $2,500 account. Based on

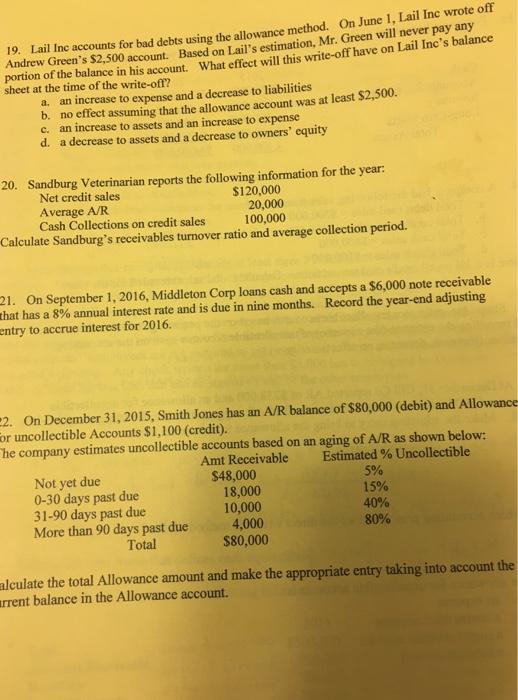

19. Lail Inc accounts for bad debts using the allowance method. On June 1, Lail Inc wrote off Andrew Green's $2,500 account. Based on Lail's estimation, Mr. Green will never pay any portion of the balance in his account. What effect will this write-off have on Lail Inc's balance sheet at the time of the write-off? a. an increase to expense and a decrease to liabilities b. no effect assuming that the allowance account was at least $2,500. c. an increase to assets and an increase to expense d. a decrease to assets and a decrease to owners' equity 20. Sandburg Veterinarian reports the following information for the year: Net credit sales Average A/R $120,000 20,000 Cash Collections on credit sales 100,000 Calculate Sandburg's receivables turnover ratio and average collection period. 21. On September 1, 2016, Middleton Corp loans cash and accepts a $6,000 note receivable that has a 8% annual interest rate and is due in nine months. Record the year-end adjusting entry to accrue interest for 2016. 22. On December 31, 2015, Smith Jones has an A/R balance of $80,000 (debit) and Allowance or uncollectible Accounts $1,100 (credit). The company estimates uncollectible accounts based on an aging of A/R as shown below: Amt Receivable Estimated % Uncollectible Not yet due 0-30 days past due 31-90 days past due More than 90 days past due Total $48,000 18,000 10,000 4,000 $80,000 5% 15% 40% 80% alculate the total Allowance amount and make the appropriate entry taking into account the rrent balance in the Allowance account.

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

19 The following entry is passed at the time of writeoff allowance for dou... View full answer

Get step-by-step solutions from verified subject matter experts