Question: How do i put this infomation in an excel spreadsheet Respond to the following scenario with your thoughts, ideas, and comments. Be substantive and clear,

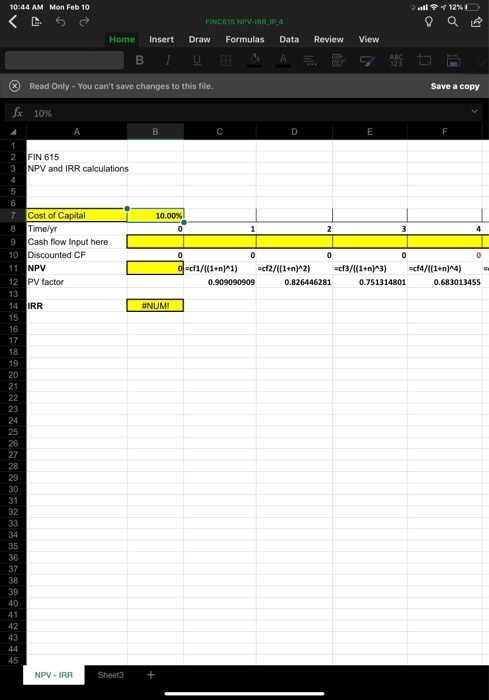

Respond to the following scenario with your thoughts, ideas, and comments. Be substantive and clear, and use research to reinforce your ideas. Apix is considering coffee packaging as an additional diversification to its product line. Here's information regarding the coft packaging project: Initial investment outlay of $40 million, consisting of $35 million for equipment and $5 million for net working capital (NWC) (plastic substrate and ink inventory); NWC recoverable in terminal year Project and equipment life: 5 years Sales: $27 million per year for five years Assume gross margin of 50% (exclusive of depreciation) Depreciation: Straight-line for tax purposes Selling, general, and administrative expenses: 10% of sales Tax rate: 35% Assume a WACC of 10%. Should the coffee packaging project be accepted? Why or why not? Compute the project's IRR and NPV. In addition, answer the following questions: Do you believe that there was sufficient financial information to make a solid decision on what to do? Was there further financial information that you required that was not provided to you? What financial figure do you believe was the determinant to your decision and why? How would you be able to apply this particular financial information to other situations? Discuss risk methodologies used in capital budgeting, Please submit your assignment For assistance with your assignment, please use your text, Web resources, and all course materials. 10:44 AM Mon Feb 10 2 tl 4125 D 9 FINC615 NPV-IRRJP 4 Draw Formulas Data Home Insert Review View . Read Only - You can't save changes to this file Save a copy fx 10% FIN 615 NPV and IRR calculations T 10.00% 7 Cost of Capital 8 Timely 9 Cash flow Input here 10 Discounted CF 11 NPV 12 PV factor d-cf1/((1+n)1) 0.909090909 =cf2/((1+n)^2) 0 .826446281 +cf3/((1+1^3) 0.751314801 04/((1+n)^4) 0.683013455 14 IRR NPV - IRR Sheet3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts