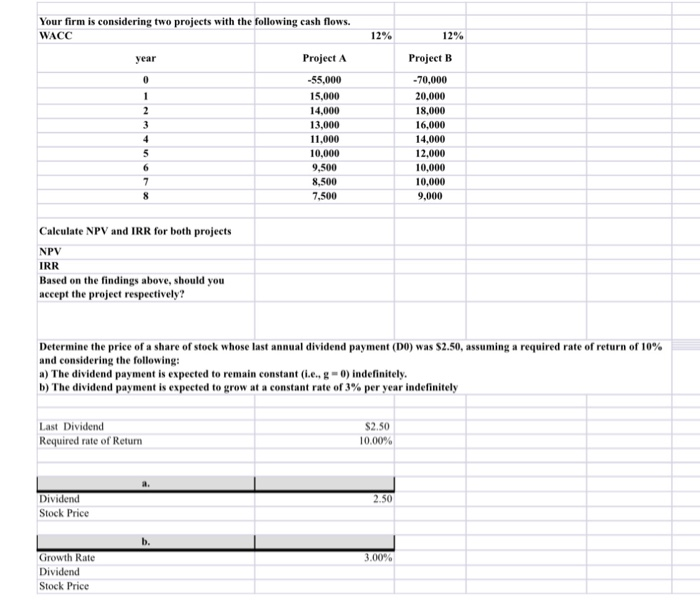

Question: how do i do thiz? Your firm is considering two projects with the following cash flows. WACC 12% 1294 year Project A Project B -55,000

Your firm is considering two projects with the following cash flows. WACC 12% 1294 year Project A Project B -55,000 15,000 14,000 13,000 11,000 10,000 9,500 8,500 7.500 -70,000 20,000 18,000 16,000 14,000 12.000 10,000 10,000 9,000 Calculate NPV and IRR for both projects NPV IRR Based on the findings above, should you accept the project respectively? Determine the price of a share of stock whose last annual dividend payment (DO) was $2.50, assuming a required rate of return of 10% and considering the following: a) The dividend payment is expected to remain constant (i... - 0) indefinitely. b) The dividend payment is expected to grow at a constant rate of 3% per year indefinitely Last Dividend Required rate of Return $2.50 10.00% Dividend Stock Price 3.00% Growth Rate Dividend Stock Price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts