Question: How do I get the 12 percent I don't understand how .63552 is equal to 12 percent (a) SEK should record revenue of $900,000 on

How do I get the 12 percent I don't understand how .63552 is equal to 12 percent

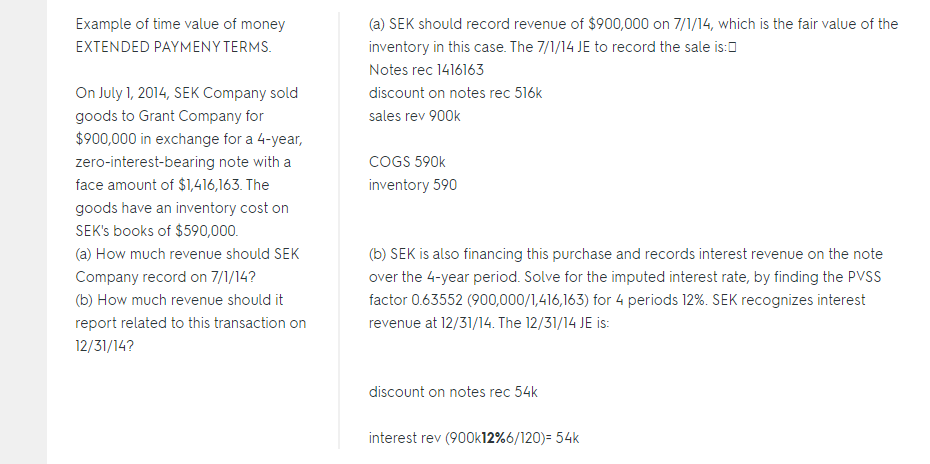

(a) SEK should record revenue of $900,000 on 7/1/14, which is the fair value of the inventory in this case. The 7/1/14 JE to record the sale is:D Notes rec 1416163 discount on notes rec 516k sales rev 900k Example of time value of money EXTENDED PAYMENY TERMS On July 1, 2014, SEK Company sold goods to Grant Company for $900,000 in exchange for a 4-year zero-interest-bearing note with a face amount of $1,416,163. The goods have an inventory cost on SEK's books of $590,000 (a) How much revenue should SEK Company record on 7/1/14? (b) How much revenue should it report related to this transaction on 12/31/14? COGS 590k inventory 590 (b) SEK is also financing this purchase and records interest revenue on the note over the 4-year period. Solve for the imputed interest rate, by finding the PVSS factor 0.63552 (900,000/1,416,163) for 4 periods 12%. SEK recognizes interest revenue at 12/31/14. The 12/31/14 JE is: discount on notes rec 54 interest rev (900W2%6/120): 54k

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts