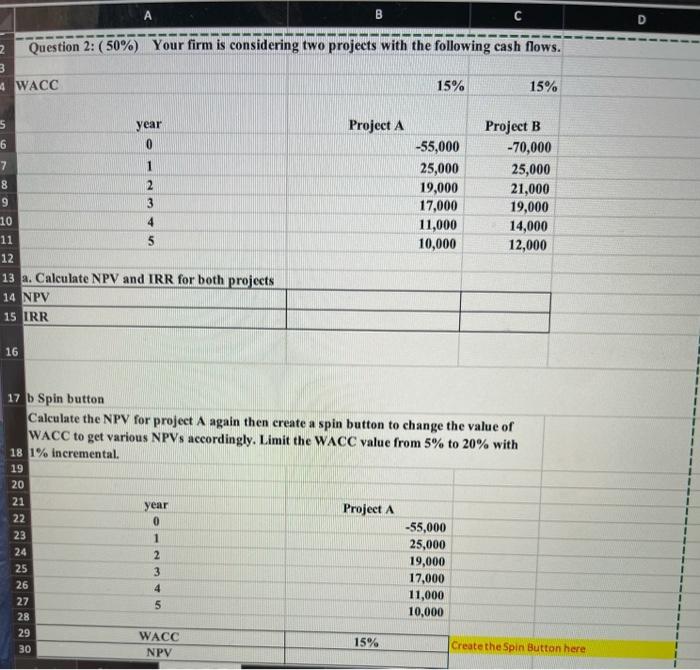

Question: Answer part B please B D C 2 Question 2: (50%) Your firm is considering two projects with the following cash flows. 3 4 WACC

B D C 2 Question 2: (50%) Your firm is considering two projects with the following cash flows. 3 4 WACC 15% 15% 5 year Project A Project B 6 0 -55,000 -70,000 7 1 25,000 25,000 8 2 19,000 21,000 17,000 19,000 10 11,000 14,000 11 5 10,000 12,000 12 13 a. Calculate NPV and IRR for both projects 14 NPV 15 IRR 9 3 4 16 17 b Spin button Calculate the NPV for project A again then create a spin button to change the value of WACC to get various NPVs accordingly. Limit the WACC value from 5% to 20% with 18 1% incremental. 19 20 year 0 Project A 21 22 23 24 25 26 27 28 29 30 1 2 3 4 5 -55,000 25,000 19,000 17,000 11,000 10,000 WACC NPV 15% Create the Spin Button here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts